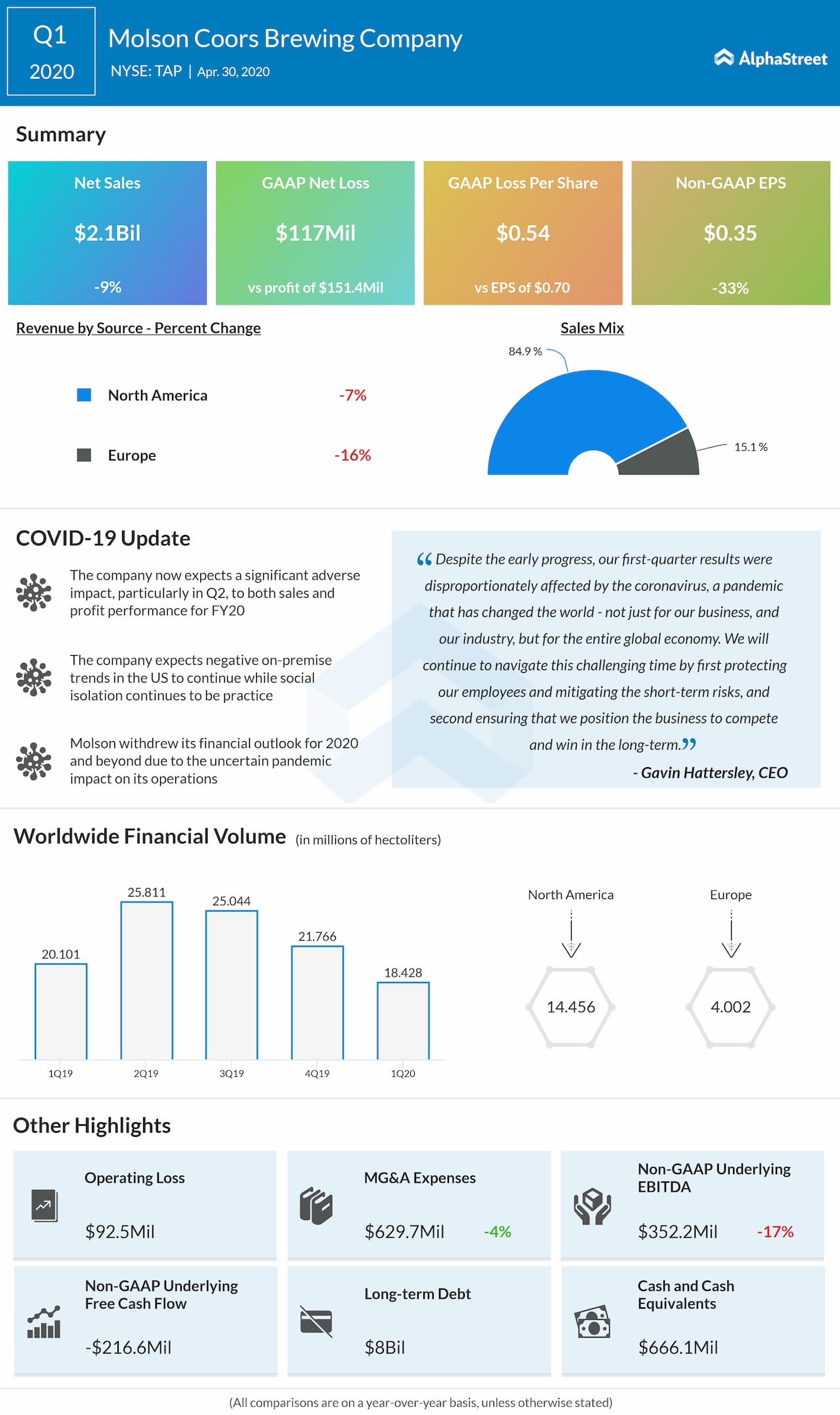

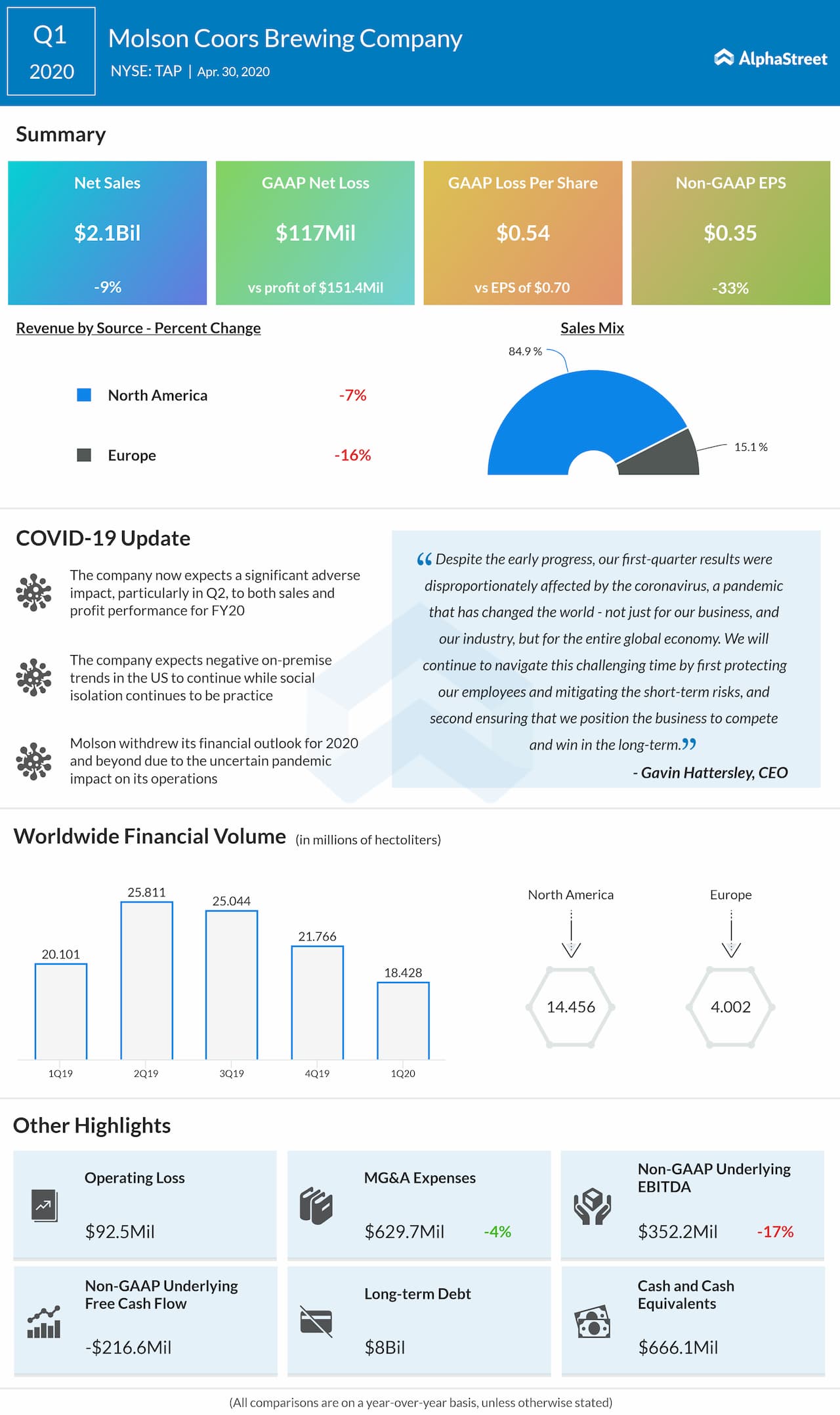

Molson Coors Beverage Company (NYSE: TAP) slipped to a loss in the first quarter of 2020 from a profit last year, due to unfavorable unrealized mark-to-market changes on its commodity positions and HEXO warrants, as well as the on-premise impacts of the coronavirus pandemic, the impact of lower financial volume, inflation and negative mix.

The top line fell by 9% due to financial volume declines, estimated keg sales returns and reimbursements, as well as unfavorable mix. The board is actively evaluating various capital allocation options, including a suspension, reduction, or temporary elimination of its dividend. On March 27, Molson withdrew its financial outlook for 2020 and beyond due to the rapid spread of the COVID-19 outbreak.

Past Performance

TAP Q4 2019 Earnings Performance

TAP Q3 2019 Earnings Results