Department store chain Target Corp. (NYSE: TGT), which has been thriving on the pandemic-driven shopping boom since early last year, maintained its strong performance during the holiday season and entered 2021 on an upbeat note. Classified as essential retailer, the company kept most of its stores open during the crisis period, thereby gaining an edge over rivals.

Walmart sees near-term slowdown as biz enters new phase

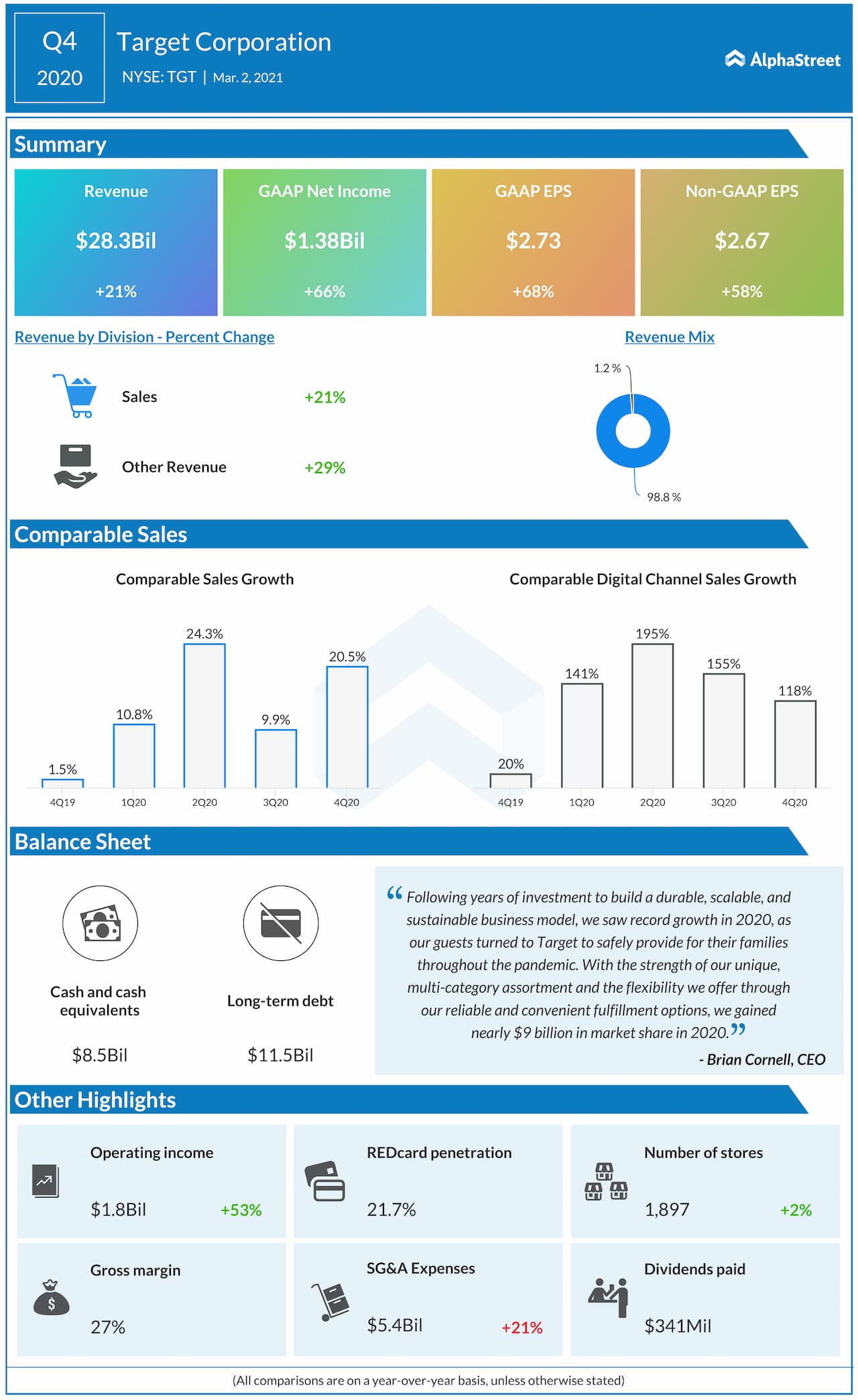

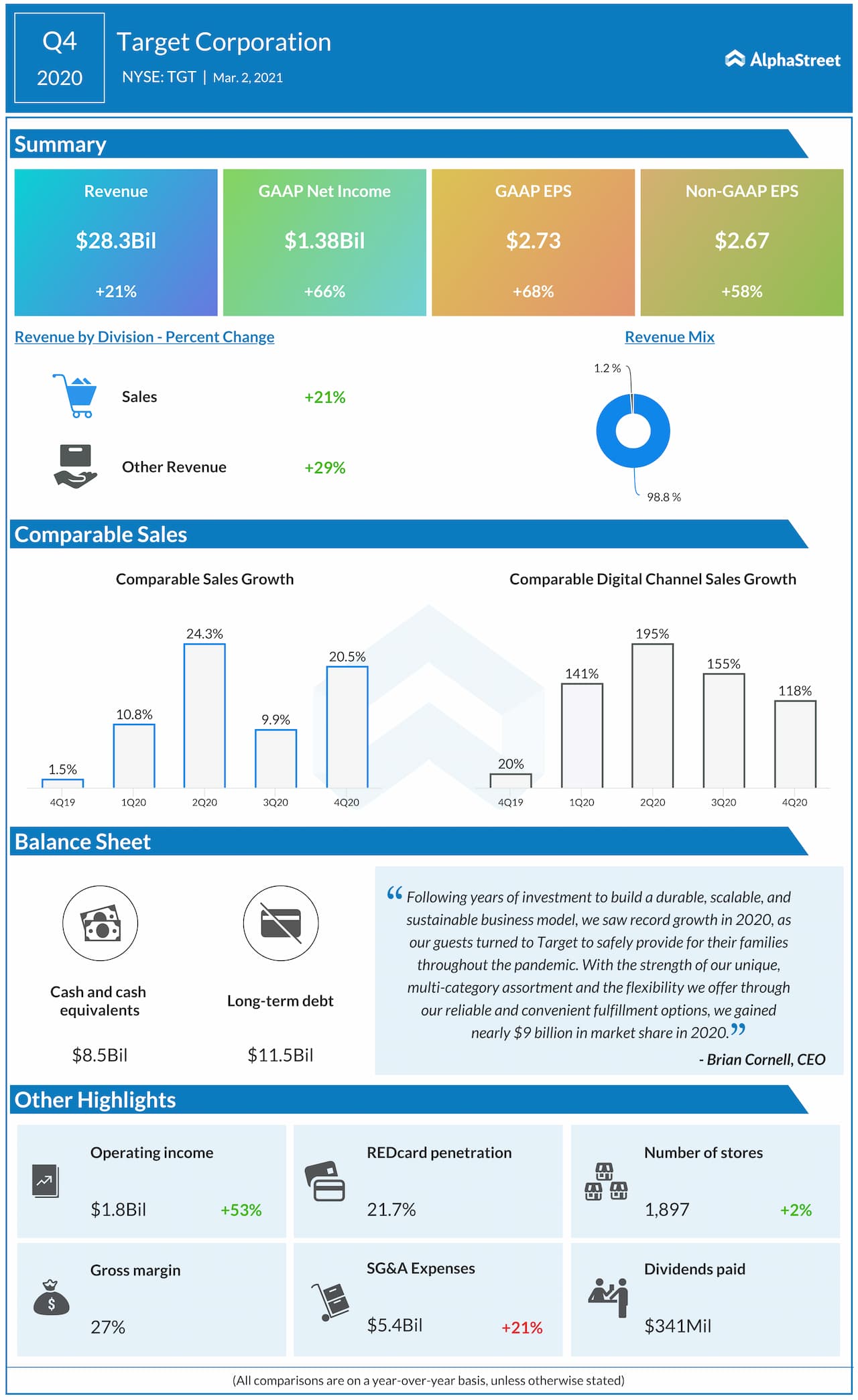

The rebound of comparable sales eased concerns that the ongoing sales boom could be short-lived. Interestingly, comparable sales in the digital channels more than doubled year-over-year in all the four quarters of 2020 and earnings topped expectations by wide margins. For the company, aggressive investments in e-commerce capabilities and services like curbside pickup and fulfillment centers came in handy when customers avoided visiting physical stores due to safety concerns.

Massive Digital Push

Shares of the retailer suffered one of the biggest intra-day losses this week, after making modest gains soon after the earnings report, as the market responded negatively to the management’s decision to make heavy investments in technology. A month earlier, they had moved up to a record high and hovered near the $200-mark. Analysts’ average target price indicates the current downturn is short-lived and the stock would bounce back in the remainder of the year, gaining as much as 25%. The consensus rating is strong buy.

Comparable store sales surged 21% in the final three months of fiscal 2020, after slowing down in the previous quarter. As a result, revenues moved up 21% annually to about $28 billion, driving up adjusted earnings to $2.67 per share. The top-line benefited from new store additions, despite the unfavorable market conditions, while margins were impacted by a double-digit increase in expenses.

Road Ahead

American retailers witnessed a spike in sales after people stocked up on essential items as they started cooking at home, rather than spending on dining-out and travel. The persistence of the trend even after the vaccine rollout has added to the optimism that the new retail culture is going to stay here, though a part of that can be linked to the resurgence of COVID infections in key markets.

From Target’s Q4 2020 earnings conference call:

“We have consistently invested in our merchandising strength, like our differentiated own brand portfolio, our curated national brands, inspired limited-time offering, and strategic relationships that run the gamut from web-only start-ups looking for omnichannel scale to premier partners like Disney, Apple, Levi’s and Ulta Beauty. We’re continuously improving our physical and digital shopping experience, investing billions in store remodels, specialized store rolls, and service training for our teams while continuing to open up new small formats in urban centers, major college campuses, and iconic tourist destinations.”

Stock Falls

Target’s stock closed the last trading session at $173.49, down 6.7%, which is the lowest price so far this year. In the past twelve months, it gained about 64% and outperformed the market.