Nio benefited from its end-to-end direct sales business process and cloud-based service system. The company’s operations including supply chain, manufacturing and sales are returning to normal. The daily new order rate has improved since late April returning to pre-COVID levels. The recovery in deliveries coupled with the pickup in prices and reduction in costs has led Nio to forecast vehicle gross margin above 5% in the second quarter of 2020.

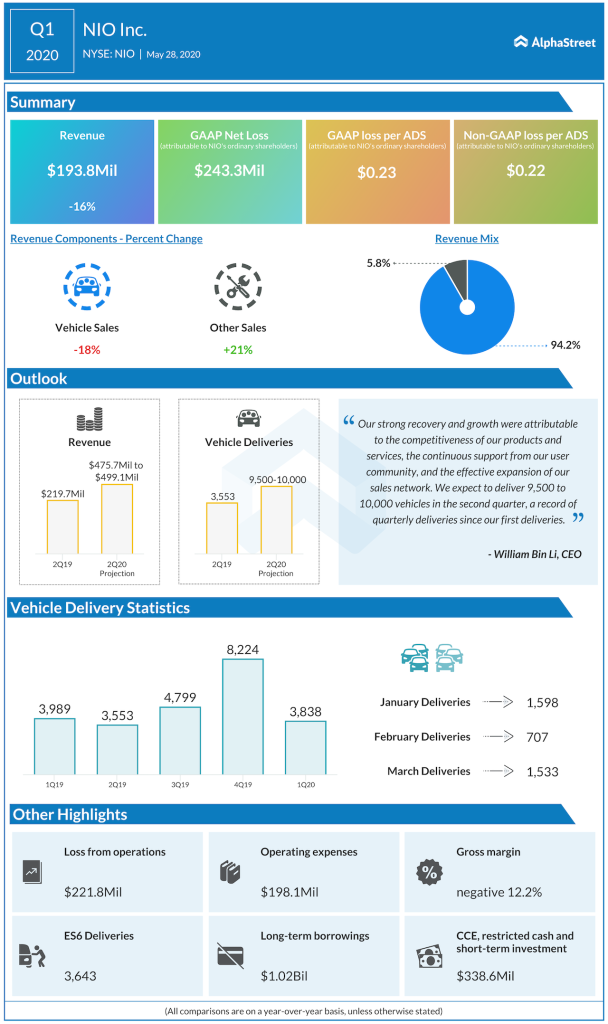

“In April 2020, we delivered 3,155 vehicles, a robust increase of 105.8% month over month. Meanwhile, we have witnessed the order growth to have rebounded to the level prior to the COVID-19 outbreak since late April. Our strong recovery and growth were attributable to the competitiveness of our products and services, the continuous support from our user community, and the effective expansion of our sales network.”- William Bin Li, Founder, Chairman and CEO

Nio China

In April, Nio partnered with strategic investors for

investments in NIO China. Under the agreement, the investors will put in RMB7

billion in cash into Nio Holding Inc., the legal entity of Nio China. Nio will

invest RMB4.26 billion in Nio China as well as provide R&D and supply chain

services.

The investments are expected to close in the second quarter,

following which Nio will own close to 76% of interests in Nio China while the

investors will hold 24%. This investment is expected to help Nio gain financing

for business development efforts as well as the enhancement of smart electric

vehicle technologies.

Battery-as-a-Service

Another important initiative the company is undertaking is

its Battery-as-a-Service business model. BaaS is a service model based on the

separation of the vehicle and battery which focuses on improving the

convenience associated with charging, swapping and upgrading batteries. This

model is expected to lower the purchase price thereby helping users upgrade

their batteries continuously.

On its quarterly conference call, Nio stated that it owns

more than 1,200 battery swap-related patents on vehicle battery pack, battery

swap stations and cloud services solutions. To-date, the company has deployed 131

battery swap stations in 58 cities nationwide and completed over 500,000

battery swaps cumulatively.

Last month, authorities issued the new energy vehicle

subsidy policy which is meant to push the development of the battery swap

technology as well as business models that focus on vehicle and battery separation.

Nio plans to accelerate the development of its BaaS solutions and release it

during the second half of this year. The company believes it is well-positioned

to take advantage of the opportunities going forward.

Outlook

The strong pickup in deliveries has allowed Nio to forecast Q2 2020 vehicle deliveries in the range of 9,500 to 10,000 vehicles, which reflects a year-over-year increase of approx. 167.4% to 181.5%. Total revenues are expected to be between $475.7 million and $499.1 million, up around 123.3% to 134.3% from the year-ago quarter.

Click here to read the full transcript of the Nio Q1 2020 earnings conference call