Docusign Inc (DOCU) Q4 2023 Earnings Call Transcript

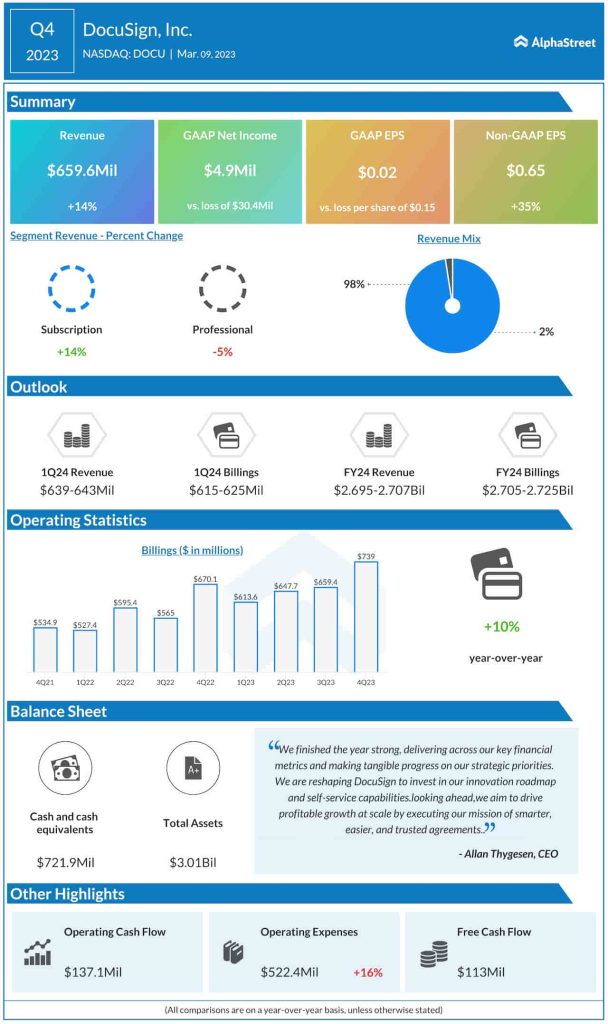

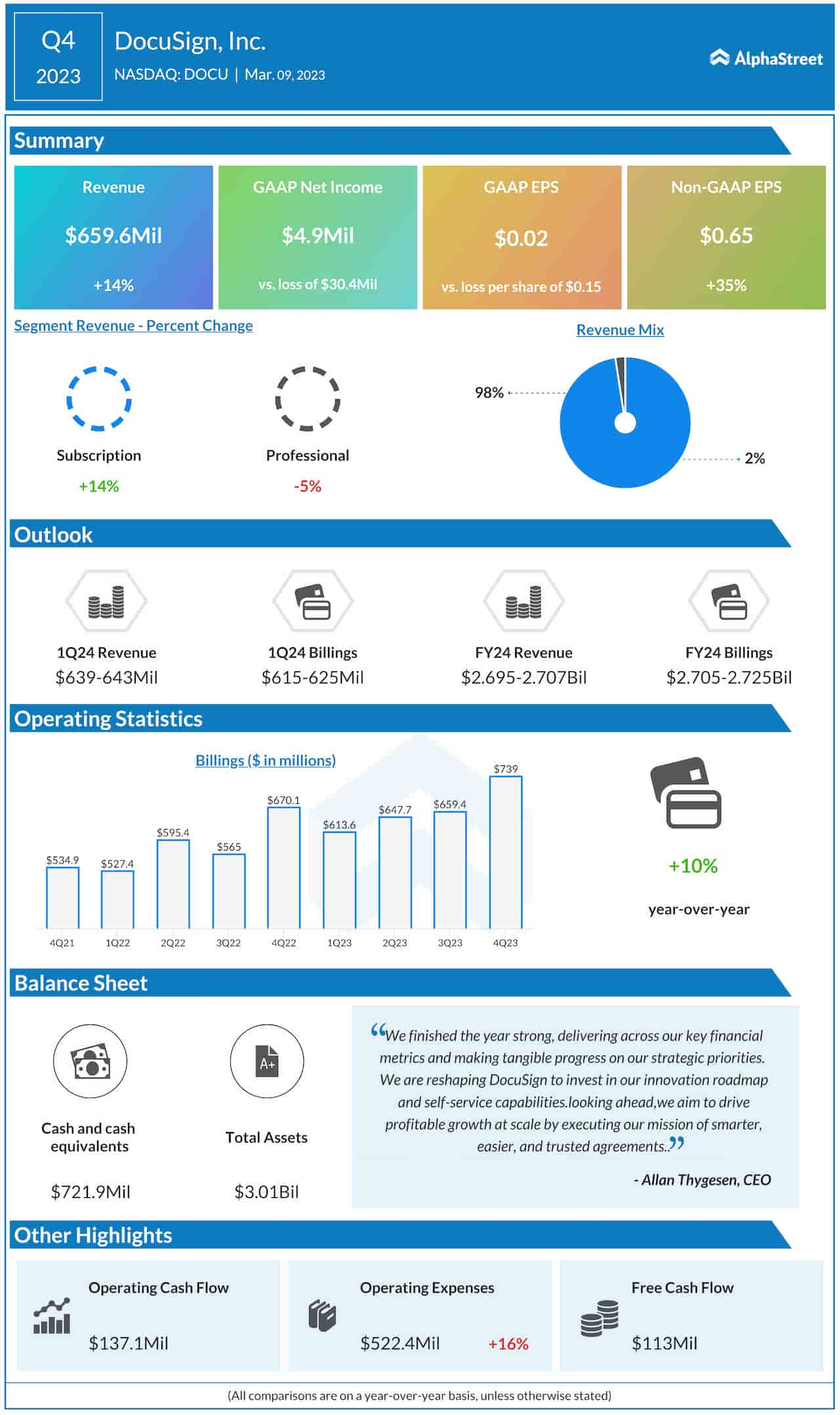

The contribution of Subscription revenue to the top line was 98% while Professional and Other revenues accounted for the remaining 2%. Fourth-quarter billings rose 10% to $739 million year-over-year. Together, cash, cash equivalents, restricted cash, and investments came in at $1.2 billion at the end of the quarter.

In FY2023, the net loss widened to $0.49 per share on account of higher operating expenses – a 20% increase to 97.5 million. The management expects the current market headwinds to persist in the coming quarters. Adobe Inc. (NASDAQ: ADBE), DocuSign’s main rival that competes with the company for market share, will be reporting earnings this week.

Outlook

The management forecasts that total revenues would be between $639 million and $643 million in the first quarter of 2024 — subscription revenue in the range of $625 million to $629 million. Billings are expected to be in the range of $615 million to $625 million. For fiscal 2024, the company estimates revenue to be between $2.695 billion and $ 2.707 billion, while full-year billings are expected to be in the $2.705-$2.725 billion range.

What Next?

Though the stock created a big hype in the early phase of the pandemic lockdown – climbing to an all-time high in 2021 – it is currently trading a dismal 83% below that peak. There is a probability of further downfall this year if the financial performance is weak in the coming quarters.

Last week, DOCU fell about 19% soon after the earnings release. At the moment, it is advisable to follow a watch-and-wait policy, for investing. However, the industry has upside potential, and it is likely to stabilize once the market gyrations get over in the next few months.