When online platforms thrived on the unusually strong traffic growth during the shutdown, as home-bound people turned to video-streaming and gaming sites, there was speculation that the trend might reverse once normalcy returns. Underlining those concerns, OTT giant Netflix, Inc. (NASDAQ: NFLX) this week reported lackluster quarterly results that failed to impress the market.

Investors responded harshly to the management’s weaker-than-expected subscription guidance and the stock suffered one of the biggest falls, losing about 25% since Thursday evening. The market which has been keenly following the company’s recent performance considers membership growth as a key parameter to assess the health of the business, irrespective of how the other metrics perform.

Buy the Dip?

Analysts’ consensus outlook warns that the membership woes of NFLX might be far from over, though the current target price on the stock points to a decent upside in the long term. However, many prospective buyers would be tempted to go ahead and use the opportunity that emerged after the price drop.

Read management/analysts’ comments on Netflix’s Q4 results

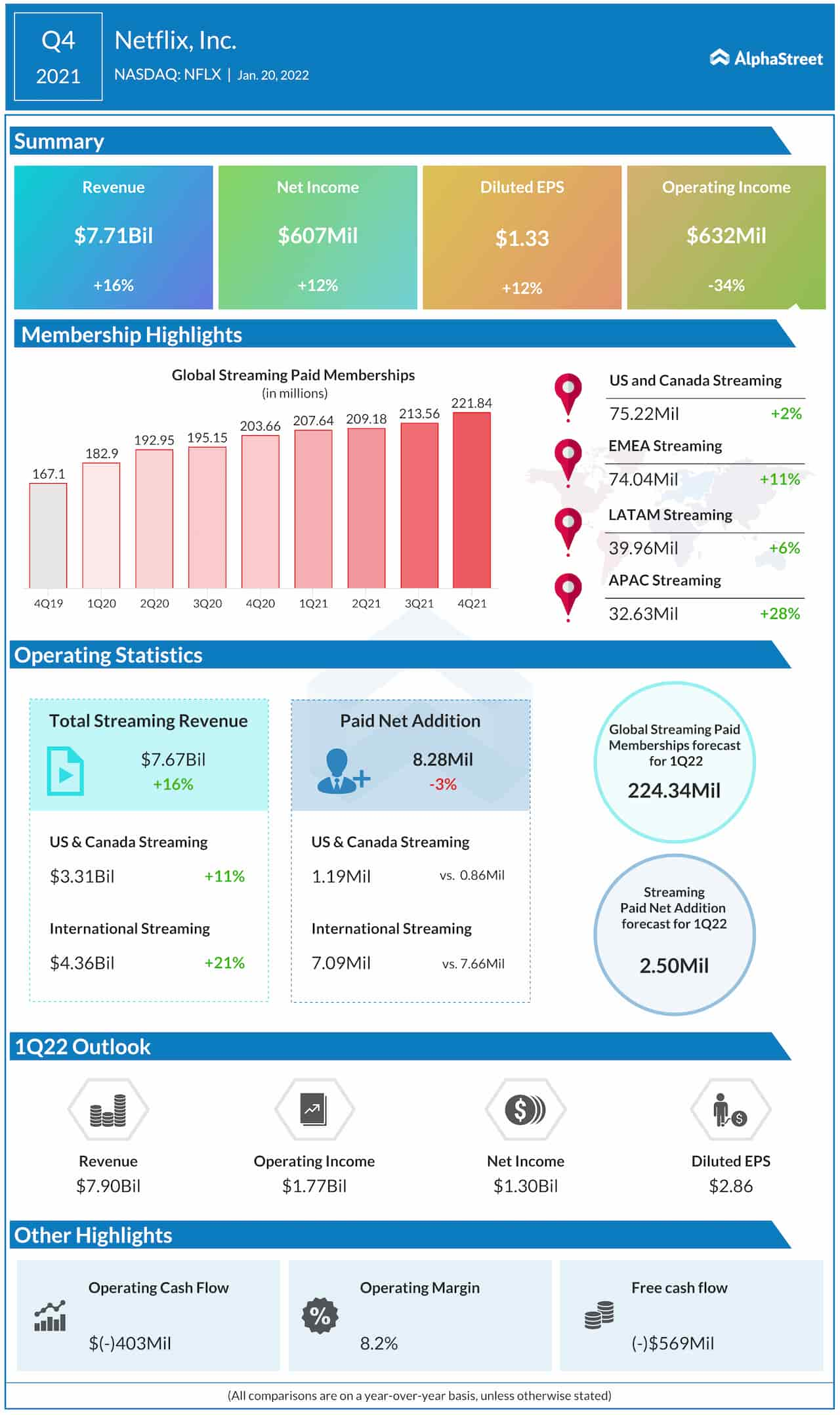

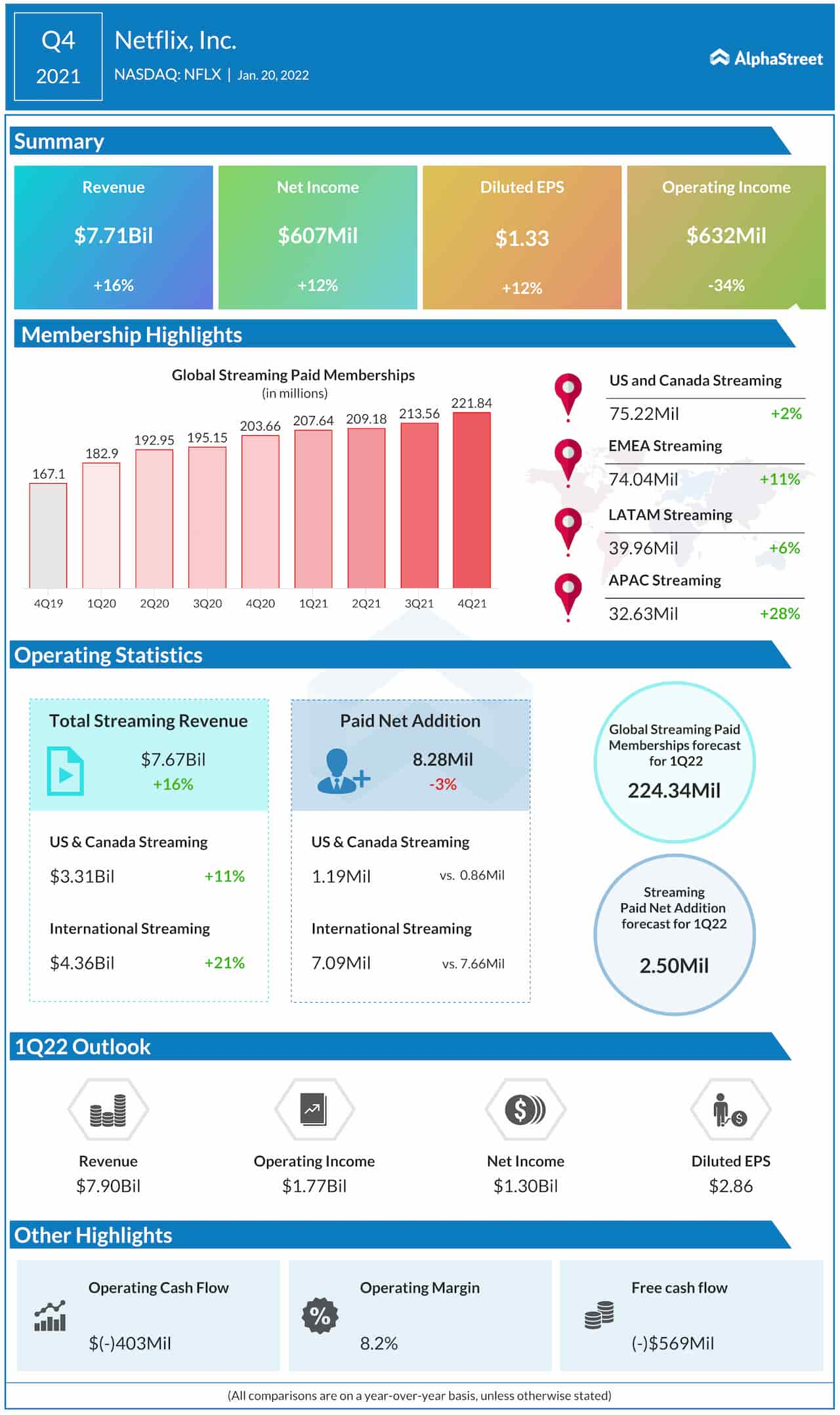

In the final three months of fiscal 2021, the company added 8.28 million paid subscribers globally, taking the total to 221.84 million which is above the market’s projection. Anticipating a slowdown, the management projects membership additions of 2.5 million for the first quarter, which marks a decrease from the year-ago period. Fourth-quarter net income, on an adjusted basis, increased to $1.33 per share from $1.19 per share and topped expectations. At $7.71 billion, revenues were up 16% year-over-year.

Subscription Woes

Of late, there has been a notable decline in the number of people seeking paid membership on the platform, and the trend is expected to continue this year as more and more people come out of home confinement encouraged by the protection offered by COVID vaccines and improvement in the overall pandemic situation. Also, the company is currently dealing with stiffer competition compared to a few years ago due to the entry of new players including big names like Disney+ and Paramount+.

The resultant strain on the top line prompted the management to hike subscription fees in the U.S and Canada, a move that would also boost cash flow and help it meet the growth goals. The good news is that not many customers, both existing and new, were dissuaded by the tariff hikes, thanks to the team’s aggressive efforts to ensure a high level of audience engagement.

Roku Stock: Why is it a good idea to buy the recent dip

From Netflix’s Q4 2021 earnings conference call:

“What we’ve seen over the last couple of years, which is that sort of core theory that we have that if we’ve done a good job investing, the members, subscription fee that they paid us into better stories, more great storytelling, bigger movies, more variety. Then when we come back and ask them occasionally for a little bit more to keep that sort of cycle going then they’re generally willing to do that and we don’t see any significant disruption to the business otherwise in that regard.”

Stock Performance

The post-earnings sell-off extended into the following days and NFLX traded sharply lower during the last trading session. The stock has lost 33% since the beginning of the year.