Buy PYPL?

Having slipped to a one-year low, the stock has become one of the cheapest in the segment. For many, this could be a rare opportunity to own PYPL, and analysts’ strong buy recommendation underscores the bullish sentiment. Experts see a 44% growth in the next twelve months, which will take the stock close to the $300-mark. From the investment perspective, keeping the company on the watch list would pay off.

Read management/analysts’ comments on quarterly results

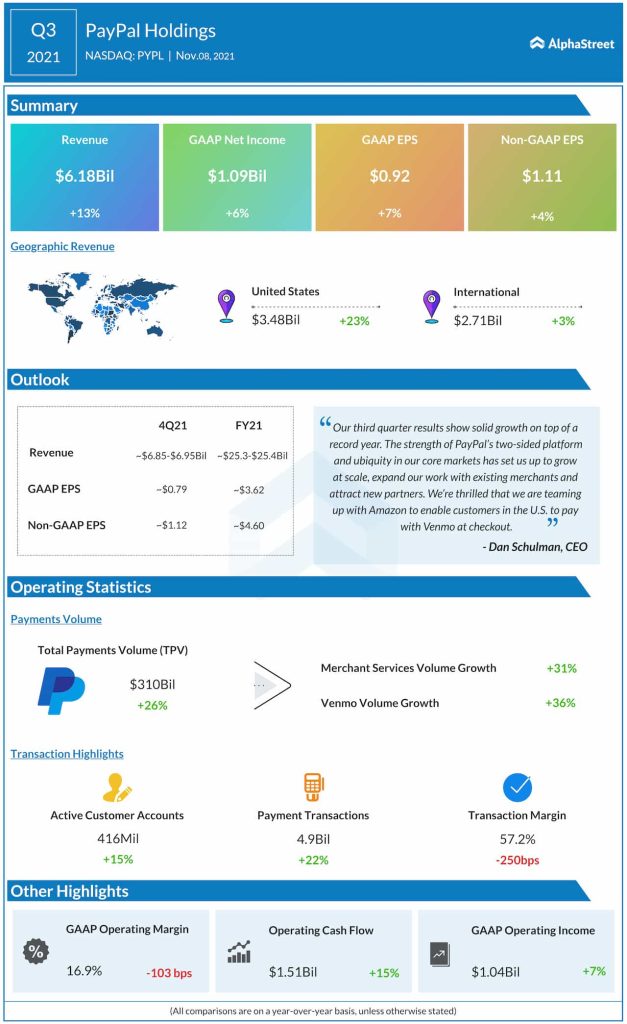

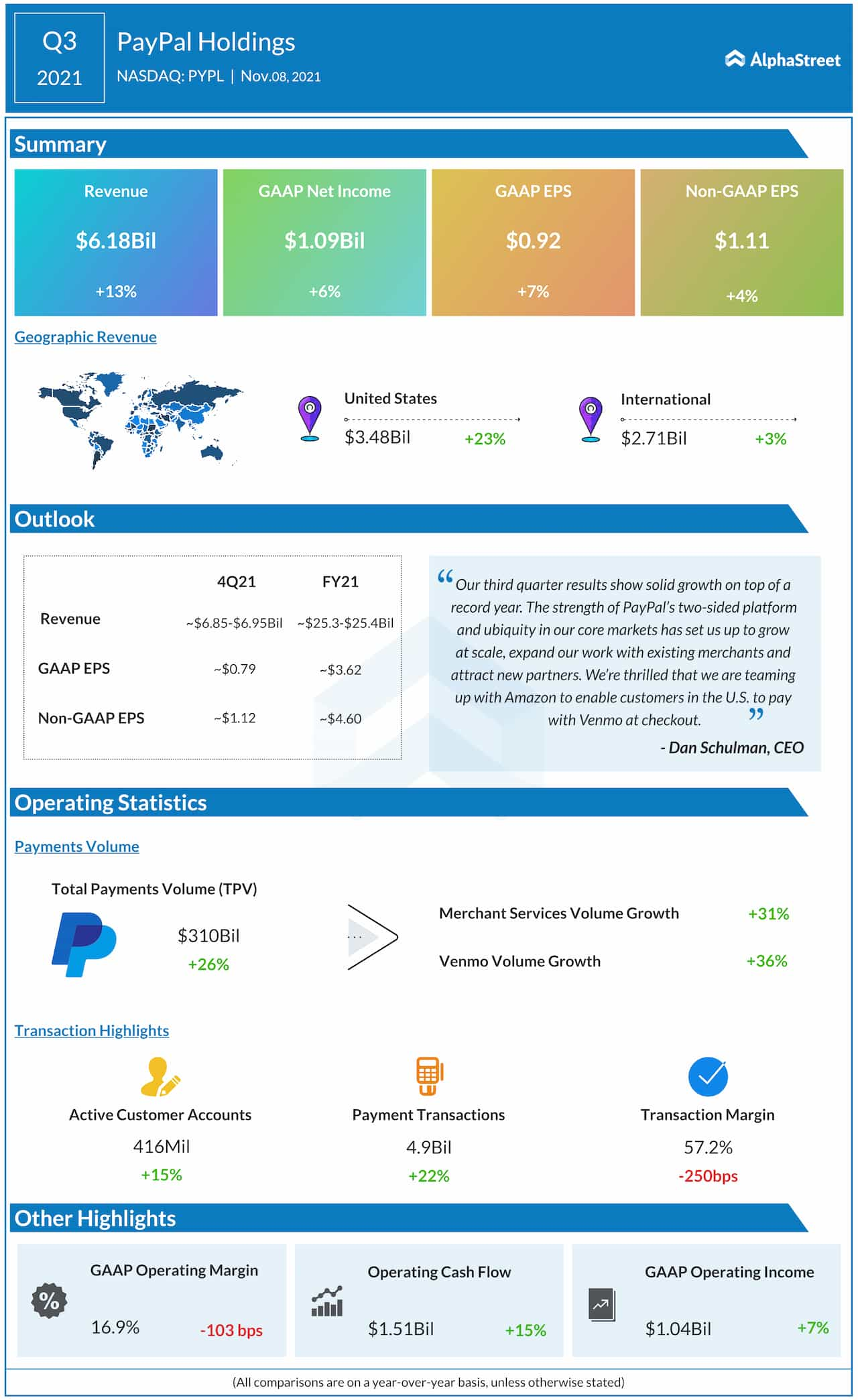

The company recently clinched a deal with Amazon, allowing customers to use its Venmo wallets on the latter’s website for making payments at checkout. Earlier, the executives had denied reports that PayPal was pursuing the acquisition of social media platform Pinterest, a controversial deal that added to the stock’s downfall at one point.

The Good & Bad

PayPal recently slashed its future guidance, partly reflecting the exit of eBay Inc. (NASDAQ: EBAY) from a long-time partnership that will likely have a major impact on its revenues in the coming quarters. The company is probably headed for a flat 2022, though the management has reaffirmed its long-term revenue growth target of 20%. However, the fundamentals remain impressive and the balance sheet is pretty strong, with a cash balance of $20 billion at the end of September.

With the holiday season around the corner, it is expected that more customers would opt for in-store purchases due to supply chain disruption that continues to affect the delivery of goods sold online. As part of strengthening the user base, the company plans to expand its successful buy now-pay later scheme to more international markets by early next year. The recent acquisition of Japan-based payment services firm Paidy complements the initiative.

Mixed Q3 Results

PayPal’s third-quarter revenues rose 13% annually to $6.18 billion but fell short of expectations. Adjusted earnings moved up 4% to $1.11 per share and topped expectations. At $310 billion, the total payment volume was up 26%. The company had 416 million active customers at the end of the quarter, up 15%. The results were generally in line with the management’s expectations.

From PayPal’s Q3 2021 earnings conference call:

“It’s quite clear that consumers and merchants prefer a more connected digital lifestyle that encompasses financial services, shopping, payments, and commerce. Our market research and that of others strongly support the vision of a more connected economy. And PayPal clearly has the brand trust, regulatory relationships, and scale to be a meaningful leader in the digital economy. Exploring all potential opportunities to enhance shareholder value is our responsibility.“

Mastercard Stock: The best is yet to come from the payments giant

PayPal’s stock traded higher in the early hours of Wednesday, after closing the previous session lower. It is down 16% since the beginning of the year and well below the 52-week average.