Like some of its peers, Five Below (NASDAQ: FIVE) had a not-so-impressive performance this holiday season. On Monday, the specialty apparel retailer said its fourth-quarter earnings and sales might fall short of expectations, triggering a stock selloff.

The stock suffered one of its biggest single-day losses and slipped to a one-year low. It traded down 15% during the regular session, reversing the uptrend seen since the beginning of the year. It could be a major letdown for the market, considering the bullish sentiment typically associated with the stock, which has long been an investors’ favorite for the handsome returns and stability.

Guidance Revision

Taking a cue from the initial estimates, the company revised down the estimates. It currently expects fourth-quarter earnings per share to be in the range of $1.93 to $1.96 on net sales of $685-$688 million. In the whole of 2019, the bottom line is expected to come in between $3.07 per share and $3.10 per share on estimated sales of $1.845 billion to $1.848 billion. Wall Street analysts have forecast better performance for the period.

Comps Drop

The guidance was lowered based on the financial performance in the first two months of the fourth quarter when comparable sales dropped 2.6%. Meanwhile, brokerage firm JP Morgan blamed it on the lower number of selling days this year, compared to last year. The analyst’s view matched that of the Five Below management.

Pros & Cons

While it is not the first time investors are turning bearish on the company, the inconsistency in comparable sales performance is a cause for concern. Going forward, growth will depend on the effectiveness of the store expansion program and consumers’ spending power, which was positive last year.

“While our comparable sales during key holiday selling periods were positive, they were not strong enough to overcome the headwind of six fewer shopping days between Thanksgiving and Christmas, and overall sales did not meet our expectations,” said Five Below CEO Joel Anderson.

Mixed Q3

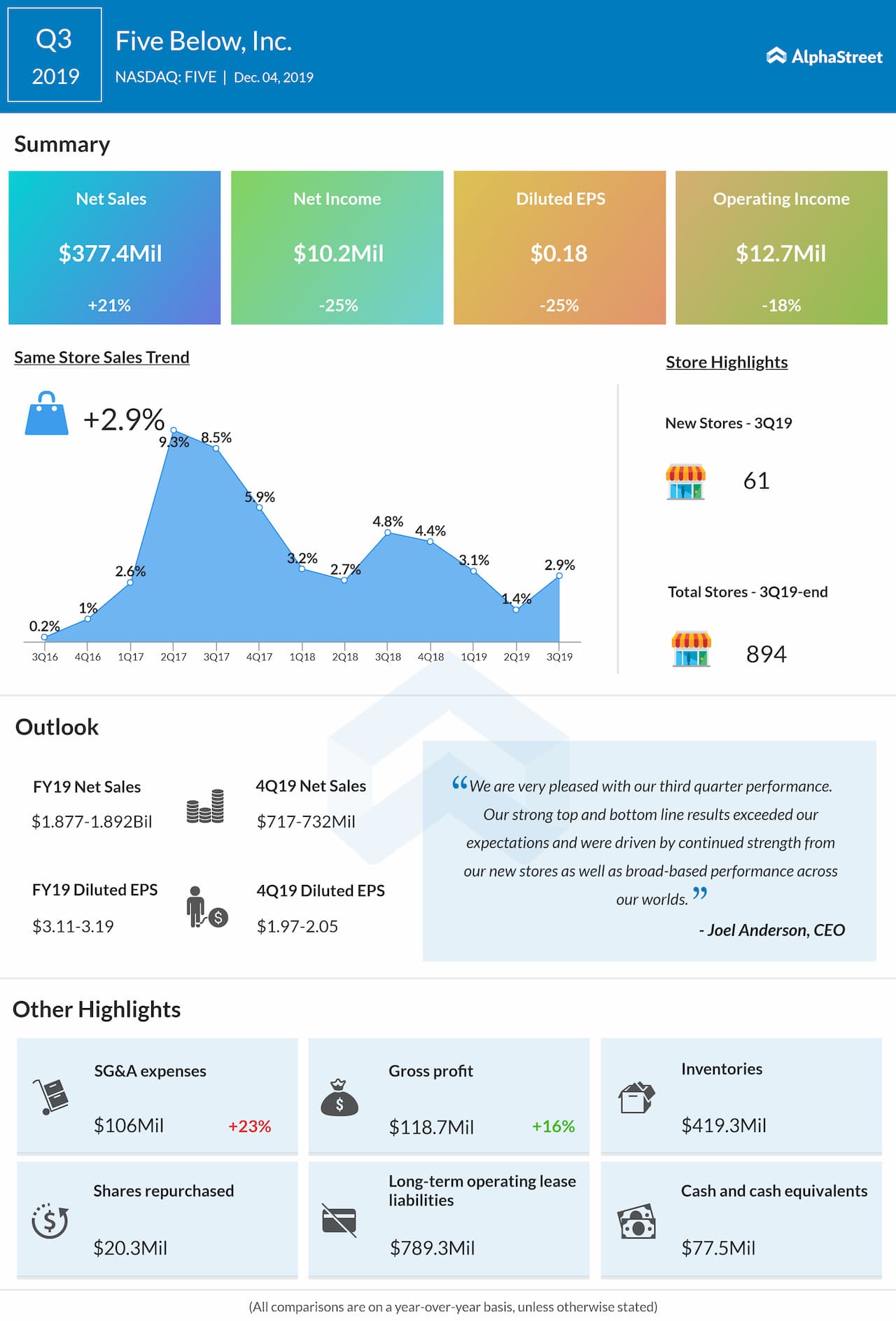

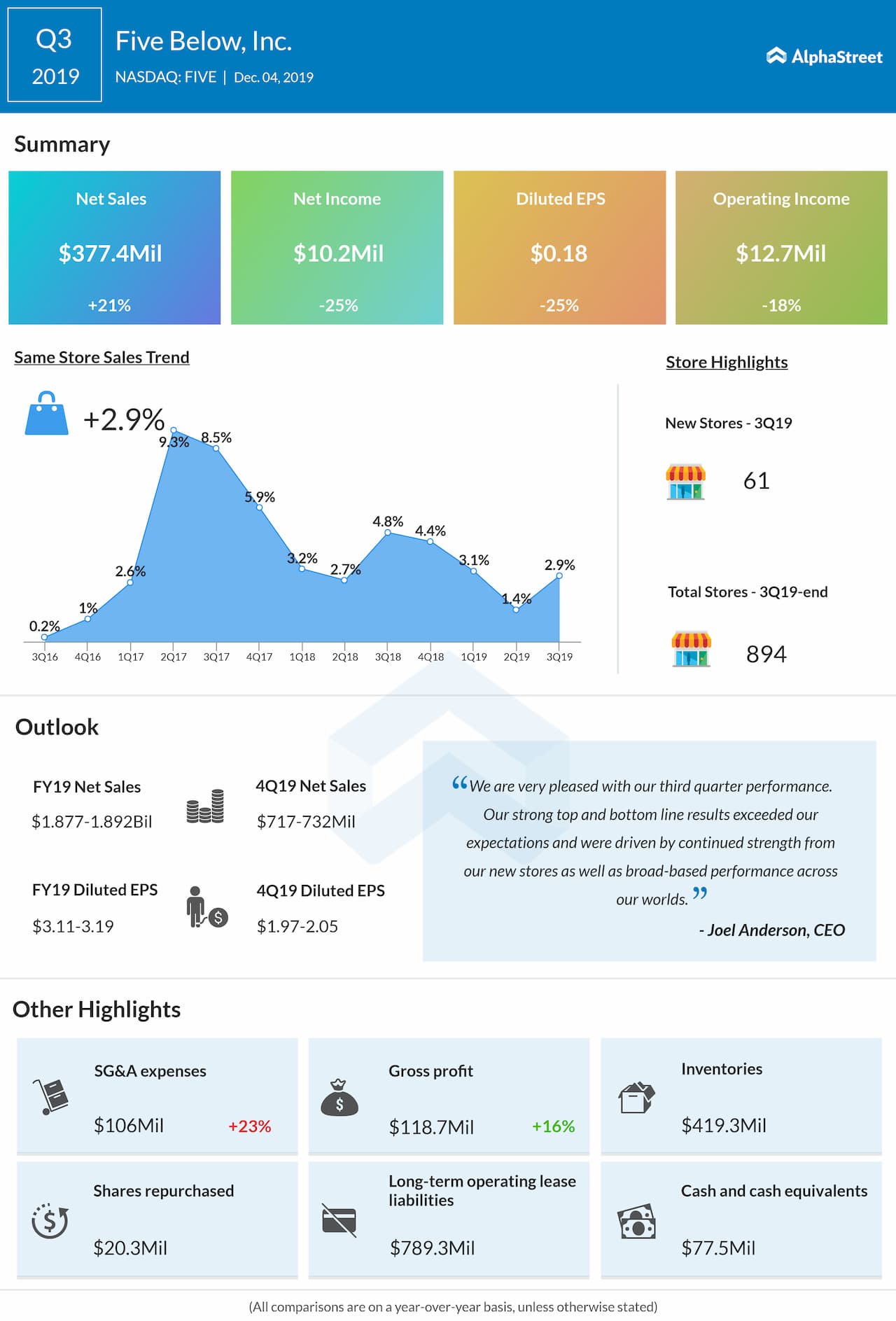

A few months ago, the market responded positively after Five Below reported stronger-than-expected earnings for the third quarter, despite a double-digit decline. Sales, meanwhile, increased 21% annually to $377.4 million and topped the Street view. The company this week said it is on track to open 180 new stores in 2020, as initially planned, and to roll out Ten Below zones in select outlets.

Five Below’s shares ended 2019 broadly at the levels seen a year earlier, after staying volatile all along. In the past three years, the stock’s value more than tripled.