Quarterly performance

Category performance

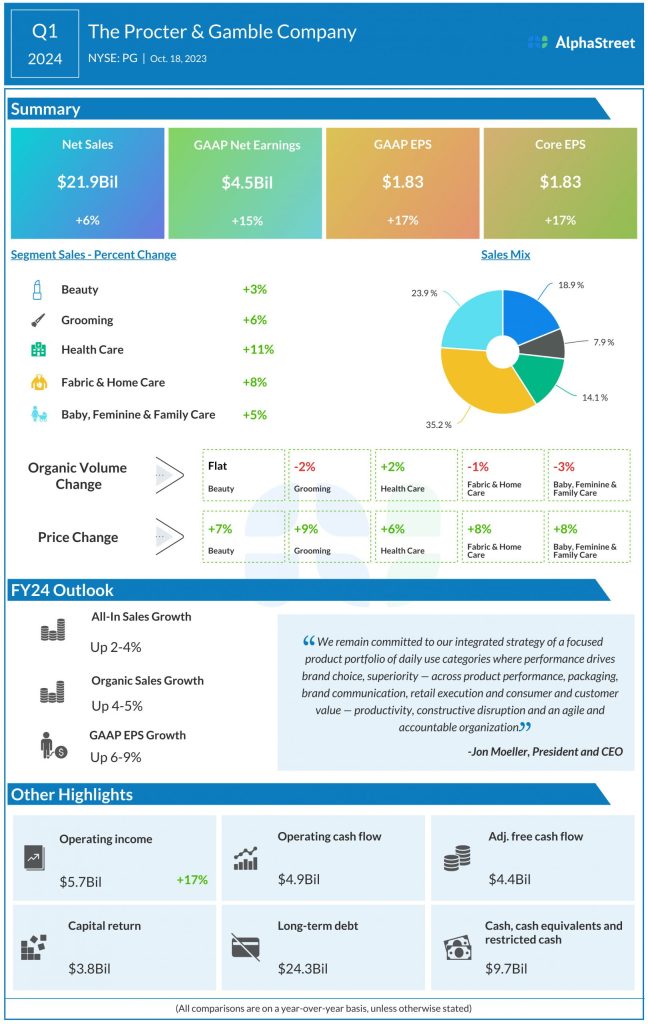

P&G recorded sales increases across all its segments in the first quarter, both on a reported and organic basis. Pricing played a significant role in driving sales growth. The Health Care segment posted the highest sales growth of 11% on a reported basis and 10% on an organic basis.

Within Health Care, oral care organic sales grew in the high single digits helped by higher pricing and favorable product mix. Personal health care saw double-digit organic sales growth due to higher pricing and volume growth driven by strong demand for respiratory products.

Both the Grooming and Fabric & Home Care segments saw organic sales increase by 9%, driven by higher pricing and favorable product mix. Both segments were impacted by volume declines.

The Baby, Feminine and Family Care segment recorded organic sales growth of 7% in Q1. The categories within this segment benefited from higher pricing and favorable product mix but were impacted by volume declines and unfavorable pack size mix.

The Beauty segment recorded the lowest organic sales growth of 5% in the quarter. Within Beauty, skin and personal care sales growth was impacted by lower sales of SK-II. Hair care organic sales grew in the high single digits, driven by pricing.

Outlook

P&G revised its outlook for all-in sales growth for the full year of 2024 to a range of 2-4% versus the previous range of 3-4%. It maintained its organic sales growth guidance at 4-5%. The company expects EPS to range between $6.25-6.43, representing a YoY growth of 6-9%.