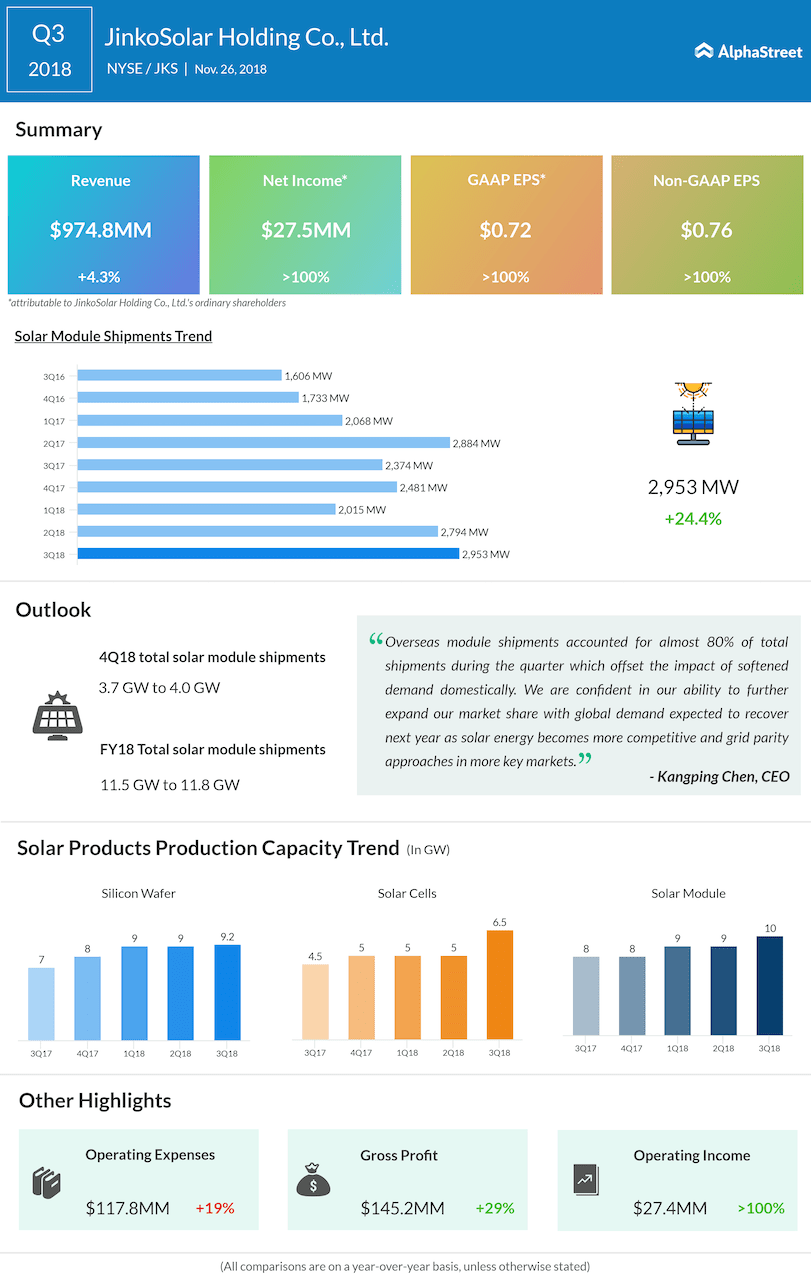

Chinese solar giant JinkoSolar (JKS) saw third-quarter revenue grow 4.3% to $974.8 million, pushing net profit to $27.5 million or $0.18 per share, as it posted its results before opening bell on Monday, Nov. 26. However, this fell below market expectations — analysts were looking for earnings of $0.61 a share on revenue of $989 million for the three-month period.

The quarter saw total solar module shipments of 2,953 MW, including 0.2 MW to the JinkoSolar’s overseas downstream segment.

As of September 30, 2018, JinkoSolar’s in-house annual silicon wafer, solar cell and solar module production capacity were 9.2 GW, 6.5 GW and 10.0 GW, respectively.

JinkoSolar now expects fourth-quarter total solar module shipments to be in the range of 3.7 GW to 4.0 GW. For the full year 2018, the Chinese firm estimates total solar module shipments to be in the range of 11.5 GW to 11.8 GW.

Back in August, JinkoSolar had slipped as much as 27% in trade on the day it posted second-quarter results. Investors were not happy with the numbers they say, even as shipments jumped 38.7% to 2,794 MW and revenue soared 32.7% to $915.9 million.

However, earlier this month, JinkoSolar shares jumped 16.5% after reports of a reversal in policy back in China that would benefit solar firms. Earlier, the Chines govt had suggested that further production of panels might go down as it achieved targets. However, recent findings suggest that the targets may be ramped up to more than twice the initiation projection. Shares moved on the hope that the Chinese government may raise the solar capacity goal of 2020 to 210-270 gigawatts.

JinkoSolar, with institutions on the share registry who own 21% share liking the stock, there is hope for the solar company to do good in the long term. While risks of a ‘crowded trade’ are high in such a stock, let’s see how the solar industry performs from this quarter.

Tesla cuts prices of home solar systems to boost sales

ADVERTISEMENT