Temporary Hitch

Investing in FEYE

While the low valuation makes FireEye attractive to investors, there is uncertainty over the stock’s ability to create value for shareholders, considering its dismal performance in the recent past. As per analysts’ consensus recommendation, the stock is moderate buy, though they are more bullish about its growth prospects. The average target price of $19 represents a 36% upside.

Caution

It needs to be noted that FireEye is operating in a highly competitive industry, where customer requirements keep varying according to changes in the threat landscape and the development of technology. The company will have to constantly update its products to outsmart competitors, including tech giants like Cisco Systems (CSCO) and International Business Machines (IBM).

Continuing the innovation, the company recently introduced new cloud security solutions – including advanced features for its Helix platform – and launched FireEye Messaging Security. Plans are afoot to expand the cloud security offerings, using inputs from the recently acquired Cloudvisory business. Verodin, the IT security firm that joined the FireEye fold last year, continues to be a key growth driver.

Mixed Outcome

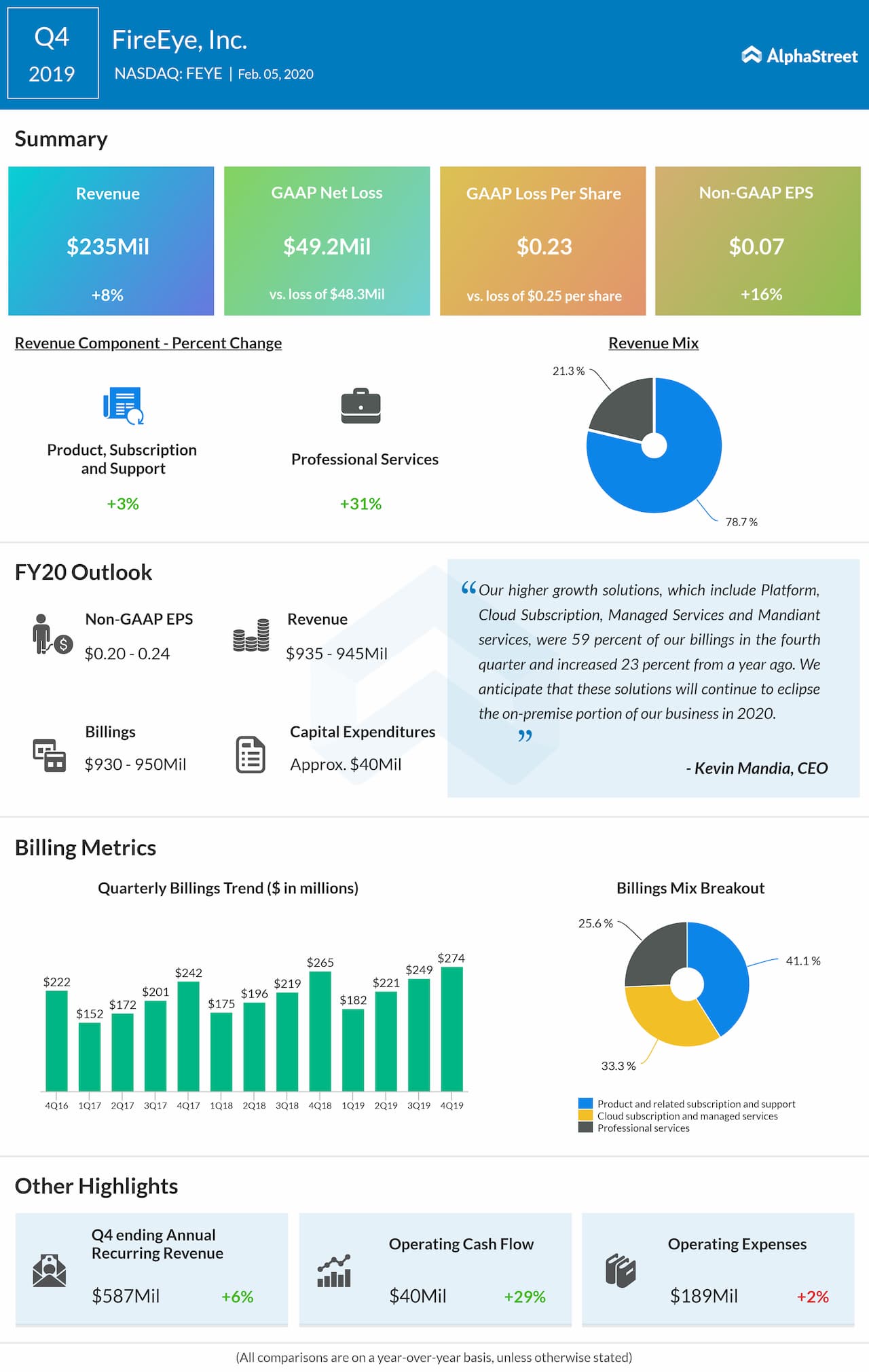

In the fourth quarter, earnings grew in double digits aided by an 8% increase in revenues. The growth is attributable to contributions from the company’s new line of services, which was partially offset by weakness in the legacy hardware business. Meanwhile, the market responded negatively as billings and the management’s guidance fell short of expectations.

Related: FireEye Q4 2019 Earnings Conference Call Transcript

After withdrawing from the peak a few years ago, FireEye shares have been struggling to regain strength. Though the stock recovered from the post-earnings slump, it pared most of the gains this week and once again slipped below the $15-mark. Since its 2013 Wall Street debut, the stock has routinely underperformed the industry and the IT index of the S&P 500.