After registering a slow recovery in the first half of the week, the markets pared these gains on Thursday and Friday. The weakness witnessed in the latter half of the week was based on hiring uncertainties in the aftermath of COVID-19 pandemic, as well as the central bank’s guidance of a slow recovery. The Federal Reserve also announced its intention not to raise interest rates for another three to four years. The S&P 500 index fell 1.6% in the week’s run.

Meanwhile, NASDAQ 100 and Dow Jones Industrial Average were dragged by the continued weakness in Big Tech. JPMorgan analyst Marko Kolanovic has, meanwhile, predicted that the sell-off in NASDAQ 100 is “probably over.”

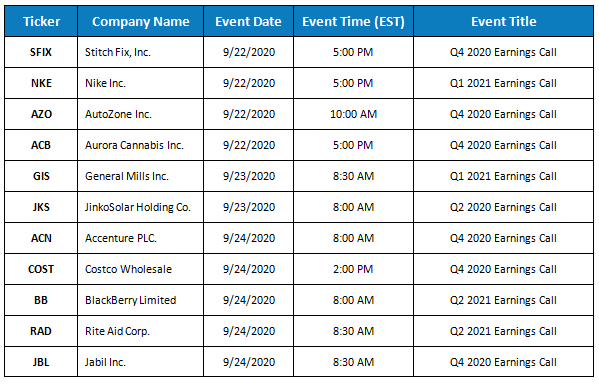

On the notable earnings for the upcoming week, sportswear giant Nike (NKE) and Canadian pot producer Aurora Cannabis (ACB) are set to conduct their quarterly earnings calls on September 22, the once-dominant smartphone maker BlackBerry (BB), drugstore chain Rite Aid (RAD), and warehouse retailer Costco Wholesale (COST) will be conducting their quarterly earnings calls on September 24.

Key Earnings to Watch

Investor Days to Watch

Key Corporate Conferences to Watch

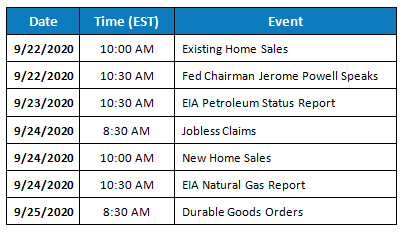

Key US Economic Events

Looking Back

The following are notable companies which have reported their earnings last week. In case if you have missed to catch up on their performance, click the respective links to skim through the transcripts/infographs to glean more insights.

Lennar Corp. (LEN)

Adobe Inc. (ADBE)

Fedex Corp. (FDX)

Herman Miller Inc. (MLHR)

Apogee Enterprises Inc. (APOG)

If you want to listen to how management responds to analyst questions and the tone they use, you can head over to our YouTube channel to listen to conference calls on the go.