The Bottom-line

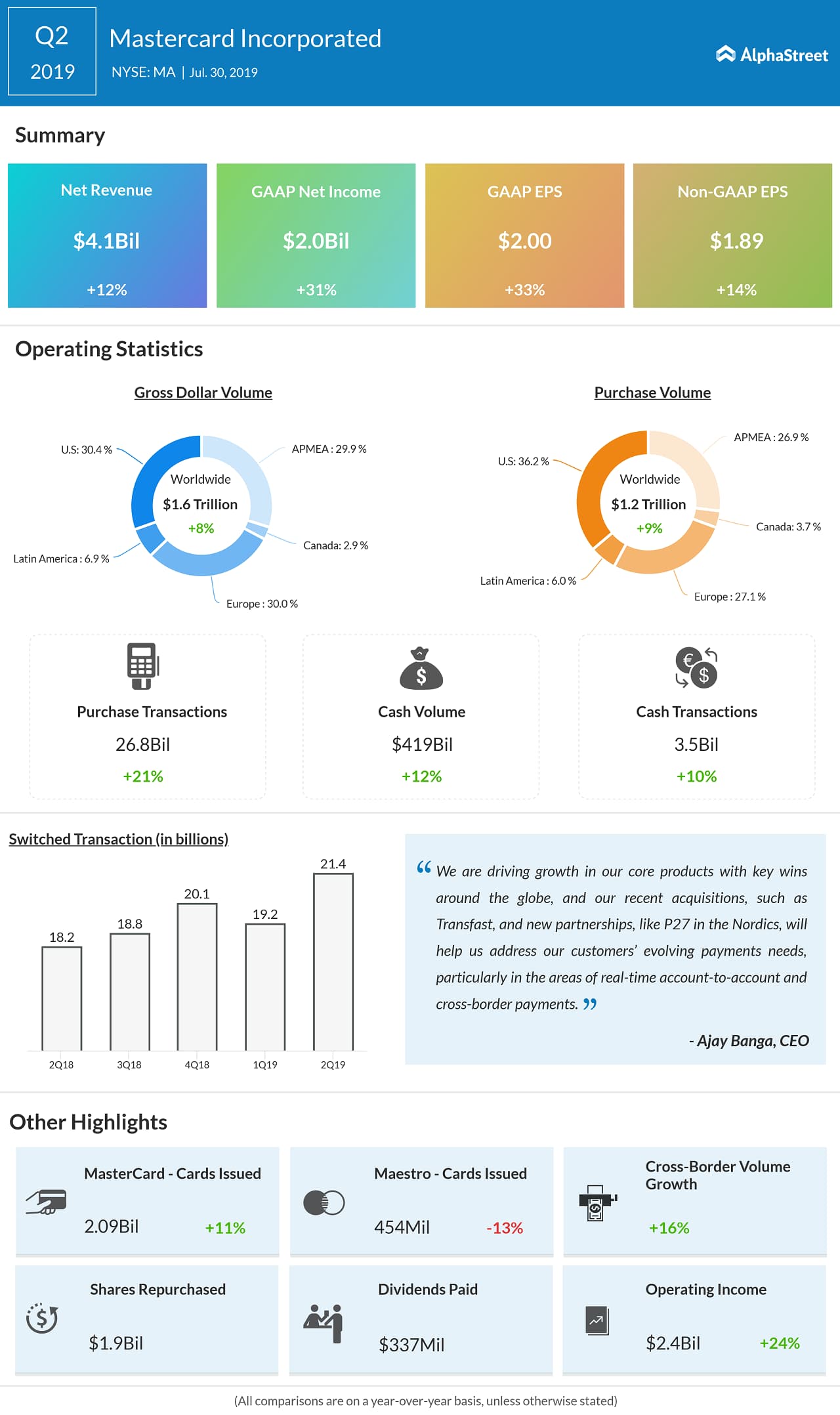

During the three-month period, both gross dollar volume and purchase volume increased by 13%. Contributing to the top-line growth, cross-border volumes grew 16% on a local currency basis. There was a 23% growth in other revenues, supported by the company’s Cyber & Intelligence and Data & Services solutions, which was partially offset by rebates and incentives.

Also read: MasterCard Q1 2019 Earnings Conference Call Transcript

CEO Ajay Banga said, “We are driving growth in our core products with key wins around the globe, and our recent acquisitions, such as Transfast, and new partnerships, like P27 in the Nordics, will help us address our customers’ evolving payments needs, particularly in the areas of real-time account-to-account and cross-border payments.”

Stock Buyback

During the quarter, the management repurchased 7.7 million shares for about $1.9 billion and paid $337 million in dividends. As of June 30, 2019, there were a total of 2.6 billion Mastercard and Maestro-branded cards issued to the company’s customers.

Competitors

Earlier this month, Visa (V) reported double-digit growth for third-quarter earnings and revenues to $1.37 per share and $5.84 billion respectively, which also surpassed analysts’ estimates. However, the stock suffered as the management slashed its full-year outlook.

Mastercard stock made steady gains so far this year and is currently trading at a record high of around $280. It has moved up 39% in the past twelve months, outperforming Visa and the S&P 500 index. The stock closed the last trading session lower.