Stock

After recovering from the sales slump experienced in the early weeks of the pandemic, Nike generated positive quarterly earnings that surpassed the market’s projections every time including the November quarter, for which results were published in December last year. The top line also performed in a similar fashion.

Read management/analysts’ comments on quarterly reports

Early estimates show that the company’s efforts to woo customers with promotional offers and discounts yielded the desired results. However, high operating costs amid continued supply chain disruption and elevated inflation remain a drag on margins in the near term. That, in turn, would weigh on profitability.

Stable Sales

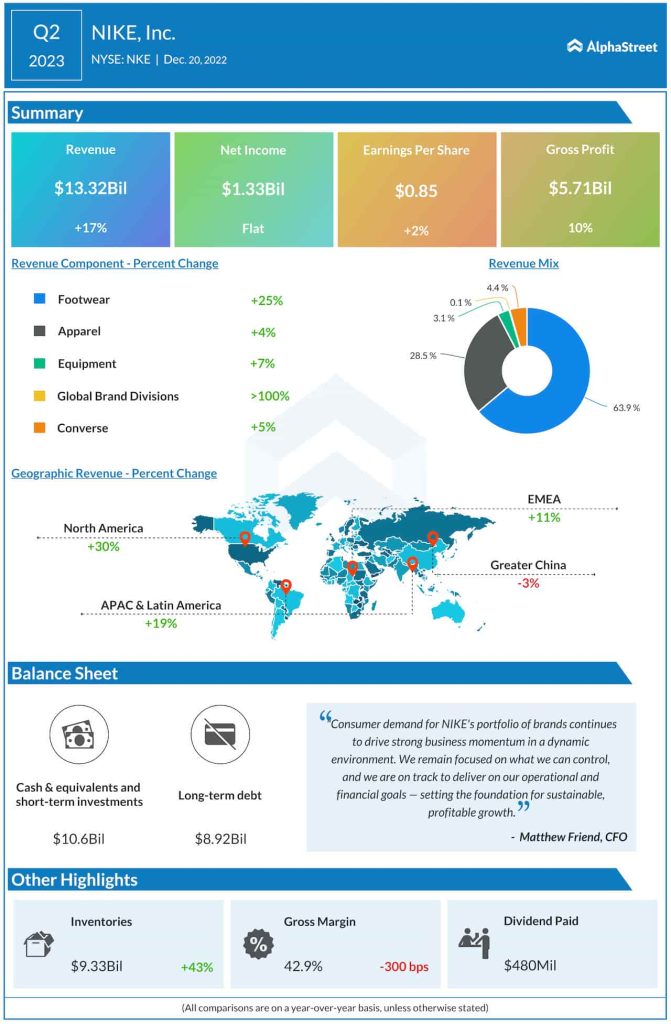

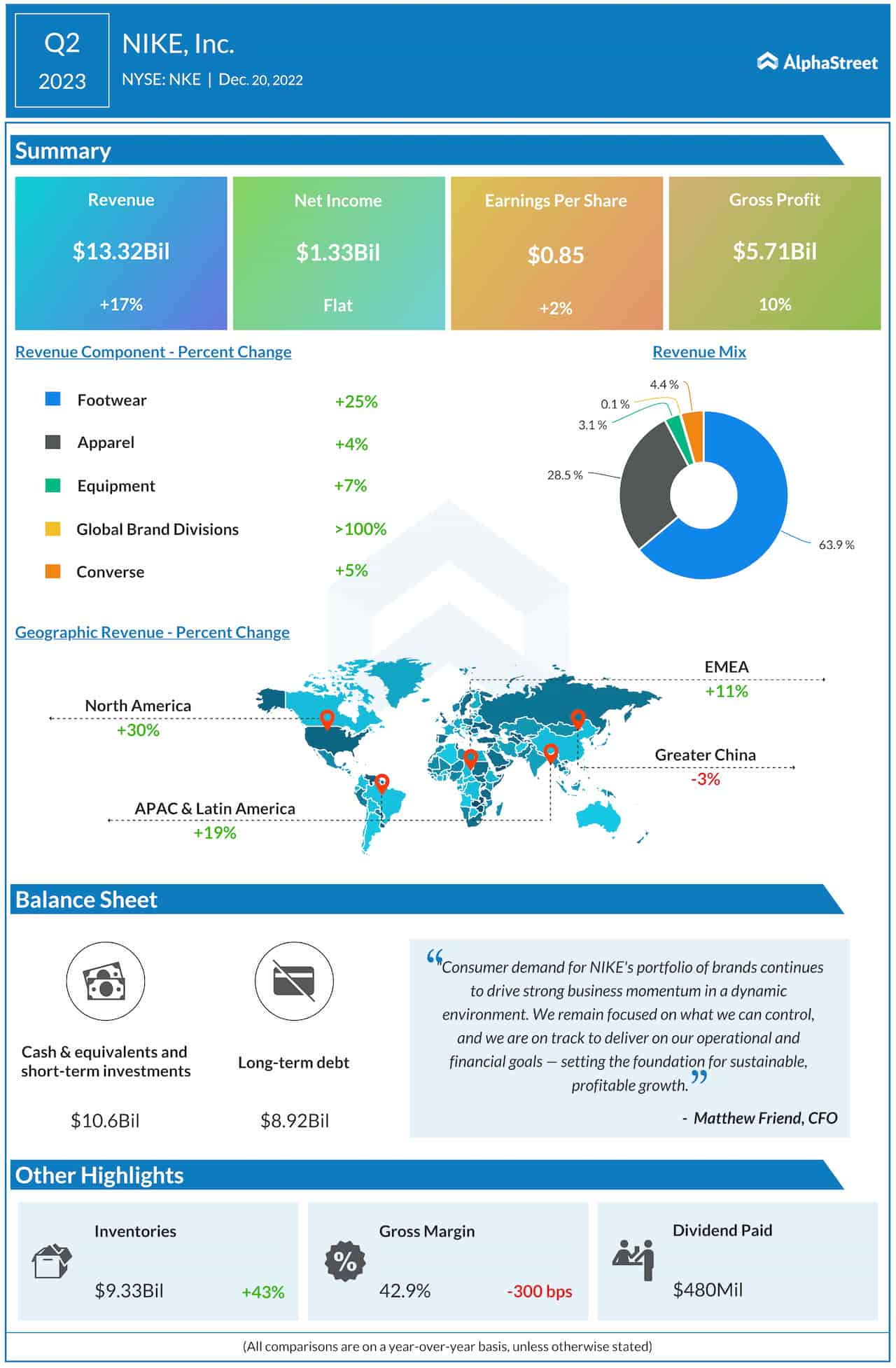

Sales at the main Footwear business rose in double digits in the second quarter, driving up total sales by 17% to $13.32 billion, which also benefited from broad-based growth across all operating segments. Sales increased in major geographical divisions, except China where COVID-related uncertainties persisted. Earnings moved up 2% from last year to $0.85 per share during the three-month period.

“NIKE is already learning more about our members, which helps us elevate in areas such as product creation, line planning, and the experiences we deliver. And our partners are telling us that these engaged members are driving improved traffic conversion and mutual profitability for them as well. And so, while it’s still early days on this journey, we’re excited by the foundation we’re creating. The ability to give consumers a personalized experience across channels, fueled by data and insight, opens up a whole host of opportunities for us,” said Nike’s chief executive officer John Donahoe during an interaction with analysts a few weeks ago.

What to Expect

The market will be keeping a close watch when the company reports results for the all-important holiday quarter on March 21, after the closing bell, given the cautious outlook for the period. Market watchers are of the view that earnings dropped 38% to $0.54 per share in the third quarter on revenues of $11.45 billion, which marks a 5.4% increase.

Nike beats inventory and inflation woes with discounts. What future holds?

Nike’s stock experienced volatility ahead of the earnings release, but it gained in early trading on Tuesday. After rising in the early weeks of 2023, NKE is currently where it was at the beginning of the year.