Shares of Lennar Corporation (NYSE: LEN) were down over 2% on Friday. The stock has dropped 20% thus far this year. The company delivered strong results for the fourth quarter of 2022 even as it faced a complicated market. Lennar continued to change its strategy to deal with the changes in the housing market.

Quarterly numbers

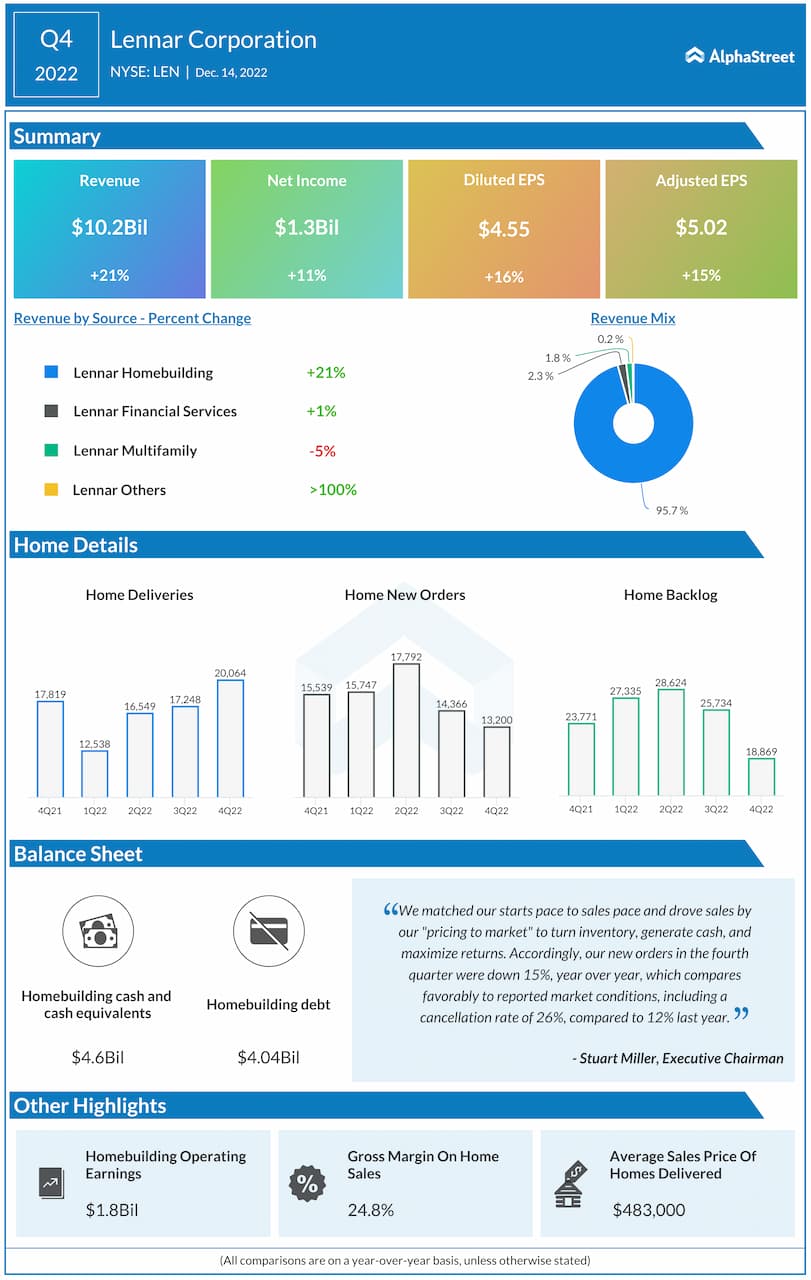

Total revenue in the fourth quarter of 2022 increased 21% to $10.2 billion compared to the same quarter a year ago. Net income increased 11% to $1.3 billion and EPS grew 16% to $4.55. Adjusted EPS rose 15% to $5.02. Revenues from home sales increased 21% year-over-year to $9.7 billion, driven by increases in home deliveries and average sales price.

Trends and strategy changes

On its quarterly conference call, Lennar stated that market conditions continued to deteriorate in the fourth quarter. The movement in interest rates affected both affordability and consumer confidence leading to changes in market conditions and demand.

The company estimates that production of single and multi-family dwellings across the nation will be down between a quarter to a third in 2023, amplifying the national housing supply shortage.

Lennar saw a material decrease in sales and sales prices across both new and existing home markets. The company adjusted base sales prices, increased incentives and provided mortgage rate buydowns in order to maintain or regain sales momentum. During the fourth quarter, new sales orders dropped 15% from the prior year. Community count was down 4% year-over-year.

In Q4, Lennar witnessed strength in markets like Southwest and Southeast Florida, Tampa, New Jersey, and San Diego. These markets benefited from low inventory and they are benefiting from strong employment and local economies. Even so, the company had to offer mortgage buydown programs and incentives.

Markets like Atlanta, Jacksonville, Virginia, Maryland, Dallas, Houston and Colorado had low inventory but required more aggressive financing, price reductions and incentives to regain sales momentum. Lennar is seeing more pronounced softness in markets like Orlando, Austin, Phoenix and Utah and these require more adjustments.

The company also made progress on its goal to become land lighter. At the end of Q4, it owned 166,000 home sites and controlled 281,000 home sites for a total of 447,000 home sites. This translates into 2.5 years owned, which is ahead of its year-end goal of 2.75 years.

Outlook

For the first quarter of 2023, Lennar expects both new orders and deliveries to range between 12,000-13,500 and average sales price to come between $440,000-450,000. New deliveries for the full year of 2023 are estimated to range between 60,000-65,000.

Click here to read more on homebuilding stocks