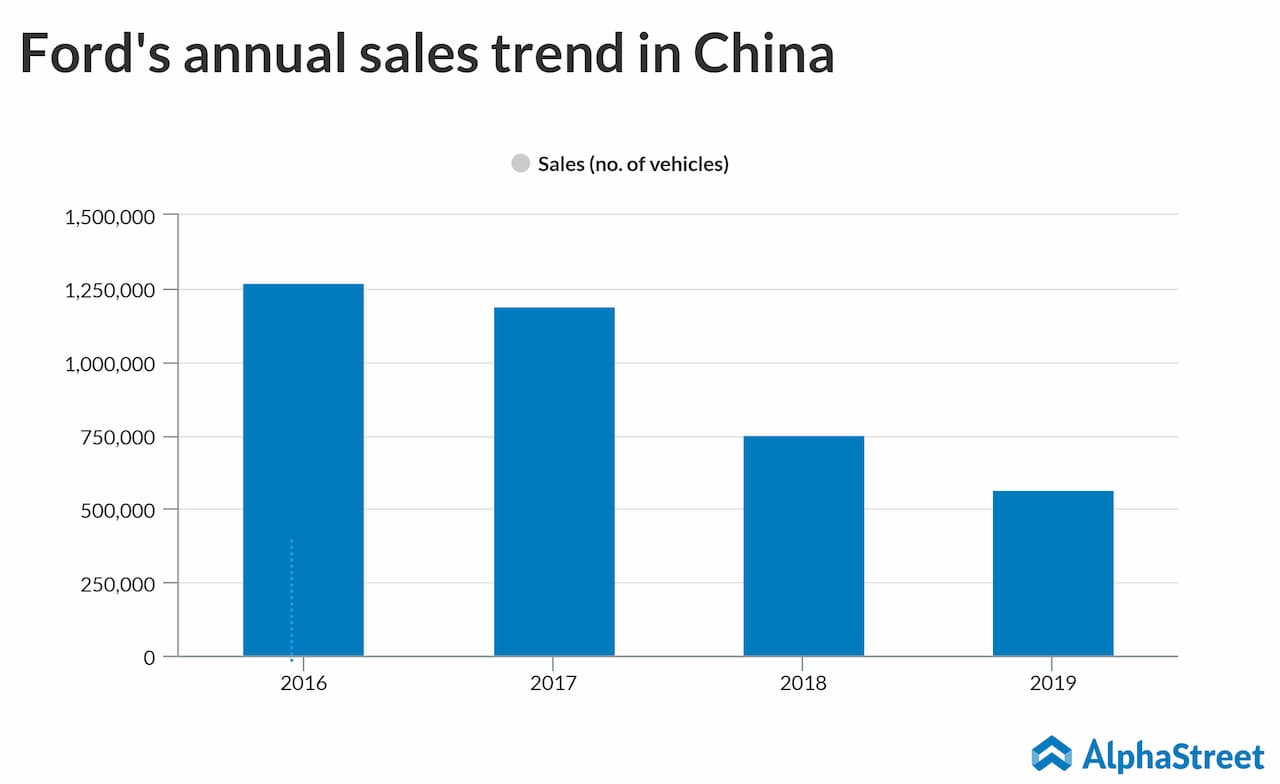

Ford Motor Company (NYSE: F) recently reported a sales decline in China, its second-biggest market, for three years in a row. After a strong performance in the region in 2016, things seem to have gone pretty much downhill.

Back in 2016, Ford posted record annual sales in China of 1.27 million vehicles, which was up 14% from 2015. The company saw solid demand for its lineup of SUVs such as Ford Edge, Ford Explorer, the Ford Taurus large car and the Ford Mustang. The demand for Ford Edge jumped 123% during the year. Lincoln’s sales grew around three-fold from 2015, supported by demand for Lincoln SUVs and the growing number of dealerships.

In 2017, annual sales in China dropped 6% to just under 1.2

million vehicles compared to 2016. Although Ford saw challenges in the

passenger vehicle segment during the first half of the year, it witnessed

strong sales for its Ford Escort and Mondeo vehicles in the second half. Lincoln

sales increased 66% from the previous year.

During 2017, the auto industry in China witnessed excess capacity at 57% of production. Ford’s market share in the country decreased slightly to 4.2% due to increased competition, particularly in the SUV segment. The negative industry pricing also caused a decline in net income margin.

Also read: Ford Motor Company (F): A look at major restructuring and growth activities

In 2018, China sales further dipped to just over 752,000

vehicles, down almost 37% from the previous year. This was mainly due to lower

sales at Changan Ford Automobile (CAF) as excess stocks led to heavy discounts

and lower dealer profits. Lincoln saw a 2.2% increase over 2017. During 2018,

the auto industry in China saw excess capacity at 78% of production.

In 2019, Ford sold just around 568,000 vehicles in China, reflecting a drop of 26.1% from the previous year. Even Lincoln’s annual sales fell 15.7% to 46,629 units versus the previous year.

Ford stated that it expects to face pressures from the external environment and to see industry volume decline in 2020. The company is looking to improve its product lineup with more customer-centric products in order to reduce the external pressure and increase dealers’ profitability. In short, the road ahead does not seem smooth for the company in China.