Shares of Kimberly-Clark Corporation (NYSE: KMB) were down over 4% on Wednesday. The company delivered disappointing results for the fourth quarter of 2023, with both revenue and earnings missing estimates. The consumer products firm expects sales growth in the low to mid-single digits for the coming fiscal year. Here are the main points from the earnings report:

Lower-than-expected results

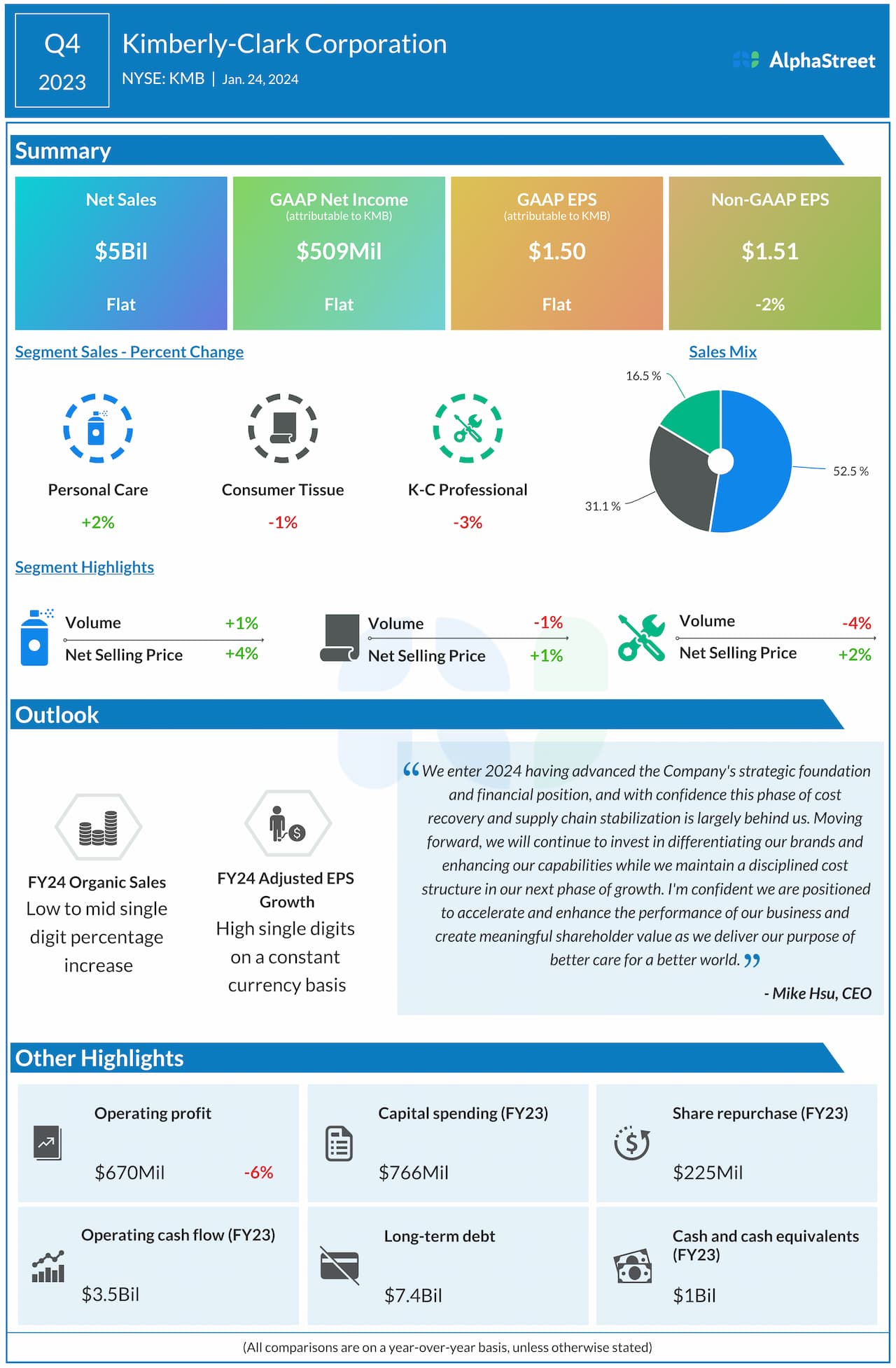

Kimberly-Clark generated net sales of $4.97 billion for the fourth quarter of 2023, which was relatively flat compared to the year-ago period and lower than analysts’ projections. On an organic basis, sales grew 3%, benefiting from higher price and favorable product mix.

At the same time, the top line was negatively impacted by foreign currency headwinds and the divestiture of the tissue and K-C Professional business in Brazil. GAAP EPS for the quarter remained flat year-over-year at $1.50. Adjusted EPS fell 2% to $1.51, missing expectations.

Business performance

In Q4 2023, KMB saw organic sales growth of 3% in North America, helped by increases of 5% and 3% in Personal Care and Consumer Tissue respectively, partly offset by a 3% drop in K-C Professional (KCP). Outside North America, organic sales grew 5% in developing and emerging markets, and 1% in developed markets.

In the Personal Care segment, sales grew 2% year-over-year to $2.6 billion on a reported basis, and 6% on an organic basis, helped by favorable price, mix and volume. Sales in the Consumer Tissue segment dropped 1% to $1.5 billion in the quarter. On an organic basis, sales in this segment remained flat YoY. KCP segment sales decreased 3% YoY to $816 million, with a 1% drop on an organic basis, as lower volumes offset improved product mix and revenue realization.

Outlook

For fiscal year 2024, Kimberly-Clark expects organic sales to grow in the low-to-mid-single digits year-over-year. Adjusted EPS is expected to grow at a high-single-digit rate on a constant currency basis. Adjusted operating profit is expected to grow at a high-single-digit to low-double-digit rate on a constant currency basis.