Revenue and earnings beat expectations

Business performance

Philip Morris continued to see momentum in its smoke-free business, which accounted for 38% of total revenues in the third quarter. Net revenues for the smoke-free business grew 14% and gross profit rose nearly 16% in Q3. This growth was driven by strength in IQOS, continued gains in ZYN, and a growing contribution from VEEV.

Heated tobacco units (HTU) adjusted in-market sales (IMS) volume increased 14.8% in Q3. PM expects this momentum to continue in the fourth quarter of 2024. IQOS is seeing strong growth in markets like Europe and Japan and the company plans to expand into more markets including Italy, Greece and Switzerland.

In Q3, oral smoke-free products shipment volume grew 24.7%, driven by growth in ZYN nicotine pouches. In the US, ZYN shipments grew 41.4% YoY to 149.1 million.

Net revenues in combustibles grew 5.2% in Q3, driven by pricing and resilient volumes. Cigarette shipments grew 1.3%. PM’s cigarette category share grew by 0.1 points in the third quarter.

Guidance hike

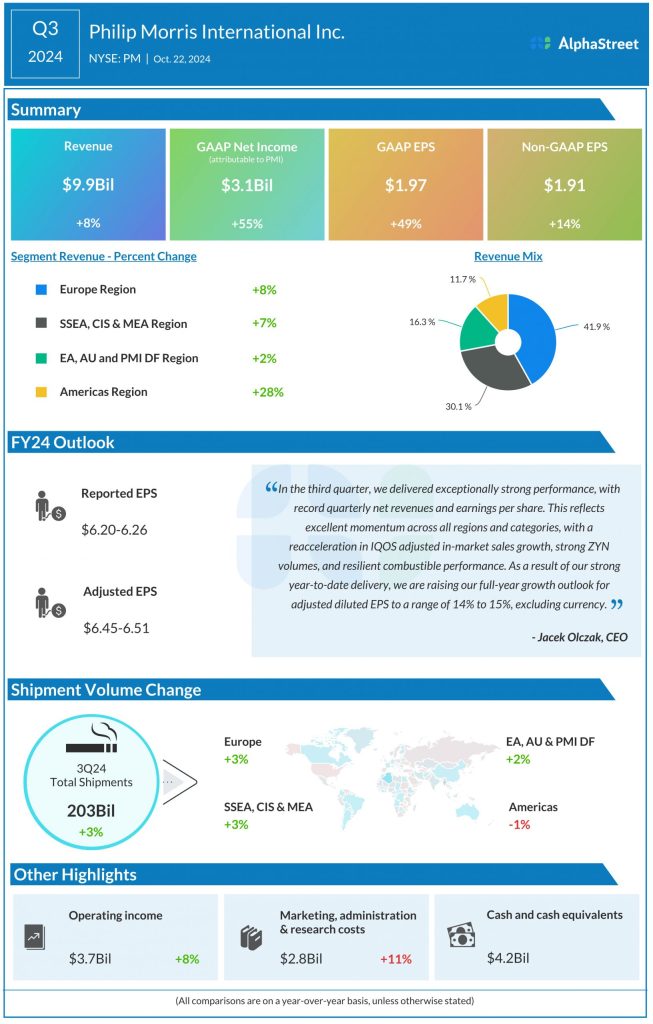

Philip Morris raised its organic revenue growth guidance for the full year of 2024 to around 9.5% on the back of stronger volumes, higher pricing, and continued smoke-free mix. The company also raised its outlook for adjusted EPS to a range of $6.45-6.51 from the previous range of $6.33-6.45. This EPS forecast represents an increase of 14-15% from last year.