Shares of the J.M. Smucker Company (NYSE: SJM) were over 3% on Tuesday after the company delivered better-than-expected results for the first quarter of 2023 and raised its outlook for the full year. The stock has gained 13% over the past three months and 12% over the past 12 months.

Quarterly performance

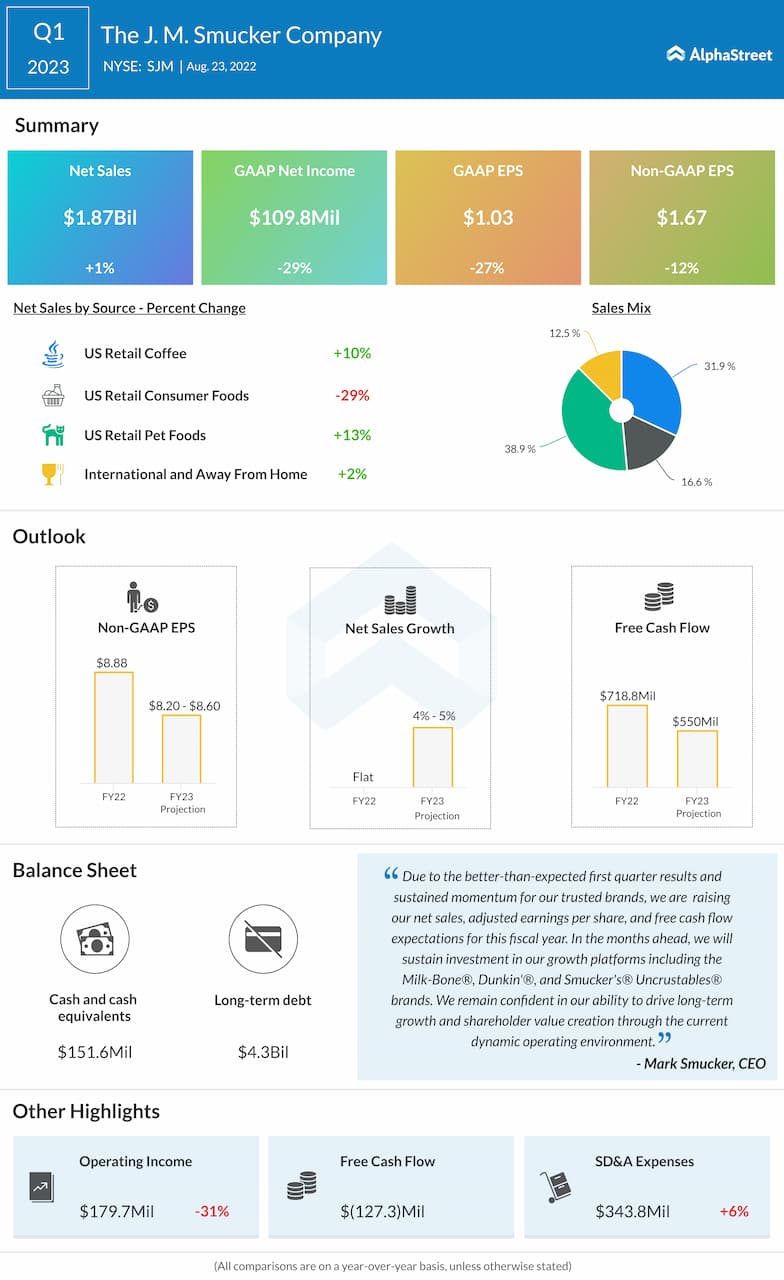

Net sales increased 1% year-over-year to $1.87 billion in Q1 2023, beating expectations. Excluding divestitures and foreign currency exchange, net sales grew 4%. The top line growth was driven by price increases across the Coffee, Pet Foods and International segments. Adjusted EPS fell 12% YoY to $1.67 but exceeded estimates. The bottom line was mainly impacted by the Jif peanut butter product recall.

Trends

JM Smucker witnessed continued demand for its brands even as costs continued to increase, which helped drive growth in its pet, coffee and snacking segments. The US Retail Pet Foods and Coffee segments recorded double-digit sales increases helped by net price realization.

Net sales in the International and Away From Home segment increased 2% driven by net price realization. Sales in the US Retail Consumer Foods division declined 29%, mainly due to the Jif peanut butter recall as well as lower net price realization.

Within Pet Foods, cat food and dog snacks recorded double-digit sales increases, fueled by higher pricing, increased volume/mix, and strong performances from its Meow Mix and Milk-Bone brands. Despite supply chain headwinds, the dog food category posted an 18% sales increase led by the Nutrish and Kibbles ‘N Bits brands.

In Coffee, sales grew 10%, driven by all brands in the at-home coffee portfolio. The company saw momentum in brands like Café Bustelo, Dunkin and Folgers. As at-home consumption makes up the majority of all coffee-drinking occasions and remains higher than pre-pandemic levels, the company expects this category to remain resilient despite inflationary pressures. Volumes and margins in this segment are expected to improve through the year.

Outlook

JM Smucker continues to face risks from cost inflation, supply chain volatility and the overall challenging macroeconomic environment. Price increases and retailer inventory levels could affect volumes while the Jif peanut butter recall is expected to continue to impact the company’s financial results for fiscal year 2023. The company is taking measures to reduce the impact of inflation and it expects higher pricing to counter these headwinds in many of its categories.

JM Smucker raised its sales and adjusted EPS guidance for FY2023. Net sales are expected to grow 4-5% versus the prior year. Excluding divestitures, comparable net sales are expected to increase 6.5% at the midpoint. The outlook reflects price increases to counter higher costs as well as momentum in away-from-home channels. Adjusted EPS is expected to be $8.20-8.60. The Jif peanut butter recall is expected to impact earnings results for the year.

Click here to read the full transcript of J.M. Smucker’s Q1 2023 earnings conference call