Revenue

Earnings

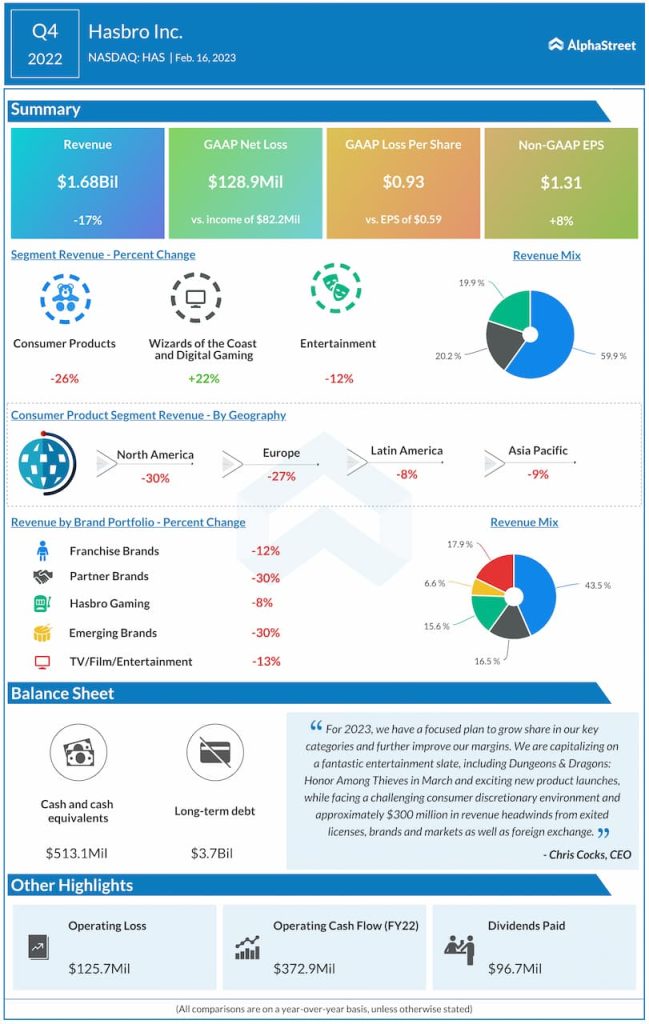

On a GAAP basis, in Q4 2022, Hasbro reported a net loss of $128.9 million, or $0.93 per share, compared to a net income of $82.2 million, or $0.59 per share, last year. Adjusted EPS rose 8% to $1.31. Mattel saw its GAAP net income fall 93% YoY to $16.1 million, or $0.04 per share. Adjusted EPS dropped to $0.18 from $0.53 last year.

Category and brand performance

During the fourth quarter, Hasbro saw revenues decline across most of its major segments and its entire brand portfolio. The Consumer Products and Entertainment segments witnessed double-digit revenue declines while Wizards of the Coast and Digital Gaming saw revenue growth of 22%.

Revenues declined across its brand portfolio with Partner Brands and Emerging Brands both down 30%. Franchise Brands and TV/Film/Entertainment saw revenues drop 12% and 13% respectively while Hasbro Gaming fell 8%.

In FY2023, Hasbro expects revenue to decline mid-single digits in Consumer Products and low-single digits in Entertainment. Wizards of the Coast and Digital Gaming is expected to see mid-single digit revenue growth for the year.

Mattel reported sales declines across all its segments during the fourth quarter. Net sales in North America decreased 26% while International sales dropped 18%. Sales in the American Girl segment were down 17% in Q4. Gross billings were down for all categories barring Vehicles, which reported a 6% growth. The Dolls, Infant, Toddler and Preschool, and Action Figures, Building Sets, Games and Other categories all recorded double-digit declines in gross billings.

Outlook

For the full year of 2023, Hasbro projects revenue to be down low single digits against an expected flat to declining toy and game market. Adjusted EPS is expected to range between $4.45-4.55. Mattel expects its net sales in FY2023 to be comparable to sales of $5.4 billion reported in FY2022. Adjusted EPS is estimated to be $1.10-1.20 for the year.

Shares of Hasbro were up over 1% on Friday while Mattel’s stock was up over 3%.

Click here to read the full transcripts of Hasbro’s and Mattel’s Q4 2022 earnings conference calls