Strong Sales

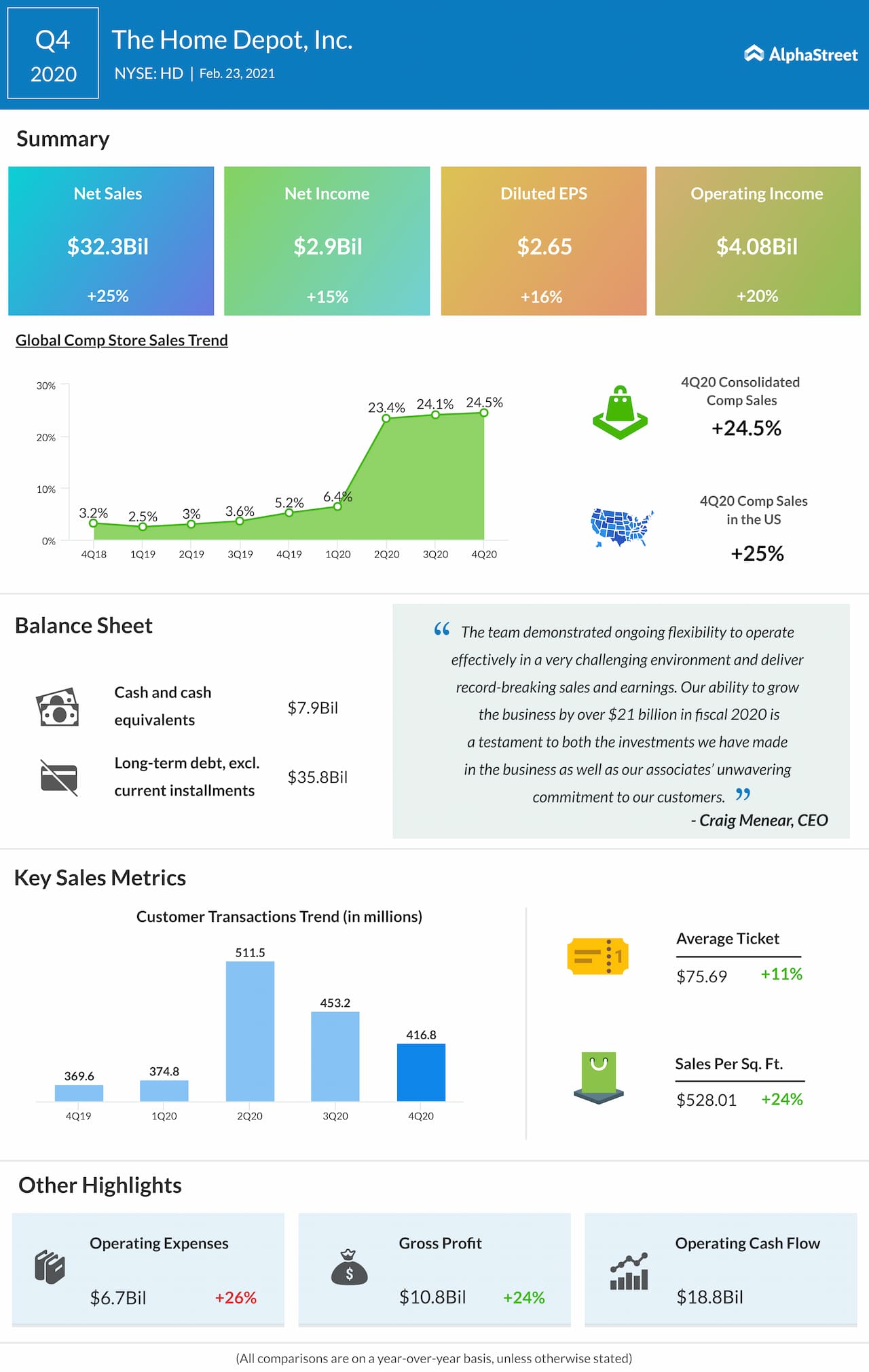

Earnings surpassed the market’s prediction for three consecutive quarters, reflecting the company’s resilience to the market turmoil. In the fourth quarter, comparable store sales growth accelerated once again to 24.5%, which translated into a 25% growth in net sales to $32 billion. The top-line beat the Street view. At $2.65 per share, fourth-quarter earnings were up 16% year-over-year.

Adding to investors’ concerns, meanwhile, the management withheld its guidance, citing a lack of clarity over consumers’ future spending patterns amid the continuing uncertainty. It expects about $250 in annual costs related to the pandemic this year if the situation does not materially improve, which is broadly in line with the 2020 level. There is a likelihood of sales retreating to the pre-COVID levels once normalcy returns to the market, making future comparisons tough.

High DIY Demand

On the positive side, the DIY culture continues to gain footing in American households, marked by heavy spending in all areas of home improvement, ranging from furniture to tools and appliances to flooring. To tap the unfolding opportunity, the company is investing heavily on its e-commerce capabilities, with a focus on integrating the online platform with physical stores.

Read management/analysts’ comments on Home Depot’s Q4 earnings

The mechanization of our upstream supply chain helped us to better flow products to our stores while investment in tools for our store associates and MET teams helped to get that product to the shelves for the customer more quickly and efficiently. Our merchants leverage data analytics to collaborate with our supplier partners to make real-time adjustments to our assortments, as we work to prioritize the highest demand SKUs for our customers. Despite one of the most difficult operating environments we have ever faced, we continue to make progress with regard to our strategic initiatives.

Craig Menear, chief executive officer of Home Depot

ADVERTISEMENT

Stock Performance

Home Depot’s stock has remained quite stable after hitting a record high in August last year. It has gained as much as 75% since last year’s mid-March sell-off. The shares closed the last trading session slightly lower.