Intel Corporation (NASDAQ: INTC) is preparing to report fourth-quarter results on Thursday after the bell, amid expectations for a positive outcome. The company reported revenues above the high end of its guidance in the third quarter when earnings benefited from expense discipline also.

The value of Intel’s stock nearly doubled in the past twelve months, but it is still far below the 2021 peak. INTC, which had a rather weak start to the year, picked up some momentum this week ahead of the earnings. The moderate valuation looks like an opportunity for long-term investors, given the tech firm’s growth prospects and positive near-term outlook.

AI Push

Currently, the chipmaker’s growth initiatives are focused on tapping into the rapid adoption of artificial intelligence. Recently, the company announced new AI-enabled chips for automobile manufacturers that will enable them to offer enhanced AI-powered experiences to customers.

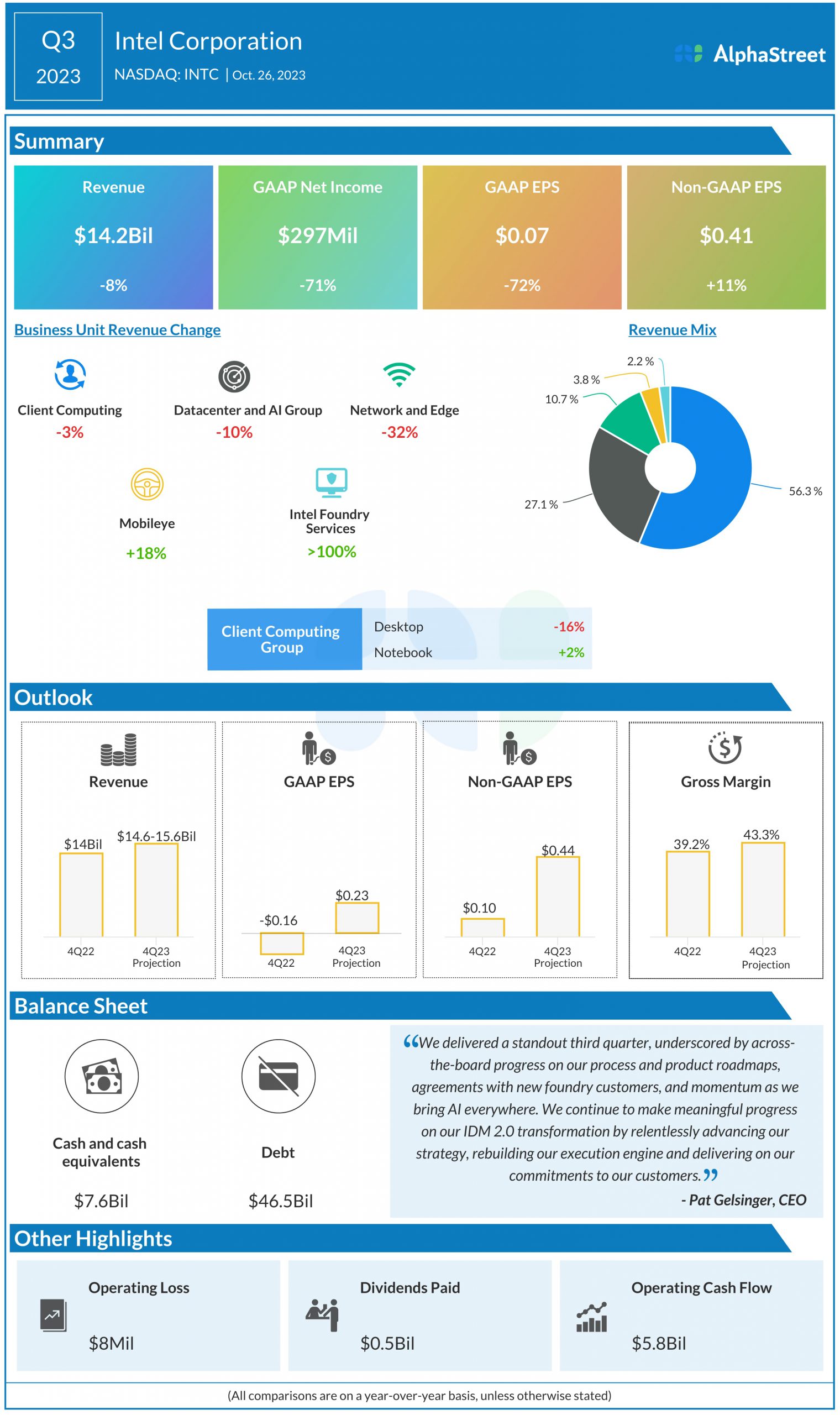

Intel will be reporting fourth-quarter results on January 25, at 4:00 p.m. ET. Wall Street is looking for a multi-fold year-over-year increase in earnings to $0.45 per share, on an adjusted basis, which is lower by one cent than the earnings guidance issued by the company recently. In the year-ago quarter, the company had reported earnings of $0.1 per share. The consensus revenue estimate is $15.16 billion, which comes at the higher end of the management’s Q4 revenue forecast of $14.6-15.6 billion.

From Intel’s Q3 2023 earnings call:

“More important than our standout financial performance were the key operational milestones we achieved in the quarter across process and products, Intel Foundry Services, and our strategy to bring AI everywhere. Simply put, this quarter demonstrates the meaningful progress we have made toward our IDM 2.0 transformation. The foundation of our strategy is reestablishing transistor power and performance leadership.”

Key Numbers

Intel has a good track record of delivering better-than-expected quarterly earnings. The trend continued in the September quarter, marking the third beat in a row. At $0.41 per share, Q3 adjusted earnings were up 11% year-over-year. However, the top-line performance was not that impressive – revenues declined 8% annually to $14.2 billion, mainly due to a dip in the core Client Computing revenue. The Datacenter and Network segments also contracted, which was partially offset by a strong performance by the Mobileye and Foundry Services businesses.

After experiencing volatility since the beginning of 2024, shares of Intel closed the last trading session slightly higher.