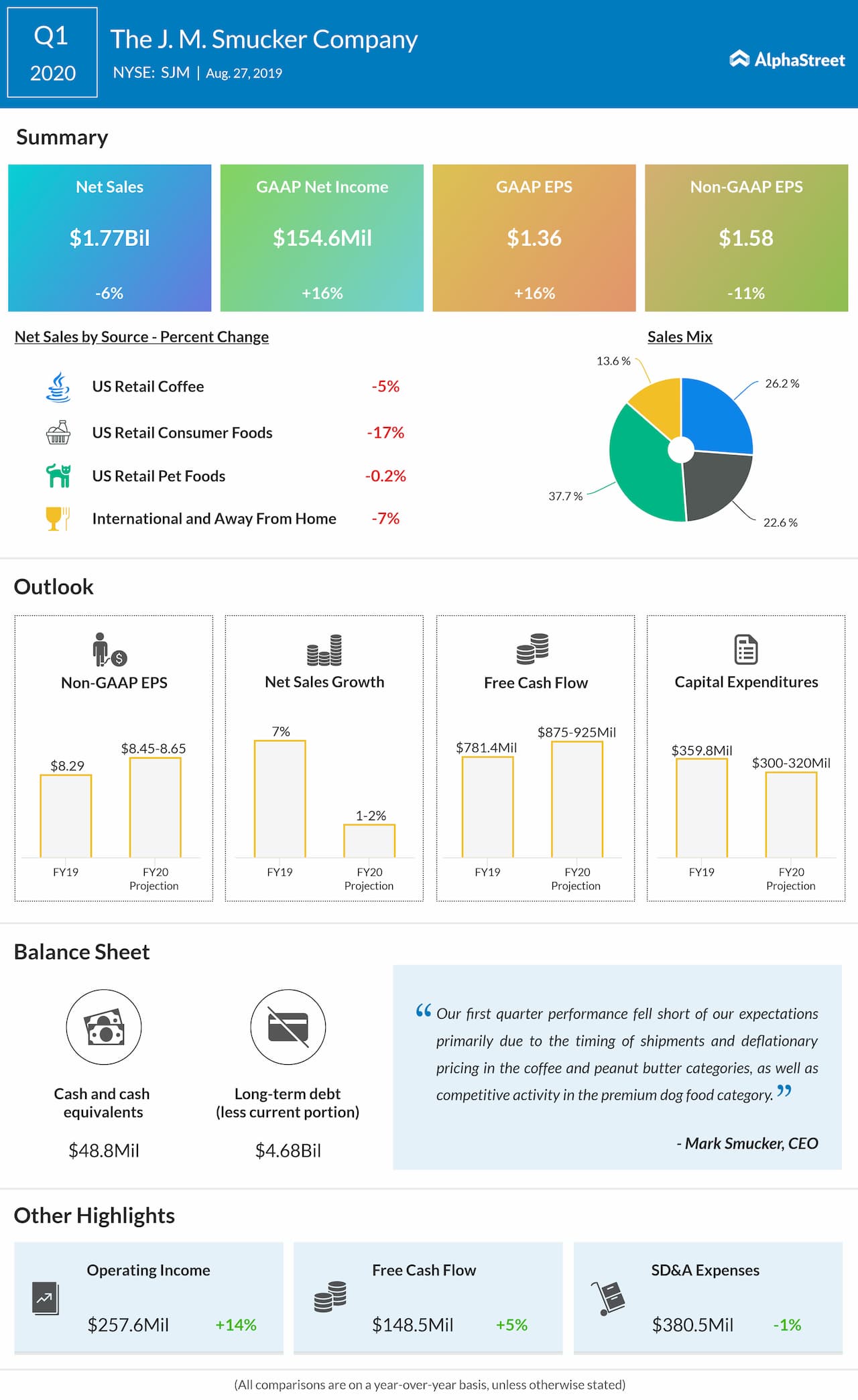

The J.M. Smucker Company (NYSE: SJM) missed market estimates for revenue and earnings in the first quarter of 2020, causing shares to fall over 5% in premarket hours on Tuesday. The consensus estimate was for earnings of $1.74 per share on revenue of $1.87 billion.

Net sales dropped 6% year-over-year to $1.77 billion, reflecting the impact of $73.1 million of net sales in the prior year attributed to the divested US baking business. Sales results were also negatively impacted by lower volume/mix and net price realization. Comparable net sales fell 4%.

Net income rose 16% year-over-year to $154.6 million, or

$1.36 per share. Adjusted EPS fell 11% to $1.58.

Gross profit increased 3%, driven mainly by a favorable net

impact of lower prices and lower costs, and the benefit of the Ainsworth

acquisition.

The company posted sales declines across all its segments during the first quarter compared to the prior-year period. In US Retail Pet Foods, sales results were impacted by volume/mix and a decrease in private label products. Sales in US Retail Coffee were hurt by lower volume/mix, mainly attributable to the Folgers brand, and net price realization.

Sales results in the US Retail Consumer Foods segment were mainly impacted by the divestiture of the US baking business as well as lower net pricing, primarily on the Jif brand. In the International and Away From Home division, sales were hurt by various factors such as the US baking business divestiture, negative foreign exchange impacts, lower volume/mix and lower net pricing.

For the full year of 2020, net sales are expected to range from down 1% to flat compared to the prior year. On a comparable basis, net sales are expected to range from flat to up 1%. Adjusted EPS is expected to be $8.35-8.55.

Get access to timely and accurate verbatim transcripts that are published within hours of the event.