[irp posts=”62725″]

Considering the prospects of the market the company serves, it can expect to achieve strong organic revenue growth in the coming years, with one of the key growth drivers being the 5G ramp-up that requires advanced solutions like those offered by Keysight. Maybe, there lies the answer to the backlog issue because a sizable share of the recent orders was related to 5G. Also, the satellite and radar solutions continue to be in demand aided by high government spending, especially in the aerospace and defense sectors.

Outlook

The stable demand, combined with the recent partnerships with industry-leading tech firms like Qualcomm (QCOMM) and Keysight’s flexible cost structure, should translate into profit going forward. Unlike some of its peers in the tech space, the company’s exposure to Huawei is very small so it is not affected by the blacklisting of the China-based telecom gear maker.

On the other hand, the challenging conditions in the auto sector do not bode well for the company, which is a leading provider of advanced technologies for onboard electronic equipment, though there is a high demand for driverless navigation technology and new-gen accessories.

“The auto business, in particular, has slowed down, we obviously saw significant slowdowns as everybody has seen in the industries for the old technologies or old auto. Some of the new auto wasn’t as strong as it was pre-COVID, but we still feel very good about our position. So we are there for when that market snaps back,” said CEO Ron Nersesian during his interaction with analysts at the earnings conference call.

Surviving COVID

When it comes to overcoming the present crisis, the positive operating cash flow is something the company can count on, as it moves ahead with the plan to reopen plants and ramp up production. The goal is to resume 100% production by the end of the quarter. Interestingly, the management expects the key third-quarter numbers to be in line with the most recent quarter.

The executives have expressed optimism that the new Innovate Anywhere program would add steam to the ongoing uptick in the software business, given the changed market scenario.

Due to the first-to-market strategy, Keysight needs to invest continuously in research and development, which could be a reason why it is focusing on preserving liquidity through initiatives like hiring-freeze and spending cuts. The R&D efforts are paying off, and Keysight is all set to roll out as many as 90 new solutions in the remainder of the fiscal year. The management has maintained its capital allocation program unchanged.

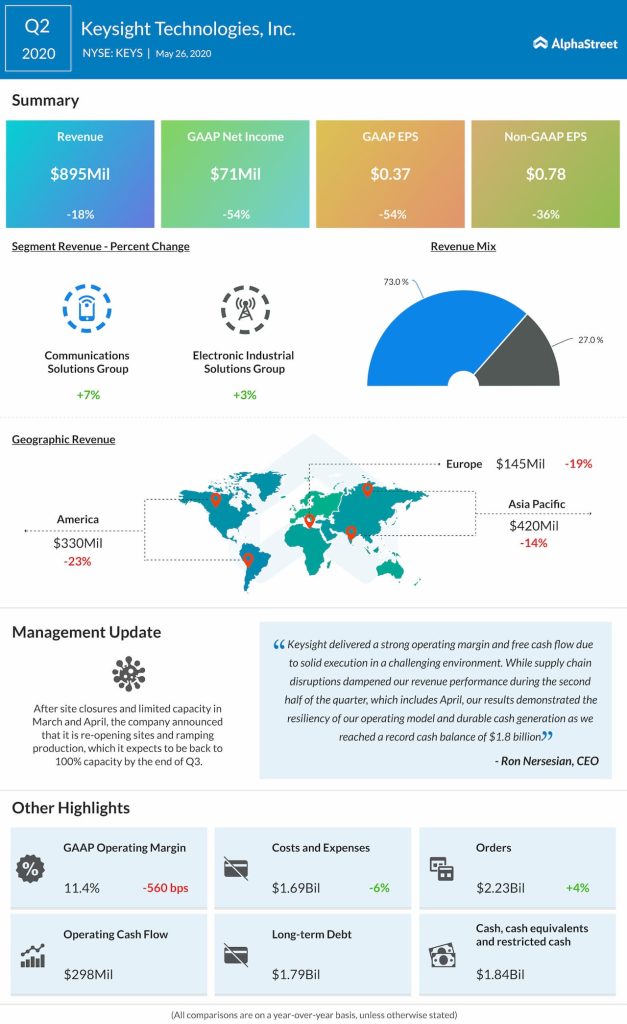

Earnings Debacle

Overall, it was a dismal performance in the April-quarter, with earnings and revenues dropping in double digits to $0.78 per share and $892 million, respectively, though the impact on margins was partially offset by lower costs. The results also missed Wall Street’s expectations. There was a 3% drop in orders, as a shift in customer behavior in April reversed the positive trend seen in the early weeks of the quarter.

“We had a drop off in April when everything pretty much shut down. So our order level was lower. Our sales organization worked from home and actually has been very effective after the first couple of weeks just trying to figure out how to contact customers. Revenue, we’ve talked about that and how that is ramping now and we’ll be back to full strength by the end of the quarter.”

Ron Nersesian, CEO of Keysight

[irp posts=”62562″]

The company’s stock entered the calendar year 2020 on a negative note and lost momentum progressively. It slipped to a twelve-month low towards the end of March but bounced back and reached the pre-selloff levels this week.