Growth in sales and profits

Affordability constraints and built-to-order advantage

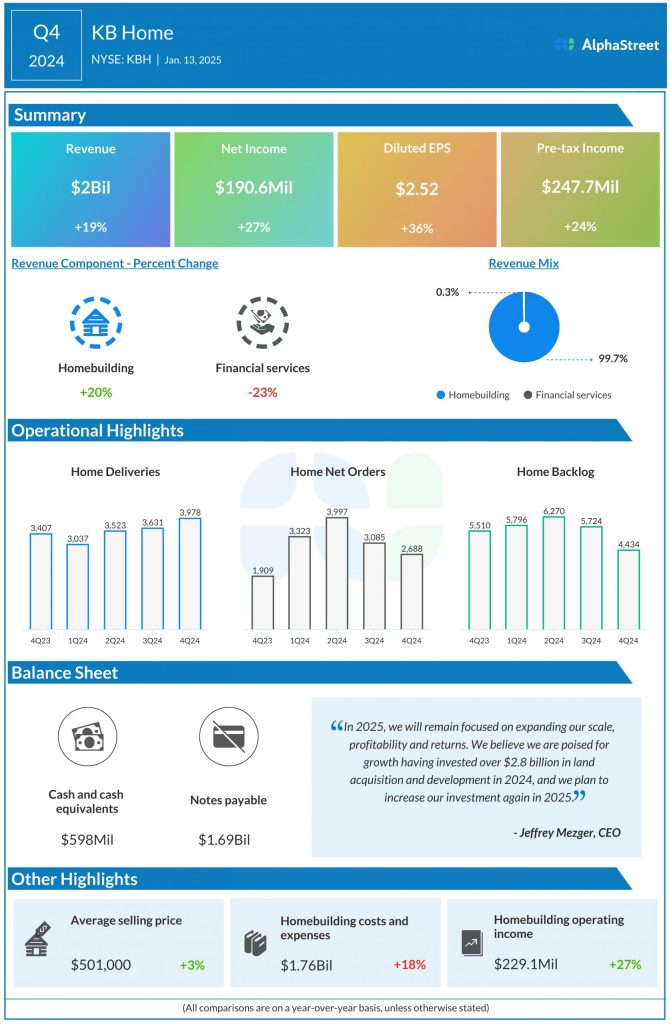

During the fourth quarter, KB Home witnessed strong demand for housing despite the headwinds from interest rates. As mentioned on the quarterly call, growth in employment and wages continue to fuel the housing market, and there is significant desire for homeownership among Millennials and Gen Z buyers who are increasingly forming new households. However, high mortgage rates continue to hinder affordability and pressure demand.

Although the company’s net orders increased 41% YoY to 2,688 homes in Q4 and its cancellation rate remained relatively low, its sales pace decelerated due to the volatility in mortgage rates as well as general uncertainty over the election and other macroeconomic concerns.

Against this backdrop, KBH’s built-to-order model is an advantage as it offers flexibility to buyers on affordability by allowing them to tailor their sales price according to their house designs. In Q4, over 60% of the company’s deliveries came from built-to-order sales.

Homes delivered increased 17% YoY to 3,978 in Q4. The average selling price rose 3% to $501,000. The company ended the quarter with a backlog of 4,434 homes with a value of $2.24 billion. Housing revenues grew 20% YoY in Q4. Homebuilding operating income margin expanded 60 basis points to 11.5%, and housing gross profit margin increased to 20.9% from 20.7% last year.

Outlook

For the first quarter of 2025, KB Home expects housing revenues of $1.45-1.55 billion. Average selling price is expected to remain flat sequentially at approx. $501,000. Homebuilding operating income margin is expected to be approx. 9.5% while housing gross profit margin is projected to range between 20.0-20.4% in Q1.

For the full year of 2025, KBH projects housing revenues to range between $7.0-7.5 billion. Average selling price is expected to range between $488,000-498,000, mainly due to a higher mix of deliveries forecasted for the Southeast region. Homebuilding operating income margin is expected to be 10.7% while housing gross profit margin is expected to be 20-21% for the year.