Buy ORCL?

While the stock is not a compelling buy right now, it has the potential for continued growth in the long term, if the past performance is any indication. In the past five years, the value has more than doubled. The strong dividend – after regular hikes – and above-average yield of 3.8% make the stock a favorite among income investors.

The company has been signing a diverse set of new customers lately, and its clientele currently includes high-profile agencies like the US Department of Defense, the US Department of Veterans Affairs, and various hospital groups. Cerner, which joined the Oracle fold last year, has significantly increased its healthcare contract base since the acquisition.

Cloud Power

The company owes its rebound mostly to the large-scale expansion of its cloud infrastructure and cloud software businesses, which often come as a combined service to customers. Interestingly, the cloud business is doing well at a time when rivals like AWS and Microsoft Azure are experiencing a slowdown.

Oracle’s CEO Safra Catz said at the Q3 earnings call, “Using our own products and services, enables us to increase our investments for growth while also growing profitability, including through acquisitions as well as during our move to the cloud. We are constantly talking with our customers about leveraging Oracle technology to accelerate their speed to market and reduce costs. All the while improving the experience they deliver to their customers. The combination of Oracle’s infrastructure and apps, which is unique in the cloud market, increases the intensity of business transformation.”

When the company reports fourth-quarter 2023 results on June 12, after the closing bell, the market will be looking for adjusted earnings of $1.58 per share, which is up 2.6% from last year. Revenue is expected to be $13.72 billion, up 16% year-over-year.

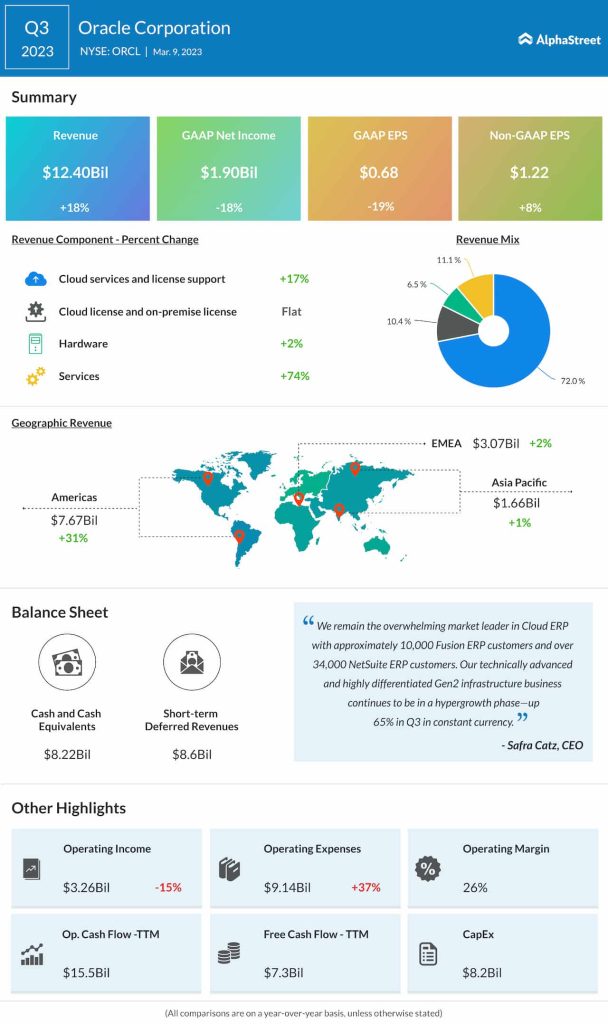

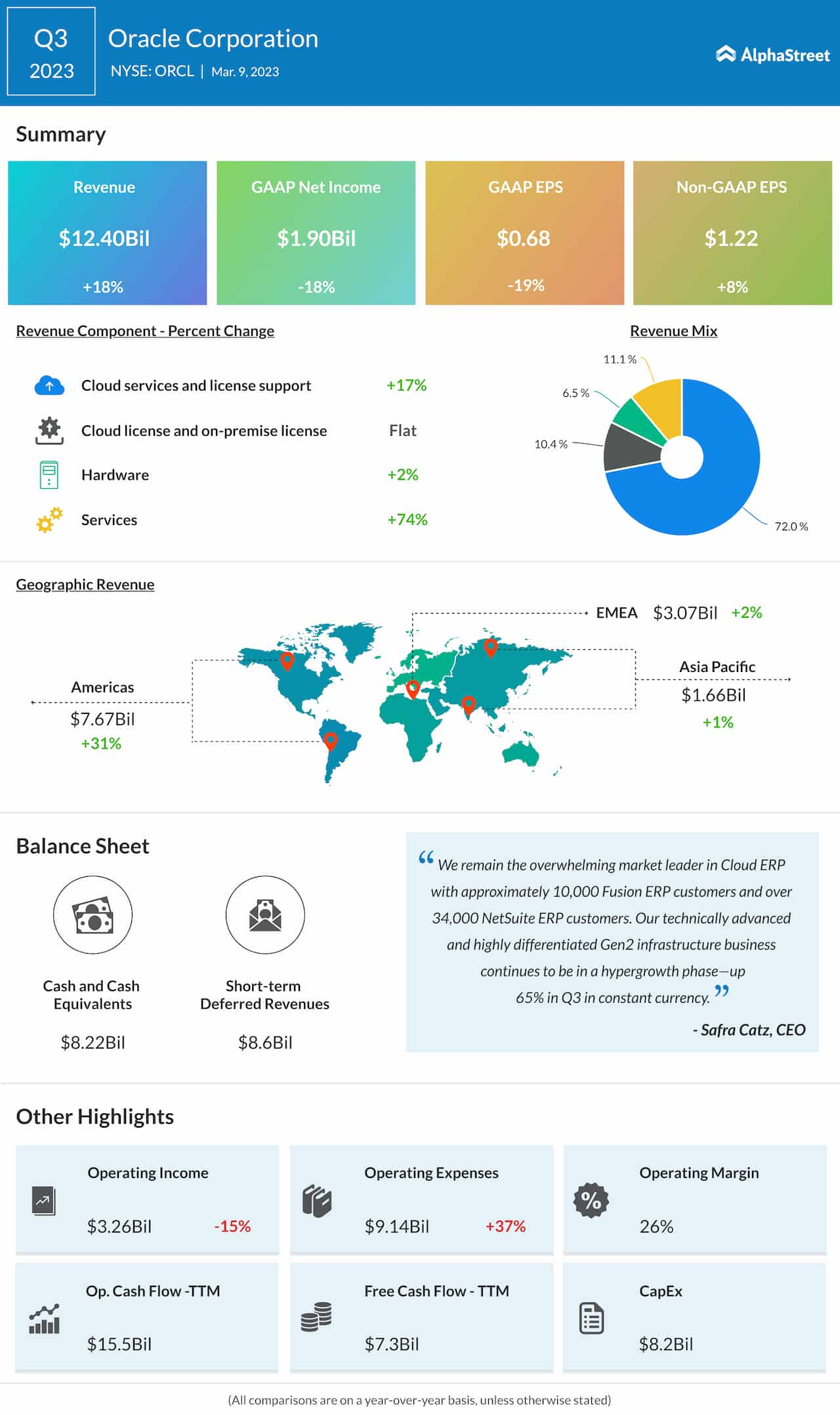

Q3 Outcome

In the third quarter, the top line and earnings increased and topped expectations, as they did in the preceding quarter. At $12.40 billion, revenues were up 18% year-over-year, while adjusted profit rose 8% to $1.22 per share. Revenue grew across all geographical divisions and operating segments, except the cloud license business which remained unchanged. On an unadjusted basis, net income declined in double digits to $1.90 billion or $0.68 per share. The company ended the quarter with an impressive free cash flow of $7.3 billion.

ORCL made modest gains in early trading on Tuesday, after peaking in the previous session. It has grown around 28% so far this year, and stayed above the 52-week average all along.