Shares of The Procter & Gamble Company (NYSE: PG) dropped over 5% on Tuesday after the company delivered mixed results for the fourth quarter of 2024. Earnings beat expectations while revenue fell short. PG has forecast sales and earnings growth for fiscal year 2025. Here are the key takeaways from the Q4 report:

Earnings beat, revenues miss

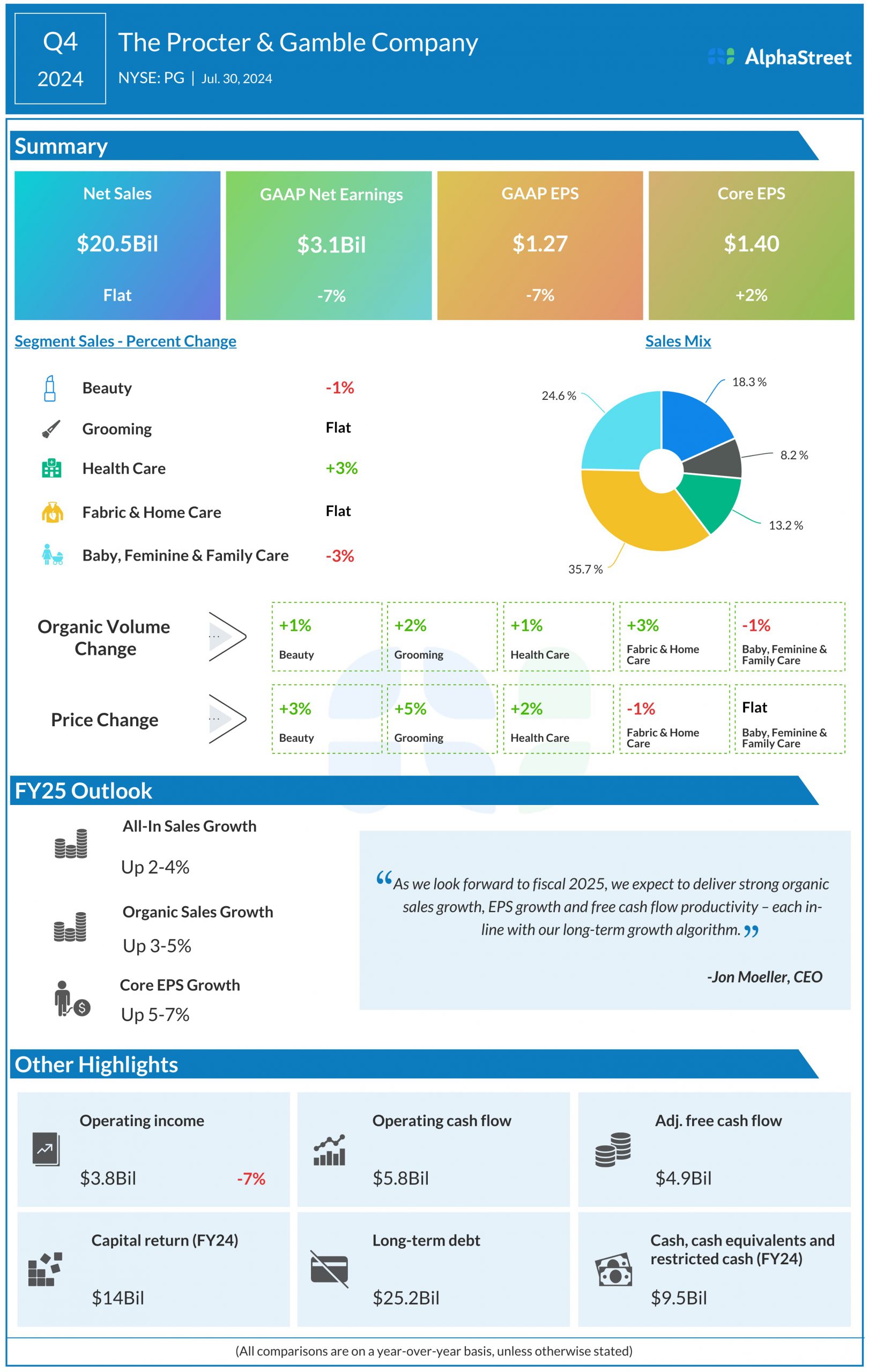

In Q4 2024, Procter & Gamble’s net sales remained flat year-over-year at $20.5 billion and came below estimates of $20.7 billion. Organic sales rose 2%. GAAP EPS decreased 7% to $1.27 in the quarter. Core EPS grew 2% to $1.40 and surpassed projections of $1.37.

Business performance

In Q4, Procter & Gamble recorded organic sales growth across all its segments, barring Baby, Feminine & Family Care. The highest growth of 7% was in the Grooming segment, driven by higher pricing and volume growth.

Organic sales in the Beauty segment increased 3% in the fourth quarter. Within this division, Skin and Personal Care sales remained flat, as growth from higher pricing was offset by lower sales of the super-premium SK-II brand. Organic sales in Hair Care grew in the high single digits, helped by higher pricing and favorable product mix.

Organic sales in the Health Care segment rose 4%, benefiting from high-single-digit sales growth in Oral Care, driven by premium product mix and volume growth in North America and Europe. Personal Health Care sales remained flat as gains from pricing and volume growth were offset by unfavorable mix.

Fabric and Home Care segment organic sales grew 2%, helped by high-single-digit sales growth in Home Care. Fabric Care sales remained flat as volume growth was offset by lower pricing. Sales in Baby, Feminine & Family Care dipped 1%, as sales in Baby Care decreased mid-single-digits due to volume declines. Feminine Care sales grew in the low single digits while Family Care sales remained flat.

Outlook

For fiscal year 2025, P&G expects all-in sales growth of 2-4% versus FY2024. Organic sales are expected to grow 3-5%. GAAP EPS for the year is projected to grow 10-12% versus GAAP EPS of $6.02 in FY2024. Core EPS is estimated to grow 5-7% YoY to a range of $6.91-7.05.