For most eCommerce companies, the virus-induced shutdown came as a blessing in disguise as people adopted online shopping en masse but some of them are witnessing a slowdown after markets started reopening, which reduced customers’ dependence on digital shopping platforms. eBay Inc. (NASDAQ: EBAY) has lost many customers in recent quarters, raising concerns that the shopping boom is over.

Stock Falls

Shares of eBay suffered one of the biggest single-day losses soon after the earnings release this week as investor sentiment was hurt by the weak guidance issued by the management. The stock has been on a losing streak after peaking four months ago, falling about 33% since then. The good thing about the recent dip is that EBAY has become less expensive, but expects’ mixed outlook calls for caution.

Read management/analysts’ comments on eBay’s Q4 earnings

When it comes to investing, the stock is not risk-free and lingering uncertainty from the pandemic is a cause for concern. Nevertheless, the future prospects of the company remain intact and the stock is unlikely to disappoint those looking for long-term investment.

Shopping Boom

The online marketplace witnessed a sharp increase in customer traffic after people turned to eCommerce platforms when the COVID-related movement restrictions came. But eBay became less popular among customers after it raised fees and cut down on promotions. Also, there has not been any major improvement in user experience in recent times due to a lack of innovation.

However, the increase in take-rates helped it maintain stable revenue growth despite weakness in gross merchandise volumes. Margins continue to benefit from the improved cost structure, achieved mainly through an extensive restructuring. At the same time, the management’s efforts to streamline the business through strategic investments and the sale of underperforming assets should unlock significant value for shareholders in the long term.

From eBay’s Q4 2021 earnings conference call:

“Our technology investments are driving a simpler and more sustainable marketplace. Looking ahead, we are excited for the next few years as we build on the momentum we have established. I look forward to introducing you to our world-class leadership team and sharing more about our plans, along with a few new initiatives, we will unveil at Investor Day. We have our eyes squarely focused on deepening our relationship with sellers and buyers in building the world’s most sustainable marketplace for the eBay community.”

Q4 Results

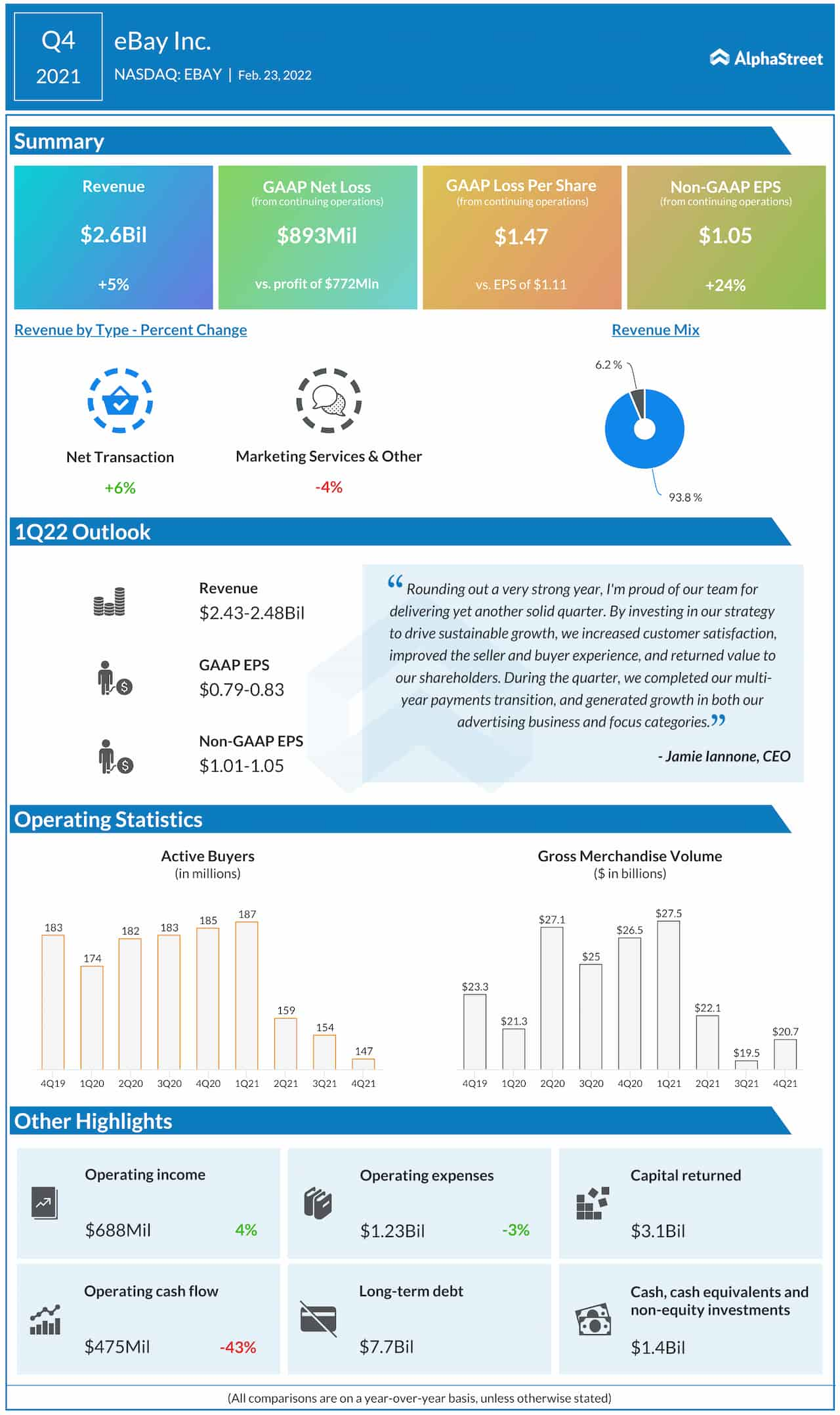

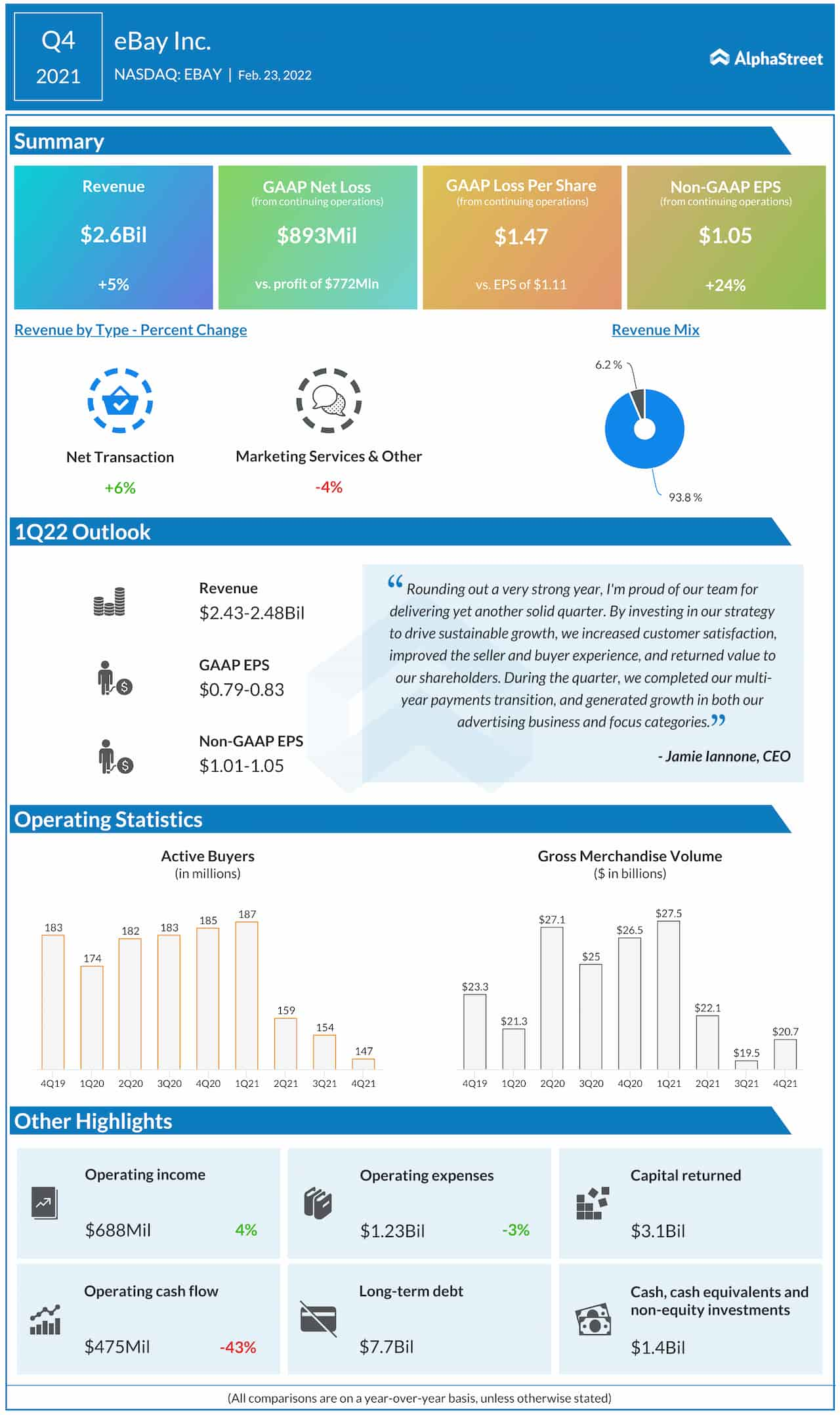

eBay’s quarterly earnings beat estimates consistently since early last year and the trend continued in the most recent quarter when adjusted earnings increased 24% year-over-year to $1.05 per share. The bottom-line benefitted from a 5% rise in revenues to $2.6 billion. Earnings topped expectations, while the top-line matched the Street view. The number of annual active buyers dropped to 147 million during the three-month period and was below the consensus estimates.

Meanwhile, the market was disappointed by the company’s cautious earnings and revenue guidance for the first quarter, which fell short of expectations.

Shopify anticipates secular tailwinds for digital commerce transformation in 2022

Though the stock recovered from the post-earnings crash, it continues to experience weakness. The shares, which lost about 19% so far this year, are currently trading below their 52-week average.