Shares of the J.M. Smucker Co. (NYSE: SJM) were down over 1% on Wednesday. The stock has dropped 9% year-to-date. The food company delivered mixed results for the first quarter of 2024 a day ago as earnings beat expectations but revenue fell short. It also raised its earnings guidance for the full year. Here are a few noteworthy points from the report:

Quarterly performance

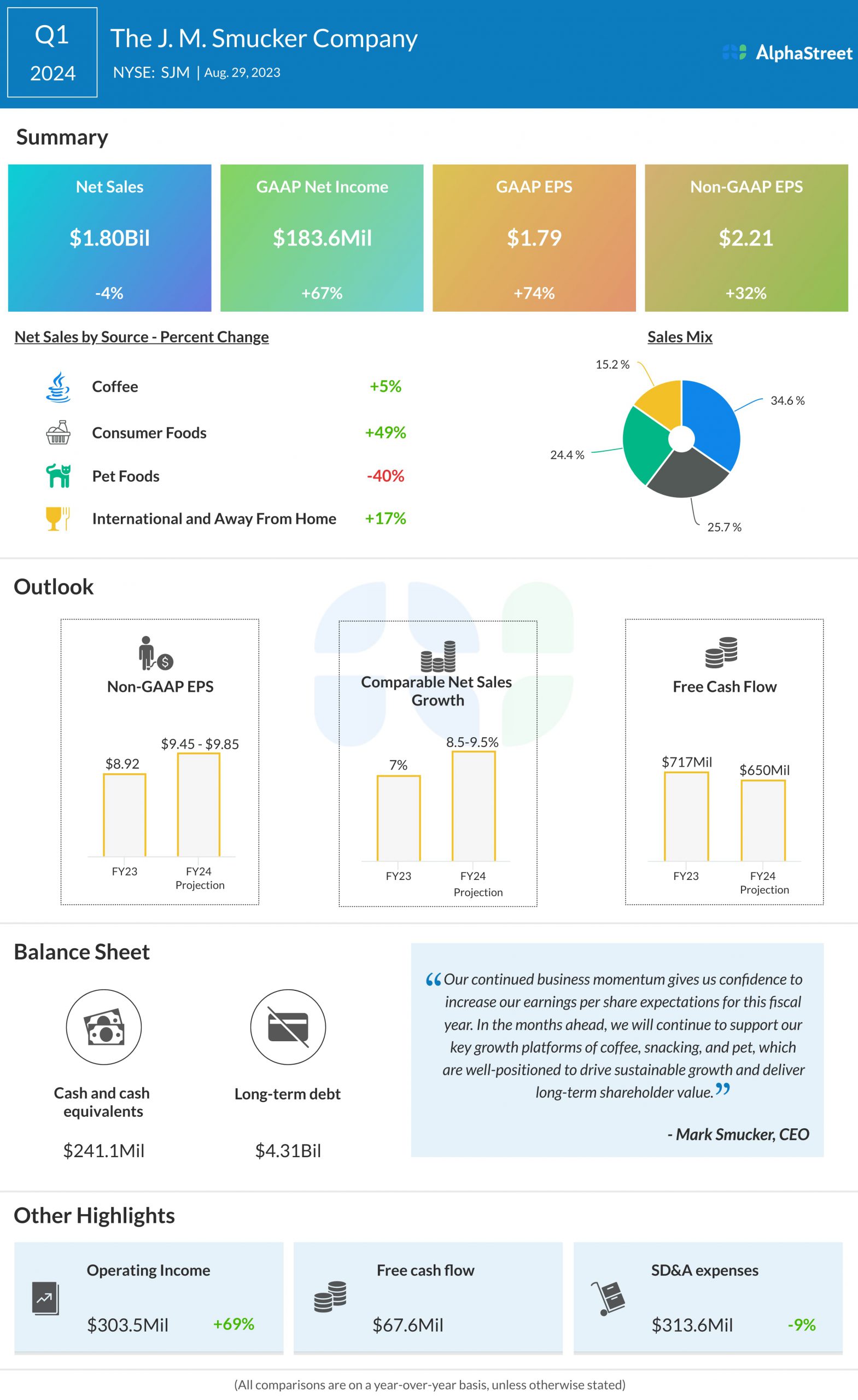

In the first quarter of 2024, net sales decreased 4% year-over-year to $1.80 billion. Comparable sales, which excludes divestitures, increased 21%, helped by favorable volume/mix and net price realization. GAAP EPS rose 74% to $1.79 while adjusted EPS increased 32% to $2.21. Adjusted gross profit increased 10%, reflecting favorable impacts from net price realization and volume/mix.

Strength in Coffee and Consumer Foods

In the Coffee segment, net sales grew 5%, helped by strong performances from its leading brands such as Café Bustelo, Folgers and Dunkin. Café Bustelo and Folgers continued to see volume share growth in the quarter. Dunkin is seeing price gaps to competitors narrow and this is expected to drive volume growth for the brand. As stated on its quarterly conference call, SJM expects momentum in coffee to continue and sees resilience in the coffee category as at-home coffee consumption remains stable.

The Consumer Foods segment saw sales increase by 49%, reflecting a 43% benefit from Jif peanut butter as well as growth in Uncrustables frozen sandwiches and Smucker’s fruit spreads. Total company net sales of Uncrustables sandwiches were around $180 million. Sales were up 11% in Q1. The brand is expected to see net sales growth of approx. 20% for the full year to over $800 million. The company also saw a full recovery in its Jif peanut butter brand.

Pet Foods

Comparable sales in Pet Foods increased 22% in Q1, helped by strong growth in Meow Mix cat food and Milk-Bone dog snacks. The company is seeing rising demand for dog snacks with strong growth in biscuits and Soft and Chewy offerings. There is also strong demand for dry cat food. The Pet segment reaped the benefits from its recent divestitures as profit margins improved nearly 200 basis points year-over-year, driven by improved product mix. The company expects margins in this segment to continue to improve over time.

Outlook

For the full year of 2024, net sales are expected to decrease 10-11% from the previous year. Comparable sales are expected to increase 8.5-9.5%. The company now expects adjusted EPS to range between $9.45-9.85 versus the previous outlook of $9.20-9.60.