Most transport service providers have been out of business ever since governments imposed restrictions on people’s movement, and there is no sign of the situation improving. Like aviation and energy, another industry that came in the firing line of Covid-19 is ridesharing.

On the heels of cutting several hundred jobs, leading rideshare platforms Uber Technologies, Inc. (NYSE: UBER) and Lyft, Inc. (NASDAQ: LYFT) this week reported mixed first-quarter results, but profitability remained elusive in both cases. Though the companies were largely unaffected in the initial months, the lockdown started impacting the core ridesharing business in March.

Ridesharing Titans

Despite being the smaller player – operating in the domestic market – Lyft keeps expanding market share. In the overseas market, several new players have entered the scene, urging Uber to strengthen its business strategy, and of course to burn more cash. According to Lyft’s CFO Brian Roberts, it is focused on “profitable growth, not growth at all costs” – which contrasts with Uber’ investment spree.

[irp posts=”60683″]

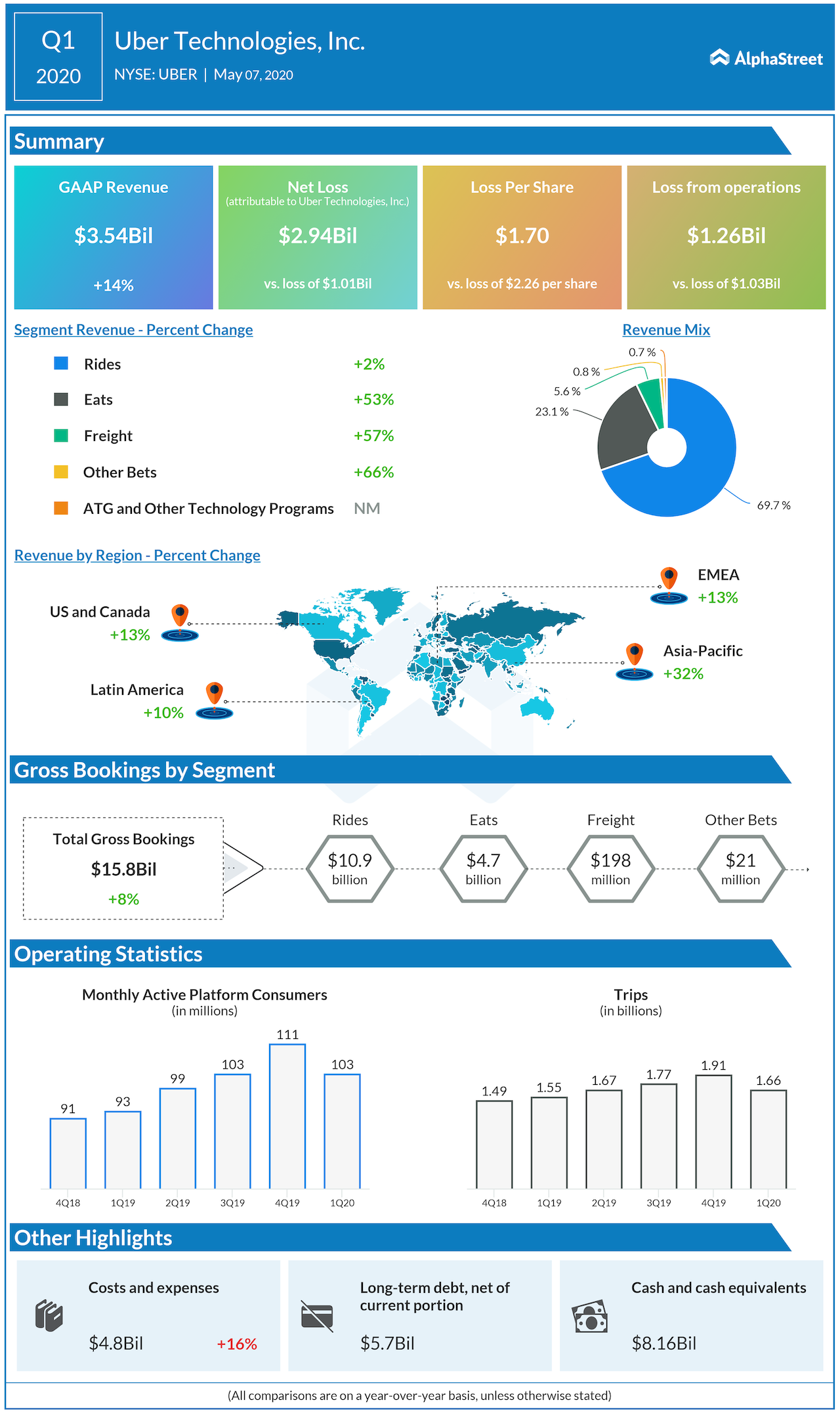

Uber, which has been struggling to come out of loss after last year’s much-hyped IPO, shocked the market this week by reporting a $3-billion loss for the March-quarter, as the main Rides and Eats businesses failed to generate profit. Though revenue moved up year-over-year, it did not translate into earnings growth due to continuing pressure on margin.

Lyft Posts Loss

Lyft impressed stakeholders with strong rider growth in the first quarter, in a sign of resilience against the coronavirus-driven slowdown. The positive top-line performance brightened investor sentiment and the stock bounced back, expediting the recovery from last month’s record lows. Revenues climbed 23% to $956 million, while loss came in at $1.31 per share.

The relatively low valuation, even after the post-earnings surge, and the bullish outlook makes the stock an attractive investment – which is endorsed by most analysts following Lyft. The stock crossed the $30-mark once again this week but is still trading down 36% from the levels seen a year earlier.

Same Pattern

A similar pattern is visible in the performance of Uber’s shares, which have lost about 23% since the Wall Street debut. Experts recommend buying the stock, and long-term investors wouldn’t want to miss the opportunity. The highlights of the first quarter are a 14% growth in revenues to $3.5 billion and widening of net loss to a whopping $2.9 billion.

[irp posts=”60653″]

So far, the trend in the current quarter shows the slump in Uber’s ride bookings would be more than offset by the steady uptick in the Eats business. Looking ahead, the management is bullish about the new categories being added to the portfolio, such as grocery. But, customer acquisition will prove to be a challenging task for the company.

“While a lot remains unknown, you can expect us to continue to focus on liquidity, exercise prudent financial discipline and take actions to maintain our position of strength. Our goal remains the same, returning our growth to business and achieving profitability for all of our stakeholders, which we are now planning to achieve on an adjusted EBITDA basis on a quarterly basis in 2021.”

Dara Khosrowshahi, CEO of Uber.

Post-earnings, the recovery of Uber’s stock got a boost – after an initial dip – as investors turned optimistic about the food-delivery segment that registered a steady uptick in business during the covid-period, when social distancing made customers use online food delivery platforms. Moreover, Eats recorded profit in certain markets.

Rough Ride

While nobody knows how the virus situation would emerge in the coming months, Lyft will have to deal with the additional issue of a fresh lawsuit filed in California, alleging the company of employment discrimination. At the same time, there is no guarantee that customers flocking to Uber Eats would remain loyal to the platform after the covid crisis ends.

Referring to a quote by former hockey player Wayne Gretzky, Uber’s CEO Dara Khosrowshahi said at the conference call that he is focused on the three key areas of the business – the strong balance sheet, rapidly growing Eats business and recovery of the Rides segment.

Weak Outlook

The fact that Lyft’s rideshare bookings were down 75% year-over-year in April gives a sense of how things are shaping up in the current quarter. The management banks on the strong balance sheet (with $2.7 billion of cash at the end of Q1) to tide over potential headwinds. It expects the new labor law would allow the company to device a new business model and engage partners more effectively to tap opportunities that await post-crisis.

“Even as shelter-in-place orders and travel restrictions are modified or lifted, we anticipate that continued social distancing, altered consumer behavior and expected corporate cost-cutting will be significant headwinds for Lyft,” said CEO Logan Green during his post-earnings interaction with analysts.