Given that many heavyweight solar firms are Chinese, trade war concerns have also hit the industry. Tesla, which also does home solar installation, has seen their bottom line and top line take hits after new duties were imposed on them by the Chinese. These were in reply to various tariffs imposed on Chinese goods and services by the Trump administration. The solar sector became collateral damage in the process of international political discourse.

JinkoSolar Q3 2018 earnings fall short of market expectations

Now, when we take costs, photovoltaics have seen the most rapid cost decline among energy technologies, while the industry took tremendous strides in improving product performance. Global solar installations have also been on the rise.

Frequent discussions on greenhouse gas emissions and pollutions have also led to higher and faster adoption of solar technology all over the world.

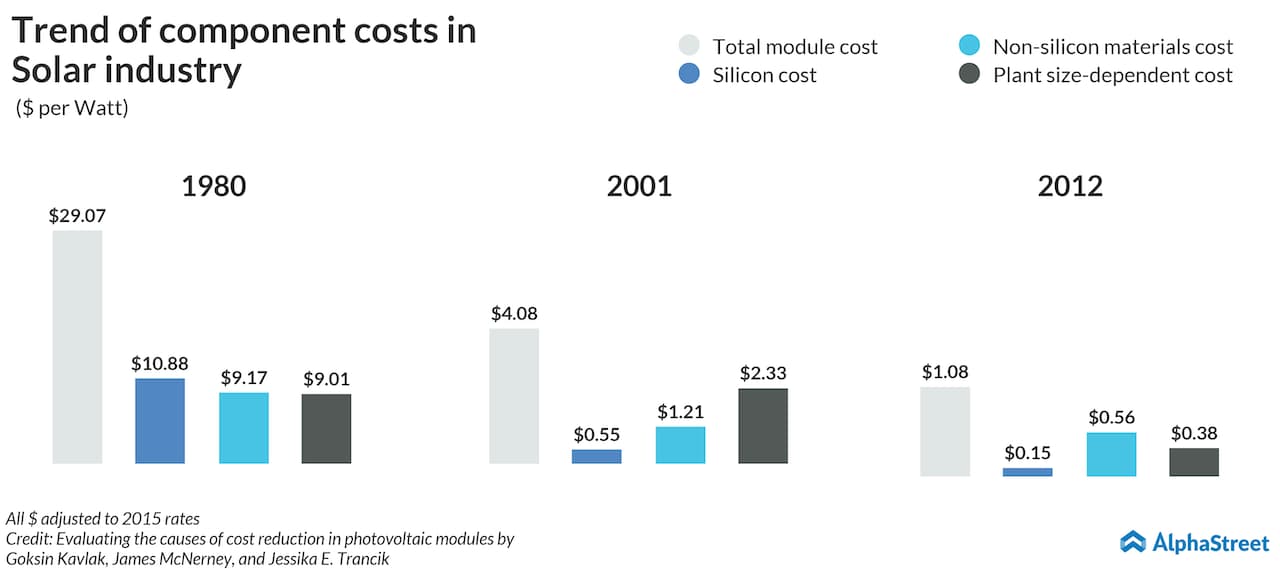

From 1980 to 2012, solar panel modules have fallen a whopping $28 per Watt. Efficiency was the biggest contributor early on, cited a research paper on the same. According to the data, lower wafer area costs of non-silicon materials contributed 22% of the cost decline in solar modules in the period.

The industry also moved from semiconductor rejects to fresh production of silicon wafers. By 2006, the solar panel industry surpassed the semiconductor industry in silicon demand. This lead to a price spike and supply shortage. To meet the demand, polysilicon producers rapidly scaled up their capacities and increased research in the arena. Soon, the availability and discovery of raw materials led to a price slump.

Looking at jobs in the US, jobs in solar saw a steady rise since its inception till 2017 — when the Solar Energy Industries Association census reported its first decline in solar jobs. In November of 2017, the solar industry employed 250,271 workers in the United States, 3.8% lower than in 2016.

So what we see now is a natural slump due to oversaturation in supply. However, research and development is in its infancy in the sector, as the future will give way a bigger demand structure. We will soon have more households shifting to solar, with Tesla (TSLA) and JinkoSolar (JKS) pioneering the switch.

While costs have come down, the mass adoption of the technology is at the horizon. We will soon see a surge in demand globally, as emerging countries try to meet its requirement. “During the third quarter, most shipments went to emerging markets,” said JinkoSolar in its latest earnings conference. According to the Chinese solar giant, India plans to achieve a cumulative solar capacity of 175-227 gigaWatts by 2022. This also points towards the trend of more emerging markets going the same way, in a bid to free from the power dynamics of OPEC’s crude oil policy.

Tesla cuts prices of home solar systems to boost sales

ADVERTISEMENT

Expiration of minimum import prices is also expected in many economies, which will help the industry to advance globally with less overhead costs. Adding to that, many firms also expect China to upgrade its 13th five-year solar targets, especially after the “positive” National Energy Administration earlier in November.

Higher adoption and market saturation in supply have affected the industry enough to cut jobs in the last two years. But this seems to be in line with the normal growth process in the nascent stages of the sector. This industry is here to stay with changing energy and climate policy. Research investments by government and the private sector are increasing, and the industry looks to grow even further than global power dependence on fossil fuels decrease with time and awareness.