Bullish View

Echoing the upbeat sentiment, market watchers predict that growth would accelerate further next year. Overall, Micron looks poised to create strong shareholder value in the coming months. It is widely expected that the stock will gain as much as 46% in the next twelve months and breach the $100-mark. This is a rare buying opportunity investors wouldn’t want to miss.

Read management/analysts’ comments on Micron’s Q1 2022 earnings call transcript

The Boise, Idaho-based semiconductor firm is betting on its cloud and data center business to drive growth, taking a cue from the rapid capacity expansion driven by growing demand for effective solutions to deal with big data. The launch of new NVMe solid-state drivers last year complements the management’s strategy to tap into unfolding opportunities in that area.

Datacenter Leads

Datacenter, which is considered the largest market for storage and memory products, continues to be the main growth driver for Micron. However, the electric vehicle and 5G mobile segments are catching up fast, and they might outperform the core business in the near future. Businesses are aggressively expanding data center capacity by investing huge amounts, and the trend will continue in the coming years. In short, Micron is serving an ever-growing market that is unlikely to slow down.

From Micron’s first-quarter 2022 earnings conference call:

“We anticipate underlying demand in calendar 2022 to be led by increasing volume of data center server deployments, 5G mobile shipments, and continued strength in automotive and industrial markets. Non-memory supply shortages have constrained customer builds and pushed out some demand across many end markets. While these shortages may cause some variability to our demand, we expect them to ease through 2022, supporting memory and storage demand growth.”

Headwinds

But the chip shortage is far from over, and semiconductor companies are struggling to fulfill orders, though ongoing economic recovery and market reopening have eased supply chain issues to some extent. For the industry to perform at its full potential, it is necessary that markets bounce back to the pre-COVID levels. Micron also faces stiff competition, especially from market leader Samsung, which can put pressure on selling prices and weigh on margin performance.

AVGO Stock: Why you need to keep an eye on Broadcom

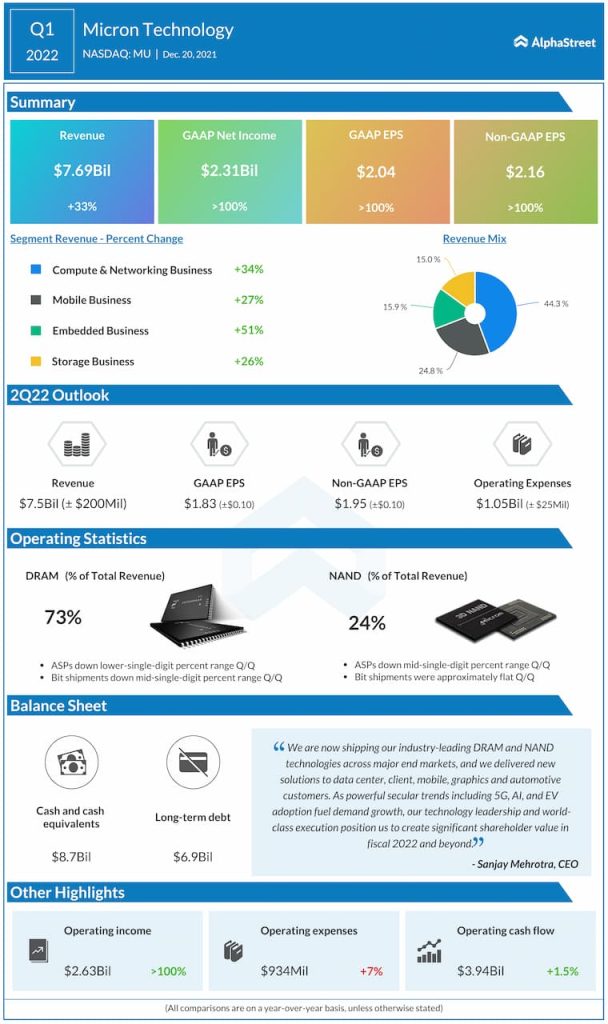

In the first three months of fiscal 2022, all the four operating segments registered double-digit growth, driving up revenues to $7.7 billion. As a result, earnings more than doubled to $2.16 per share, beating the consensus estimates. The company will be publishing second-quarter results on March 29 after the closing bell.

Micron’s shares have lost around 17% after peaking in the second week of January, often underperforming the market. The stock traded up 4% on Wednesday afternoon, after opening the session at $80.