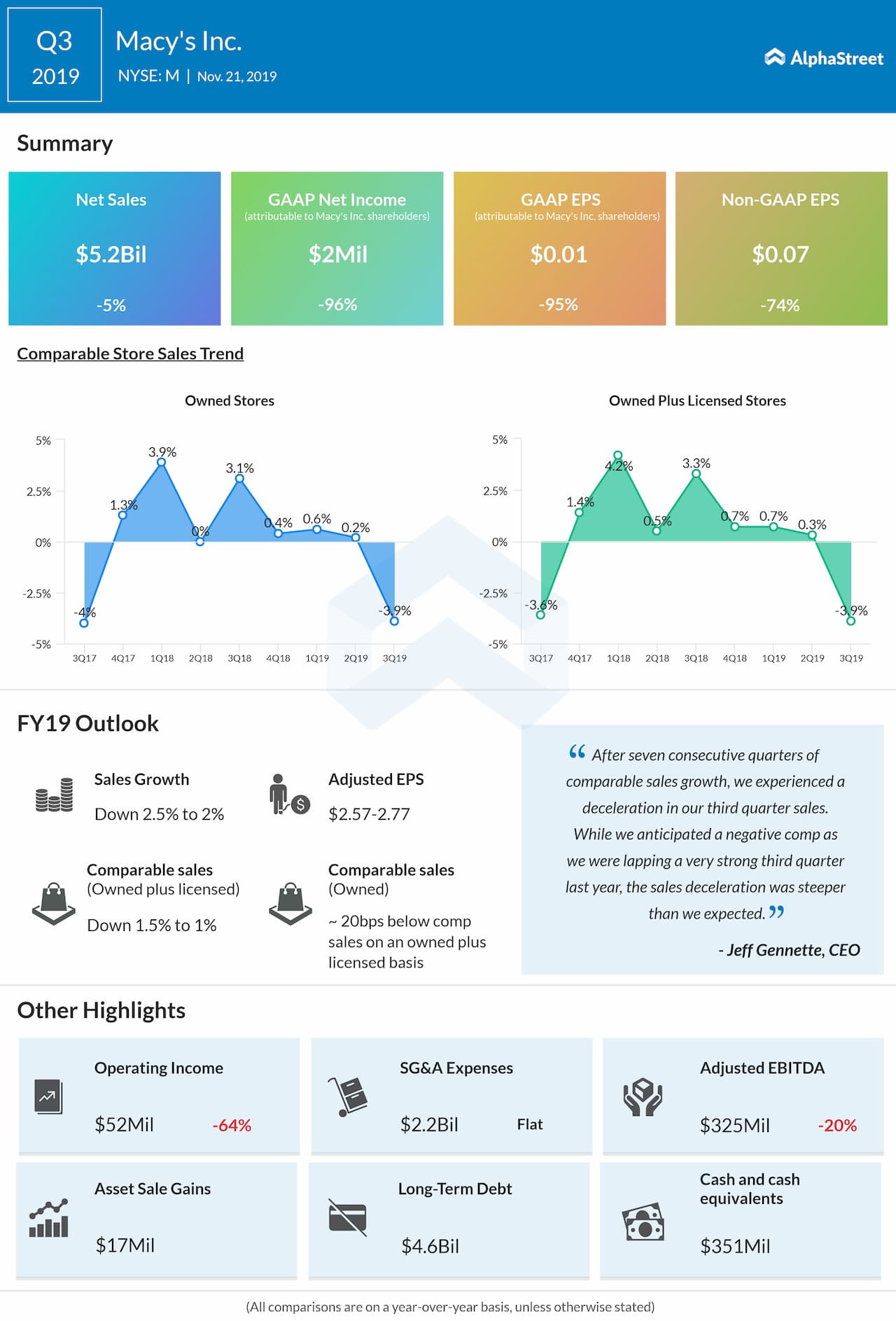

Macy’s Inc. (NYSE: M) reported better-than-expected earnings for the third quarter of 2019 but sales fell short of estimates. The company also lowered its annual sales and EPS guidance. Shares dropped 5% in premarket hours on Thursday.

Net sales fell 5% year-over-year to $5.17 billion, missing the consensus target of $5.3 billion. Comparable sales fell 3.9% on an owned basis and 3.5% on an owned plus licensed basis.

On a GAAP basis, net income amounted to $2 million, or $0.01

per share, compared to $62 million, or $0.20 per share, in the prior-year

quarter. Adjusted net income totaled $21 million, or $0.07 per share. Analysts

had predicted an adjusted loss of $0.01 per share.

CEO Jeff Gennette said, “Our

third quarter sales were impacted by the late arrival of cold weather,

continued soft international tourism and weaker than anticipated performance in

lower tier malls. We also experienced a temporary impact on our e-commerce

business due in part to work on the site in preparation for the fourth quarter.

The team has completed that work, the site is upgraded and our customers can

expect an improved experience this holiday season.”

Macy’s expressed confidence in its holiday strategies and stated that it has fully updated its Growth150 stores and completed the 2019 expansion of Backstage.

In the third quarter, asset

sale gains totaled $17 million pre-tax, or $13 million after-tax, compared to asset

sale gains of $42 million pre-tax, or $31 million after-tax, last year.

Based mainly on the impact of

its third quarter sales trend, Macy’s updated its annual guidance. The company

now expects full-year 2019 net sales to be down 2.5% to 2% versus the previous outlook

of approx. flat. The outlook for adjusted EPS was lowered to a range of

$2.57-2.77 from the prior range of $2.85-3.05.

For 2019, comparable sales on an owned plus licensed basis is now expected to be down 1.5% to 1%, while comparable sales on an owned basis is expected to be approx. 20 basis points below comparable sales on an owned plus licensed basis. The earlier outlook for both these metrics was flat to up 1%.

Listen to on-demand earnings calls and hear how management responds to analysts’ questions