Where to Invest?

Mastercard Incorporated Q4 2021 Earnings Call Transcript

Payment service providers, in general, have been cashing in on the acceleration in the adoption of digital payment platforms during the pandemic. Since the online shift is mostly permanent, the future looks bright for credit card companies. However, the recent performance of Mastercard’s stock shows this tailwind has not been fully factored into the valuation.

Outlook

As per the estimates, MA is poised for strong gains this year – as much as 25% in the next twelve months. Analysts following Mastercard unanimously recommend buying the stock, reflecting the upbeat market sentiment. The stock entered 2022 on a high note and hit a new high in the early weeks of the year, before losing a part of the momentum and retreating to the pre-peak levels.

Experts are bullish on Visa also, but their consensus rating indicates the stock’s growth prospects are not as bright as that of Mastercard. Visa is expected to move close to the $275 mark. The stock experienced high volatility since peaking in mid-2021, marked by a persistent downtrend and short-lived recoveries.

Advantage MA

Compared to Visa, Mastercard has higher earnings per share and stronger revenue per share growth and has an exceptionally strong balance sheet. The company’s aggressive investments in the business-to-business payments segment position it to effectively tap into the unfolding opportunities in that area. Taking innovation to the next level, Mastercard has announced what it calls ‘Sustainability Innovation Lab’ to explore technologies like quantum, 5G, and advanced AI to address environmental challenges. All these factors give the company a slight edge, from the investment perspective.

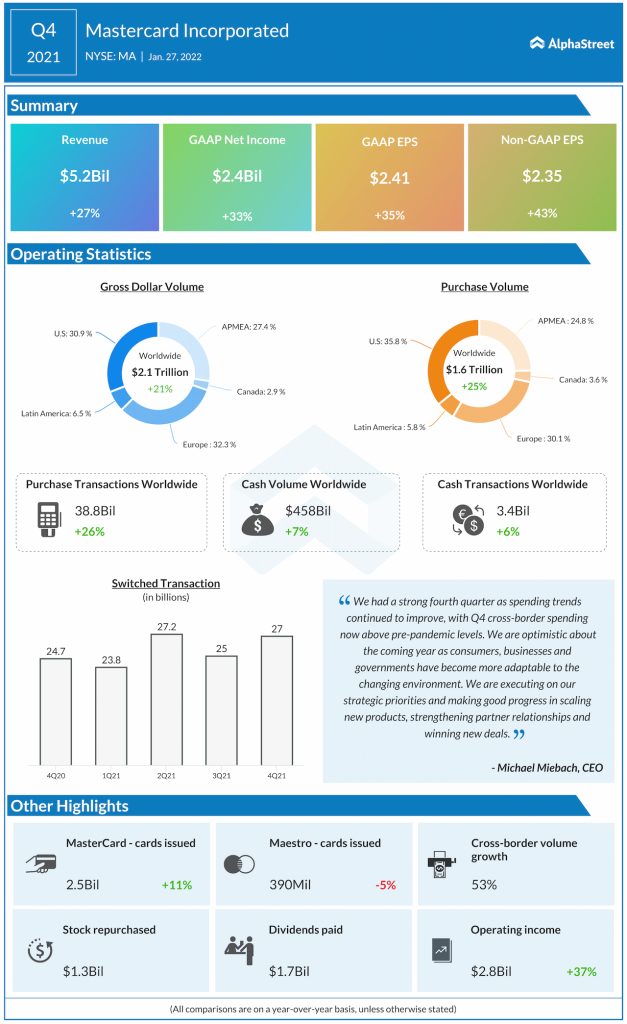

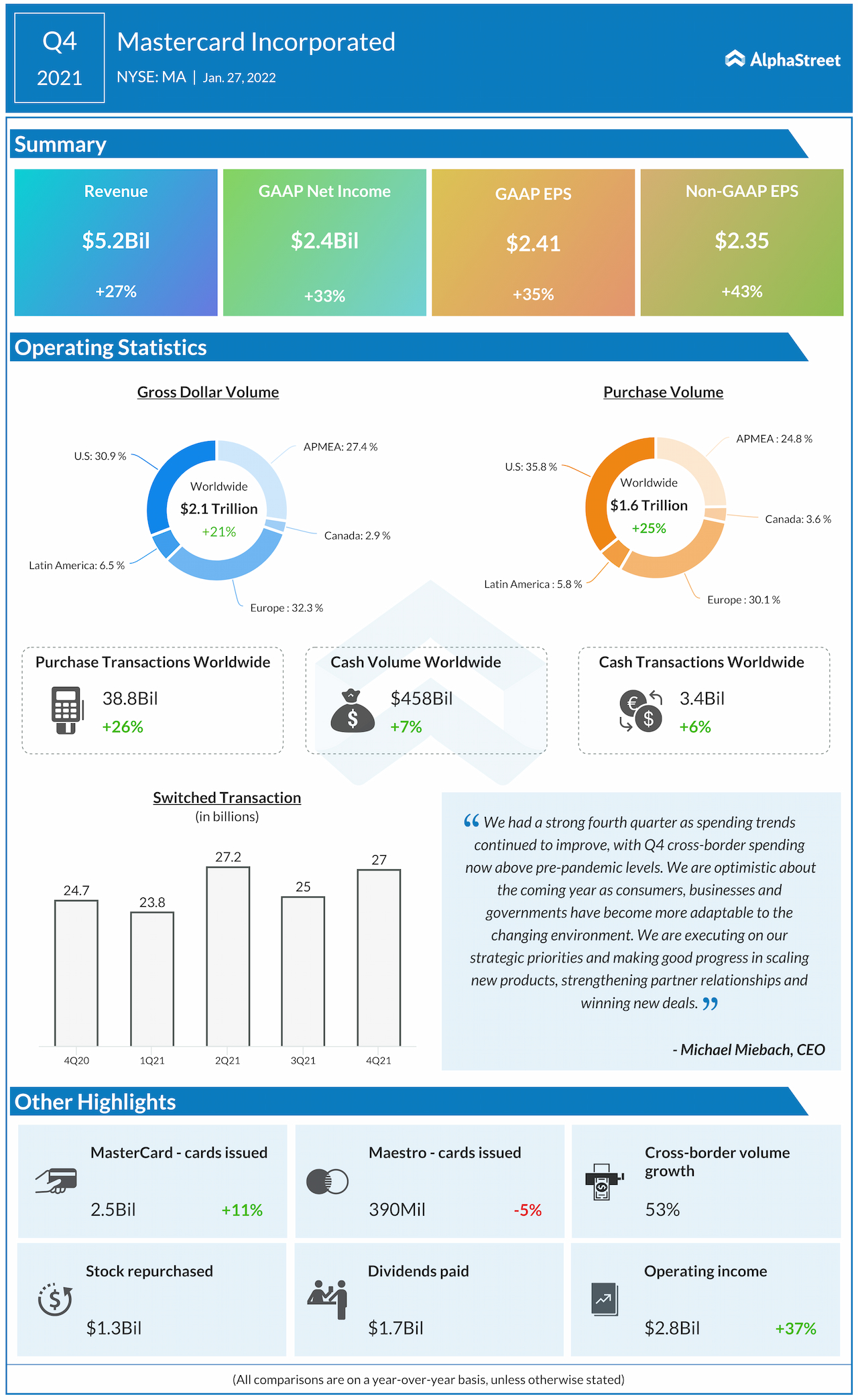

Both Mastercard and Visa reported higher earnings and revenues in recent quarters, with the bottom line mostly beating the estimates despite the COVID-related uncertainties. In the final three months of fiscal 2021, Mastercard’s revenues and earnings increased in double digits to $5.2 billion and $2.35 per share respectively. Meanwhile, Visa reported a 24% increase in first-quarter 2022 revenues to $7.1 billion, which translated into a sharp rise in earnings to $1.81 per share.

From Mastercard’s Q4 2021 earnings call:

“The secular shift has gotten a real push out of COVID, I mean, where we had to spend online. And when I look at that, I think that is a fundamental structural trend, more online commerce, more online banking, more online and everything. And what has really come out over the last two years that this is a lasting trend. So every bit of consumer research that we do, market research that we do, people will say, I like to like it, so I’m going to continue to do that.“

Read management/analysts’ comments on Visa’s Q1 2022 earnings

Mastercard’s stock traded lower on Thursday afternoon and hovered near the $350-mark, which is close to the levels seen six months ago. Visa has lost about 6% in the past six months and closed the day’s session lower.