Record User Addition

Thanks to the shelter-in-place orders, there has been a marked increase in the consumption of all types of digital content. Statistics show that player acquisition for Electronic Arts’ popular franchises more than doubled in the early months of the year as users got attracted to live service games like Apex Legends that witnessed a high level of engagement across all platforms. The company looks to continue to take advantage of the new social interaction trend, which has become less physical and more digital. That bodes well for the video game industry, which is projected to expand to about $260 billion in the next five years.

To take the momentum forward, the management also counts on new titles Command & Conquer Remastered and Burnout Paradise Remastered, which got encouraging response from the audience when released earlier this year. Moreover, the pipeline is pretty intact and on track, despite the disruption, with some major releases scheduled for next year and beyond. When it comes to the balance sheet, the company has a healthy cash flow-to-debt ratio that gives it enough leeway to invest in the business and return capital.

Interactive Gaming

The strong bookings growth and record-high demand for e-sports show that the future of entertainment lies in interactive engagement. Initial estimates show that the company’s sports franchises FIFA and Madden NFL 20 continued to attract fans so far in the current quarter, mainly due to the absence of real-world events. Nevertheless, the demand for live services might weaken once the movement restrictions are eased. Surprisingly, the company’s mobile segment has not made much headway in recent times and that can play spoilsport, considering the new gaming culture that is gaining foothold.

From Electronic Arts’ Q1 2021 earnings conference call:

“Tens of millions of new players have come into our games, and we also have many players returning to our franchises after some time away. In addition to higher engagement from our existing players, these new and returning players are now deeply engaged in our live services, establishing new play patents and building new friendships through our games. So while there are noble aspects to this period of time we are in, and it may be difficult to predict the patterns of new and returning players, we expect these trends to continue during and after the pandemic.”

Also read: Will shelter-in-place, mobile release help Activision

Financials

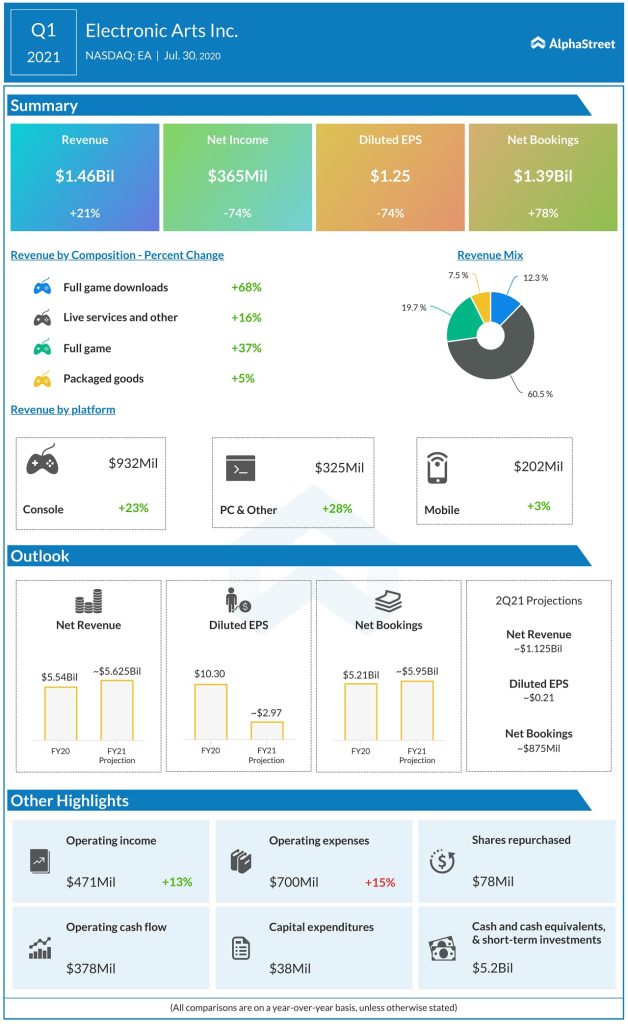

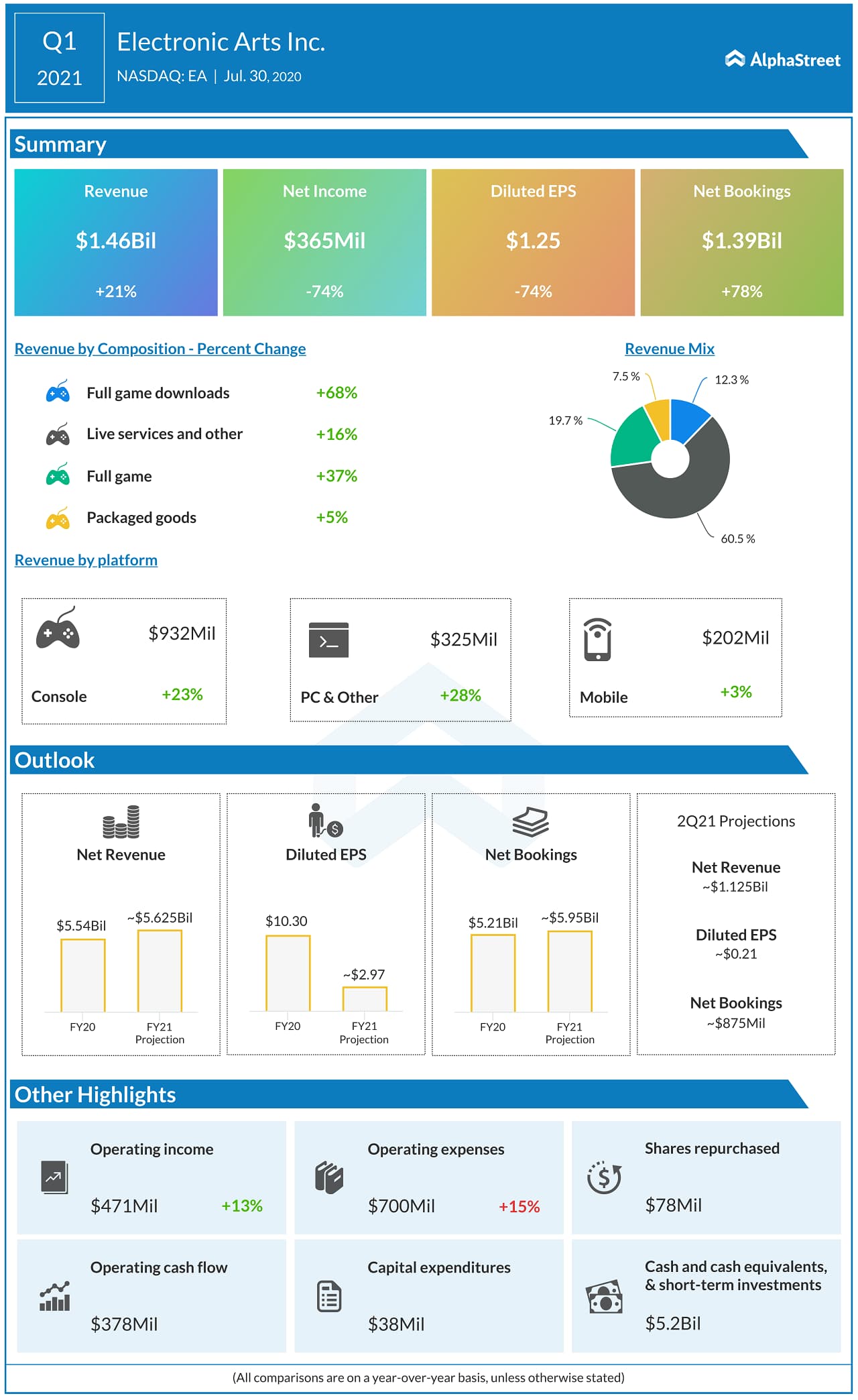

Riding on the success of live services, Electronic Arts recorded a 21% revenue growth in the first quarter to $1.5 billion. There was growth across all operating divisions and platforms, reflecting the high demand for online content during the shutdown. Earnings came in at $1.25 per share and topped Wall Street’s prediction, continuing the recent trend. Since the prior-year earnings per share of $4.75 included a significant tax-related benefit, a year-over-year comparison would be inappropriate.

It is widely expected that the consumption of digital entertainment content would remain elevated during the remainder of the year. Electronic Arts executives expressed confidence to cash in on the opportunity in the current quarter and beyond.

Read management/analysts’ comments on latest quarterly reports

Shares of the company traded slightly lower during Thursday, after openings the session at $126.10. They have gained 15% since the beginning of 2020, though the momentum waned modestly this week. The stock has outperformed the market so far in 2020.