Shares of JetBlue Airways Corp. (NASDAQ: JBLU) were down 3% on Tuesday after the airline delivered mixed results for the third quarter of 2022. Revenues surpassed expectations but earnings fell short. The stock has dropped 48% year-to-date and 50% over the past 12 months.

Mixed results

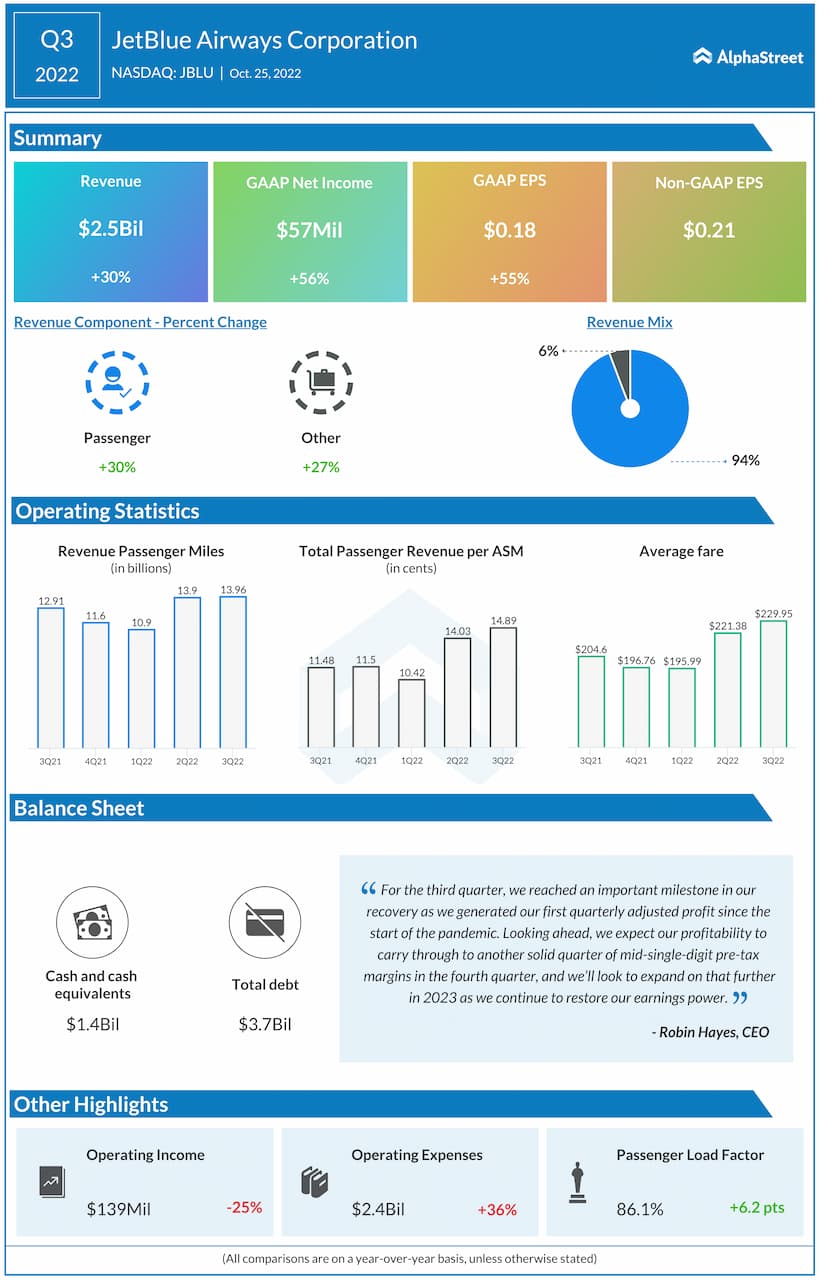

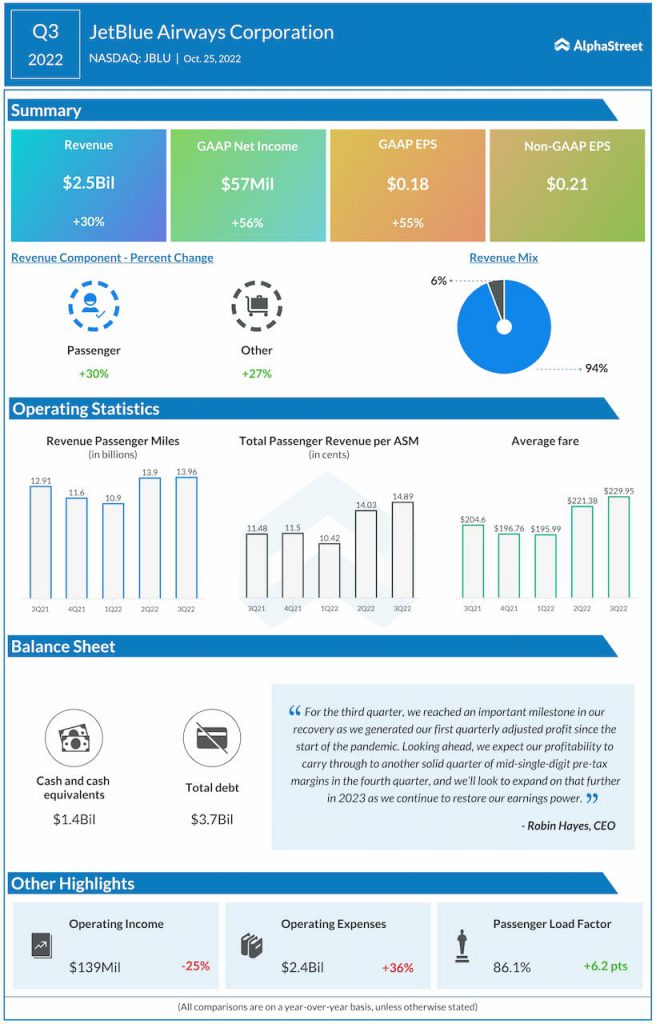

JetBlue’s total operating revenues of $2.56 billion were up 30% year-over-year and up 25% compared to the third quarter of 2019. The top line surpassed expectations. GAAP net income fell 56% YoY to $57 million, or $0.18 per share. The company delivered adjusted EPS of $0.21 in Q3, marking its first quarterly adjusted profit since the start of the pandemic. Despite this milestone, the number fell short of estimates, which caused the stock to tumble.

“Looking ahead, we expect our profitability to carry through to another solid quarter of mid-single-digit pre-tax margins in the fourth quarter, and we’ll look to expand on that further in 2023 as we continue to restore our earnings power.” – Robin Hayes, Chief Executive Officer.

Strong holiday demand

In Q3, revenue per available seat mile (RASM) increased nearly 30% year-over-year and 23% compared to 2019. Revenue turned out better than the company’s initial forecasts thanks to strong demand from people taking leisure trips and visiting friends and family.

These trends continued through the peak summer and into the fall trough period and they are continuing into the fourth quarter. JetBlue remains optimistic about the demand trends for the holiday peak season. The company expects unit revenue for Q4 2022 to increase 15-19% from Q4 2019.

In Q3, capacity was up 0.3% year-over-year and down 0.5% compared to 2019. For Q4, capacity is expected to be up 1-4% compared to the same period in 2019.

Costs

In Q3 2022, operating expenses per available seat mile, excluding fuel and special items (CASM ex-fuel) increased 3.2% YoY and 16.3% compared to 2019. For the fourth quarter of 2022, JetBlue expects CASM ex-fuel to increase 8.5-10.5% versus Q4 2019, representing a sequential improvement of approx. 7 points.