Nvidia Corporation (NASDAQ: NVDA) is preparing to report third-quarter results next week, after a blockbuster second quarter when the chipmaker generated record revenues. NVDA is one of the best-performing Wall Street stocks, gaining a whopping 67% in the past six months.

The company’s market value increased consistently over the past several months, and the stock climbed to an all-time high last week. It has been trading well above the 52-week average for quite some time. Despite the high valuation, there seems to be more room for the stock to grow. Analysts, in general, are bullish on its prospects.

Valuation

The valuation is fair when compared to earnings, but some investors will find the stock expensive. The positive sentiment can be attributed mainly to the aggressive expansion of the company’s AI platform, with the latest being the launch of the H200 AI chip which has more memory bandwidth and is capable of handling advanced generative AI work, compared to its predecessor.

Interestingly, Nvidia has many AI products lined up for release in the coming months as it strives to maintain dominance in that market. The company is well ahead of others like AMD and Intel in the AI race, which gives it a significant advantage in terms of growing market share in that area. It is estimated that the demand for AI chips will increase sharply in the coming years.

Q3 Report Due

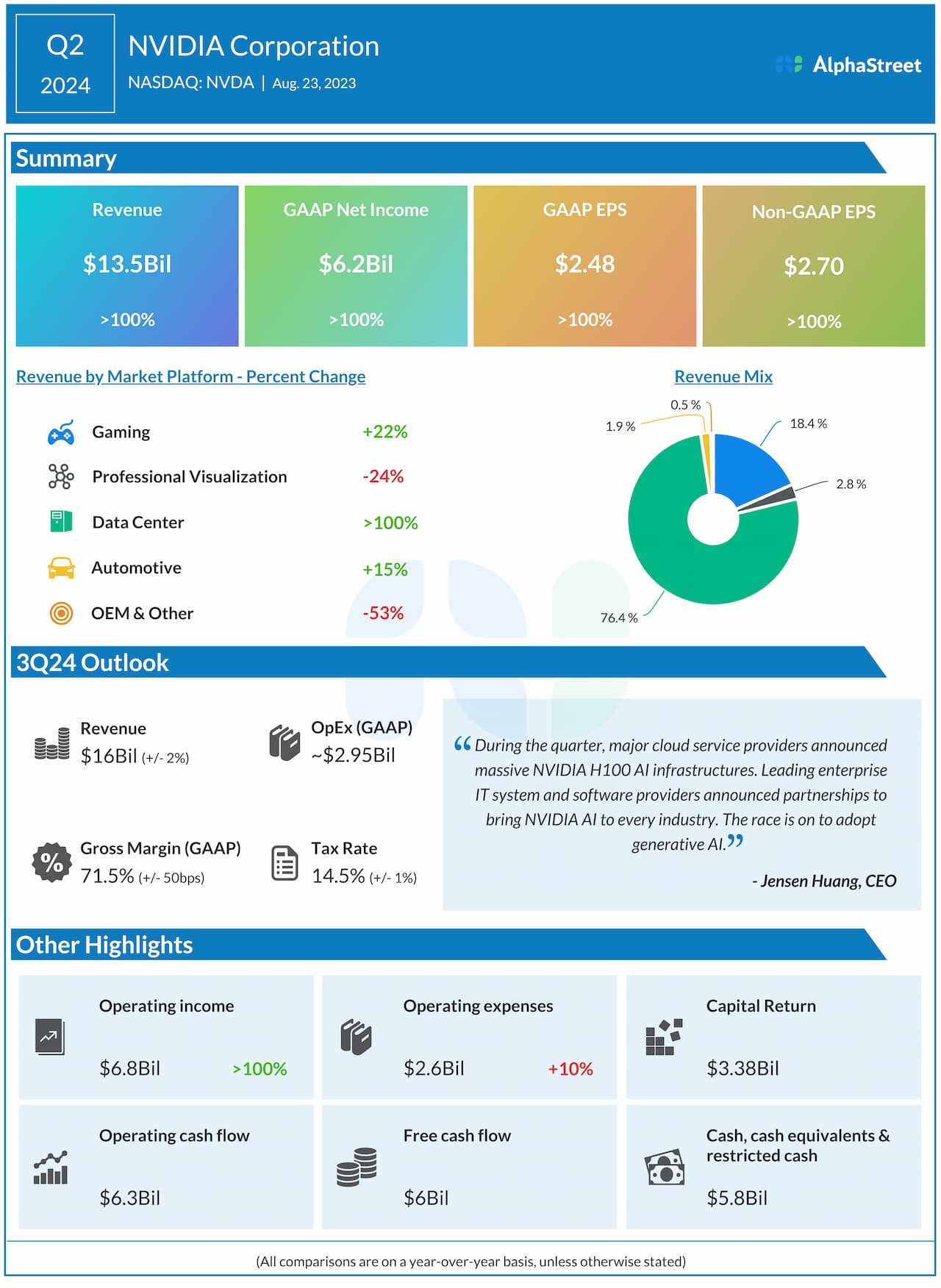

The tech firm will be reporting third-quarter earnings on November 21, at 4:20 p.m. ET. On average, analysts expect the company to report earnings of $3.09 per share for Q3, which is sharply higher than the $0.58/share the company earned in the year-ago quarter. The revenue estimate is $14.82 billion. Nvidia’s management is looking for revenues of around $16 billion for the October quarter when the total operating expense is expected to be $2.95 billion. The company predicts a gross margin of approximately 71.5% for the third quarter.

From Nvidia’s Q2 2024 earnings call:

“Our data center supply chain, including HGX, with 35,000 parts and highly complex networking, has been built up over the past decade. We have also developed and qualified additional capacity and suppliers for key steps in the manufacturing process such as co-op packaging. We expect supply to increase each quarter through next year. By geography, data center growth was strongest in the U.S. as customers direct their capital investments to AI and accelerated computing.”

Q2 Results Beat

In the second quarter, revenues more than doubled to $13.5 billion, driven mainly by strong demand for data center products which account for more than 70% of total revenues. The top line exceeded the market’s expectations. Gaming revenue climbed 22%, contributing to the top-line growth. Consequently, adjusted profit more than doubled to $2.70 per share and surpassed analysts’ estimates, marking the third beat in a row. The company has an impressive track record of delivering stronger-than-expected quarterly numbers.

Shares of Nvidia traded slightly higher early Thursday, after closing the previous session lower. The value has more than tripled since the beginning of 2023.