2020 trends

Based on data from the NPD Group, retail sales of toys in the US amounted to $25.1 billion in 2020, reflecting a year-over-year growth of 16%. Sales surged around mid-March, as lockdown measures were widely imposed, and again in October, with the onset of the holiday season. The year also saw a spike in online sales which were up 75% year-over-year. The global toy industry grew 10%.

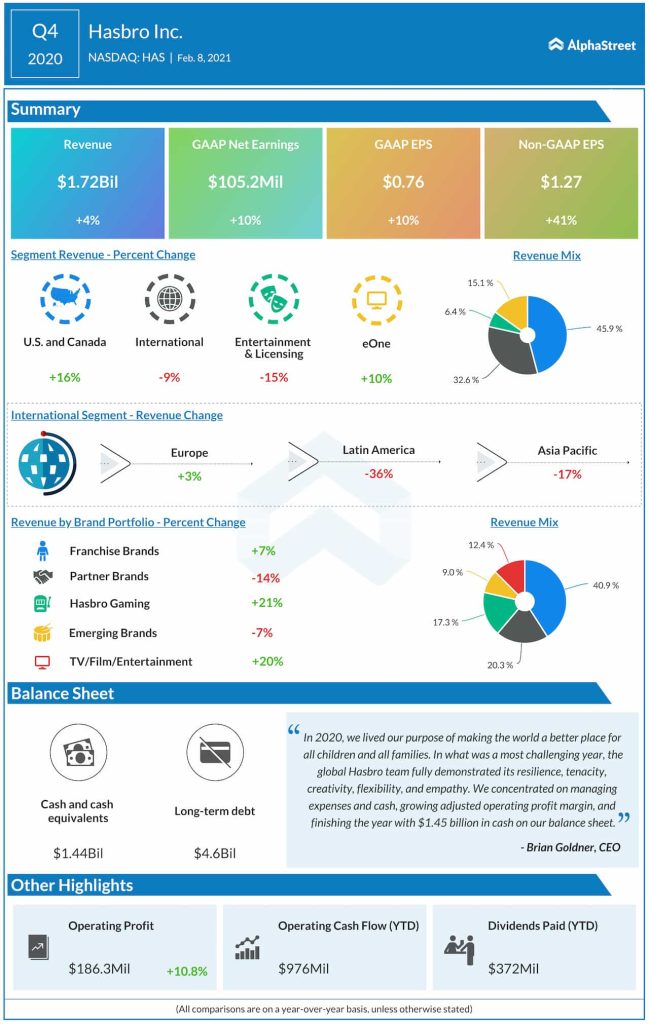

Leading toymakers Hasbro Inc. (NASDAQ: HAS) and Mattel Inc. (NASDAQ: MAT) benefited significantly last year from a rise in demand for their products and a growth in online sales. Hasbro witnessed a 15% growth in gaming revenue in 2020 while its Wizards of the Coast division generated revenues of $816 million during the year, up 24% YoY.

The growth in Wizards was led by Magic: The Gathering and Dungeons & Dragons, which recorded revenue gains of 23% and 33% respectively. The Wizards unit is almost halfway in reaching its target of doubling revenue from 2018 to 2023.

Mattel witnessed strength in categories such as outdoor, games and puzzles, and building sets in 2020. Based on data provided at its Analyst Day, Mattel holds a leading position in dolls, which is an $8 billion super-category, according to NPD, thanks to its Barbie and Polly Pocket brands. The vehicles category, valued at $3.7 billion, grew 8% in 2020. Mattel’s Hot Wheels, Matchbox, and Disney-Pixar Cars are seeing good growth within this category.

Mattel is seeing significant momentum in the $6.9 billion-dollar Games category through its UNO, Pictionary and Scrabble brands, each of which grew by high double-digits during the year. Within the building sets category, which has a value of $6.3 billion, Mattel’s Mega brand stands just behind the world leader Lego. Mega recorded double-digit growth in 2020.

2021 outlook

Based on data from ReportLinker, the global toy, doll and game market is estimated to grow from $97.99 billion in 2020 to $102.26 billion in 2021 at a compound annual growth rate (CAGR) of 4.4%. The market is projected to reach $135.66 billion in 2025 at a CAGR of 7%.

Looking ahead to this year, Hasbro expects its traditional toys and games business to grow in line with or ahead of the industry. Its Wizards of the Coast and Digital Gaming segment is expected to grow faster than the rest of the business.

The digital gaming market has over 2 billion consumers globally and $150 billion in revenue. Hasbro sees significant opportunity in this space. This year, Hasbro plans to launch several new Wizards-branded games that have been in development. Over the past five years, Hasbro has spent $210 million on game development for digital games, which is expected to add hundreds of millions of dollars in revenue over the medium-term.

Hasbro estimates that over the next five years, categories such as gaming, action figures, plush, arts and crafts, and outdoor sports will grow to an addressable market opportunity of over $30 billion globally. The company holds a leading position within these categories and believes that simply maintaining its share over this period could bring in $500 million in revenue.

For 2021, Mattel is working on driving growth and expansion with new product launches across its dolls and vehicles categories. Within the games category, the company is seeing momentum in digital gaming and it is rolling out variations for its board games like Pictionary and Scrabble. Mattel is also seeing growth in the plush and action figures categories and for 2021, the company expects accelerated growth in the action figures category to outpace the industry.

In summary, the toy industry is likely to see meaningful growth through 2021, albeit not at the levels seen in 2020, as the demand for toys and collectibles will remain stable for the foreseeable future.