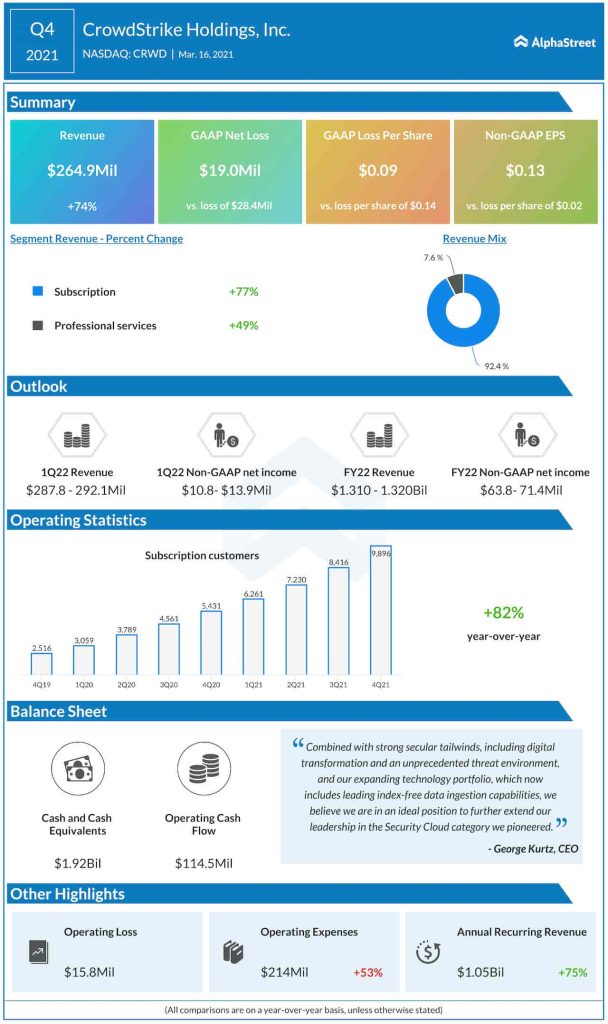

The tech firm reported earnings of $0.13 per share for the January-quarter, on an adjusted basis, marking an improvement from last year’s $0.02 per share loss. The latest number also came in above the consensus forecast. On an unadjusted basis, the company reported a loss of $19 million or $0.09 per share, compared to a loss of $28.4 million or $0.14 per share in the fourth quarter of 2020.

The positive bottom-line performance was driven by a 74% growth in revenues to $265 million, exceeding the Street view. At $245 million, subscription revenue was up 77%.

Read management/analysts’ comments on CrowdStrike’s Q4 results

CrowdStrike’s market value increased four-fold in the past twelve months, continuing the uptrend that started after last year’s IPO. The stock closed Tuesday’s regular session lower but gained in the after-hours following the announcement.