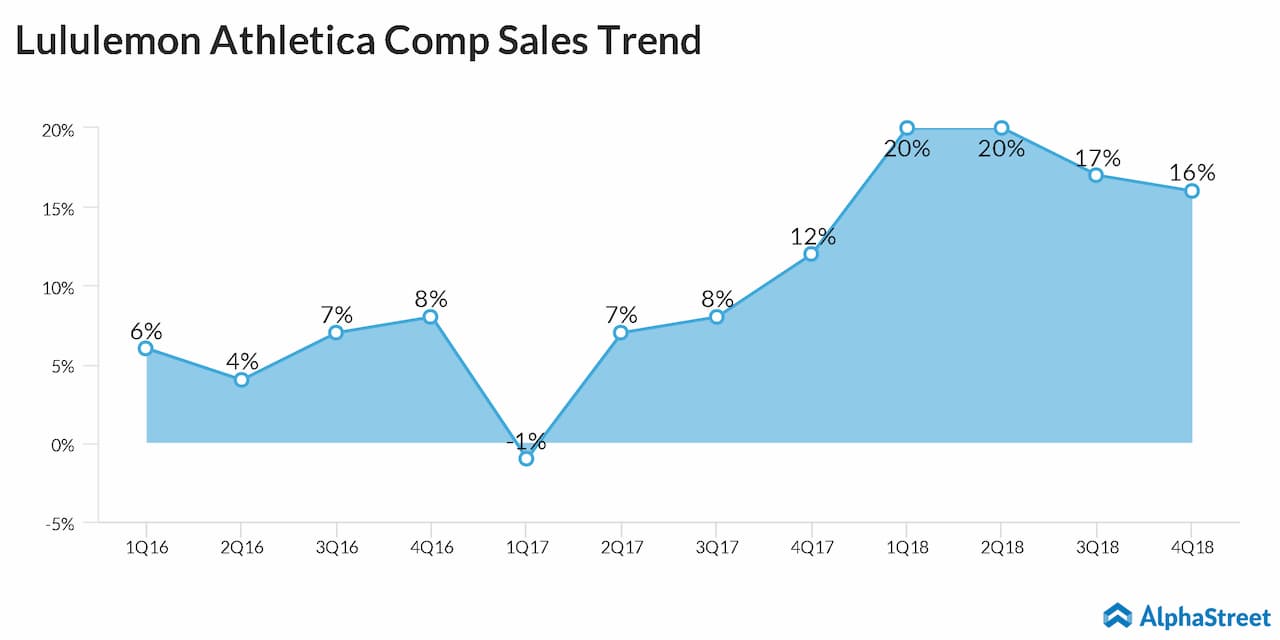

However, Lululemon remains unscathed, unlike its peers due to strong fundamentals resulting in the stock surging 42% this year. The athletic apparel seller has reported double-digit comp sales growth in the last five quarters and has recorded 5% plus growth in the last seven quarters. Investors would be expecting the retailer to continue the momentum on June 12 when the company releases its Q1 2019 results after the bell.

What

to expect?

Lululemon is forecasting Q1 sales to be between $740-750 million and earnings per share of 68 cents to 70 cents. Same-store sales, adjusting for currency exchange, is expected to increase low-double digits.

On the flip side, analysts are anticipating earnings of 70 cents per share on revenue of 755 million. The company has been consistently surpassing estimates for the past two years and shareholders would be expecting the trend to continue.

For the full year, the retailer expects revenue in the range of $3.70-3.74 billion and EPS to be between $4.48 and $4.55 helped by low double-digit sales growth. When it comes to street estimates, the top line is forecasted at $3.77 billion and earnings of $4.63 per share. It would be interesting to see whether Lululemon is revising its outlook on Wednesday.

Looking ahead, Wall Street is expecting sales of $834 million and earnings of 88 cents per share for the second quarter. For the same period last year, the company reported a revenue increase of 25% to $723.5 million and earnings of 71 cents per share.

Power

of Three

It’s a no-brainer that Lululemon’s largest customer target group is women, especially in the yoga category. The brand is known for its premium positioning and high-quality products resulting in high retention and loyal customers.

In April, the apparel retailer unveiled its five-year growth plan called “Power of Three” running until 2023. The company believes the new strategy would be a tailwind to power its next phase of growth. As part of the strategy, the three new focus areas in the near future will be menswear, digital sales, and international expansion.

In the next five years, menswear sales are expected to double with the improved brand awareness, customized offerings catering to men. This would help the company to expand the addressable market and can mimic the strong performance it’s witnessing on the women’s side.

In 2018, digital sales jumped nearly 49% to

$858 million, contributing 26% to the top line. The company now expects to

double the e-commerce sales by 2023.

Last fiscal year, the United States and Canada brought in 89% of revenues with the rest coming from international sales. Lululemon wants to expand its presence outside of North America to grow its business, which is expected to improve its brand penetration and growth potential in the near future.

The retailer wants to focus on EMEA and APAC regions which include countries like United Kingdom, Germany, China, Japan, and South Korea. In the next five years, international revenues are projected to grow jump fourfold from 2018 level of $362 million.

Bottom Line

With all things going in favor of the athletic apparel retailer, the company needs to make sure the growth strategy planned is executed well in the upcoming years which would help the firm to leapfrog into the next level, in line with the expectations of its stakeholders.