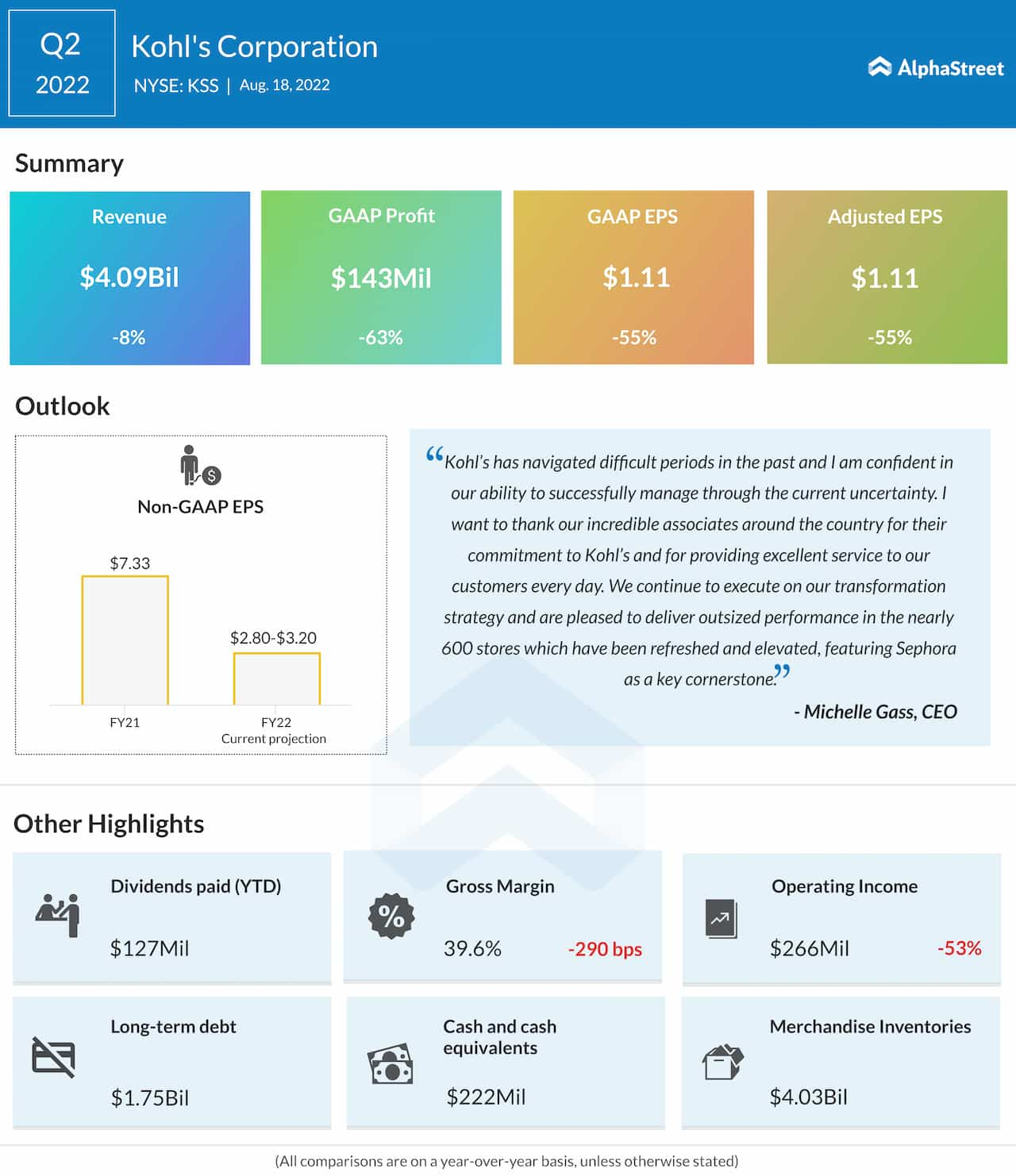

Department store chain Kohl’s Corp. (NYSE: KSS) on Thursday reported a decline in second-quarter adjusted earnings and revenues. However, the results exceeded expectations.

Second-quarter earnings, adjusted for special items, dropped to $1.11 per share from $2.48 per share in the same period of last year. But the latest number came in above the market’s projection. Unadjusted net income was $143 million or $1.11 per share, compared to $382 million or $2.48 per share in the second quarter of 2021.

The weak bottom-line performance reflects an 8% year-over-year decrease in revenues to $4.09 billion, which is above the market’s expectations. The management declared a quarterly dividend of $0.50 per share, payable on September 21, 2022, to shareholders of record on September 7, 2022.

Check this space to read management/analysts’ comments on Kohl’s Q2 results

“Second quarter results were impacted by a weakening macro environment, high inflation, and dampened consumer spending, which especially pressured our middle-income customers. We have adjusted our plans, implementing actions to reduce inventory and lower expenses to account for a softer demand outlook. Kohl’s has navigated difficult periods in the past and I am confident in our ability to successfully manage through the current uncertainty,” said Kohl’s CEO Michelle Gass.