Revenue

Profitability

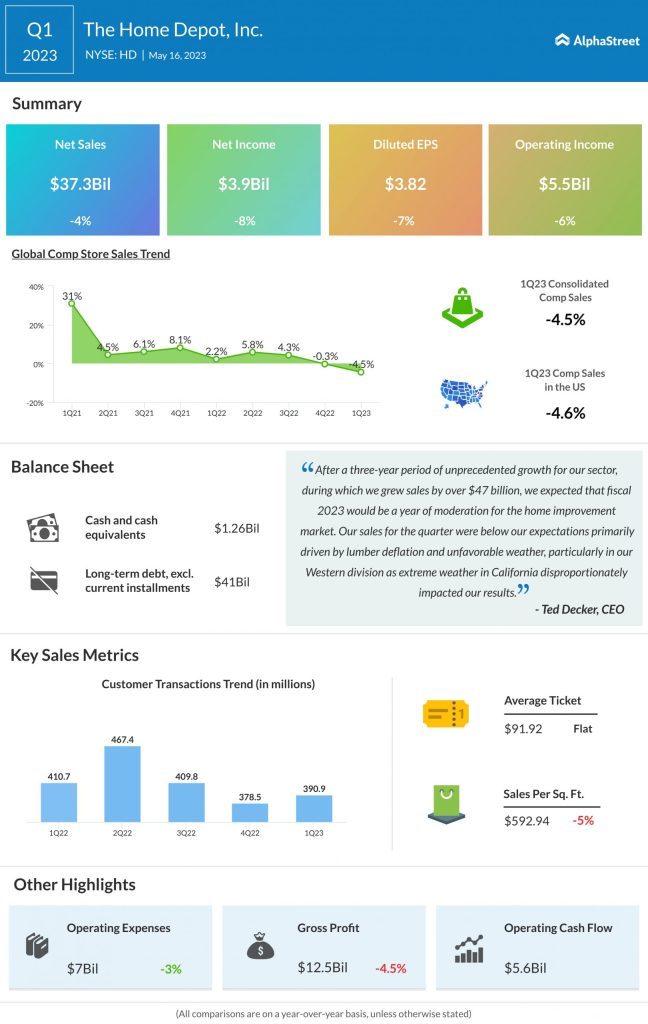

Home Depot delivered earnings of $3.82 per share in Q1 2023, which was down 7% YoY. Its gross margin decreased 8 basis points to 33.7% versus last year due to higher pressure from shrink. The company’s operating margin slipped to 14.9% from 15.2% last year.

Lowe’s posted adjusted EPS of $3.67, which rose 5% from last year. Its gross margin was 33.7%, down 35 basis points YoY. Gross margin benefited from a favorable product mix in the quarter but this was offset by supply chain network expansion costs. Adjusted operating margin expanded 47 basis points to 14.4%.

Category performance and trends

During the first quarter, unfavorable weather impacted the performance of both retailers as spring saw a delayed start in some regions. In places where the weather remained favorable, Home Depot saw strength in spring-related categories such as garden.

Both Home Depot and Lowe’s saw pressure in discretionary categories during the quarter but witnessed strength in sections like building materials and plumbing. Home Depot’s DIY segment outperformed the Pro segment but both were negative in Q1.

On its call, Home Depot said although the backlogs in Pro remain healthy, they are lower compared to the previous year and there is a shift towards smaller projects from large-scale remodels. Lowe’s saw pressure in its DIY segment, which makes up the major part of its business, due to lower discretionary demand.

Guidance

Both Home Depot and Lowe’s expect the home improvement market to remain pressured in the near term, which led them to lower their guidance for the full year of 2023. Home Depot now expects sales and comp sales to decline 2-5% in FY2023 versus its prior outlook of flat sales and comps. It expects EPS to decline 7-13% versus FY2022.

Lowe’s lowered its sales guidance to a range of $87-89 billion from the previous range of $88-90 billion. It expects comparable sales to decline 2-4% versus the previous outlook of flat to down 2%. Adjusted EPS is now expected to be $13.20-13.60 versus the prior range of $13.60-14.00.

Despite the near-term uncertainty, both Home Depot and Lowe’s remain optimistic on the long-term outlook for the home improvement industry. Shares of Home Depot have dropped 7% year-to-date while Lowe’s stock has gained 3% over the same period.