Over the years, Microsoft Corporation (NASDAQ: MSFT) has constantly diversified its portfolio, a strategy that helped it effectively deal with weaknesses in certain areas like the core PC software business. The company, which has strong presence in most of the key markets globally, experienced a slowdown last year, mainly due to inflationary pressures and cost escalation.

Buy It?

The company’s shares reached their highest-ever value more than a year ago after making steady gains, in one of the best winning streaks the market has witnessed. But then came the tech selloff, and Microsoft was not spared – this week, MSFT traded at the lowest level in about two years and well below its 52-week average. Just like the board market, the tech firm faced multiple challenges in the past couple of years, but they are not specific to the company or the industry it represents. Meanwhile, the stock has become more affordable after the year-long losing streak.

Earnings: IBM Q3 profit beats estimates; revenue up 6%

If the positive outlook on the stock is any indication, by the end of 2023 it would rebound to the level where it stood six months ago. It is unlikely to get cheaper in the foreseeable future. So, now is the time to invest in this blue-chip company that has strong fundamentals and great growth opportunities.

Considering the stock’s recovery prospects, the market will be closely following Microsoft’s second-quarter earnings report which is expected later this month. The diversified business model and healthy balance sheet, characterized by strong cash flow and sustainable debt, add to the stock’s appeal.

Road Ahead

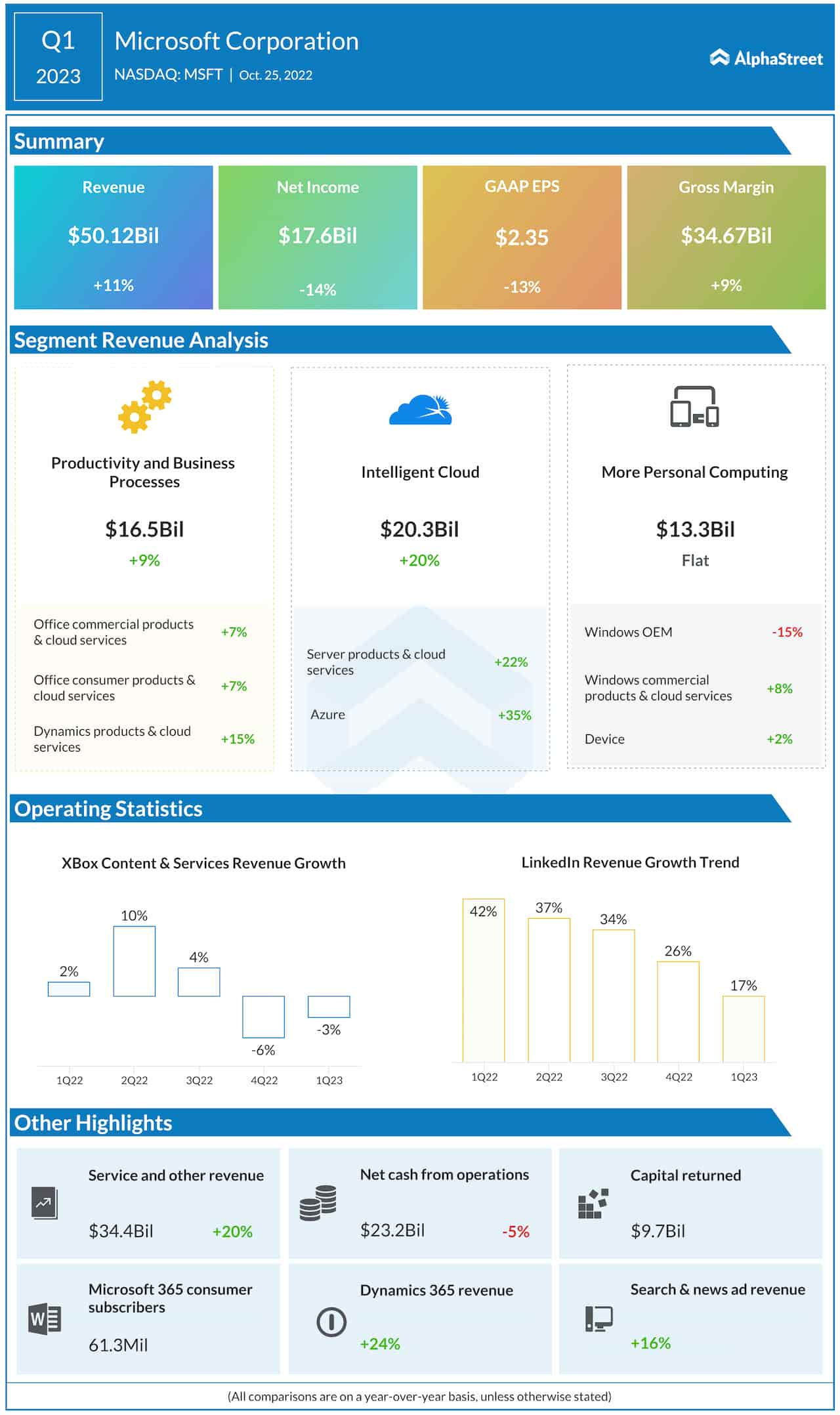

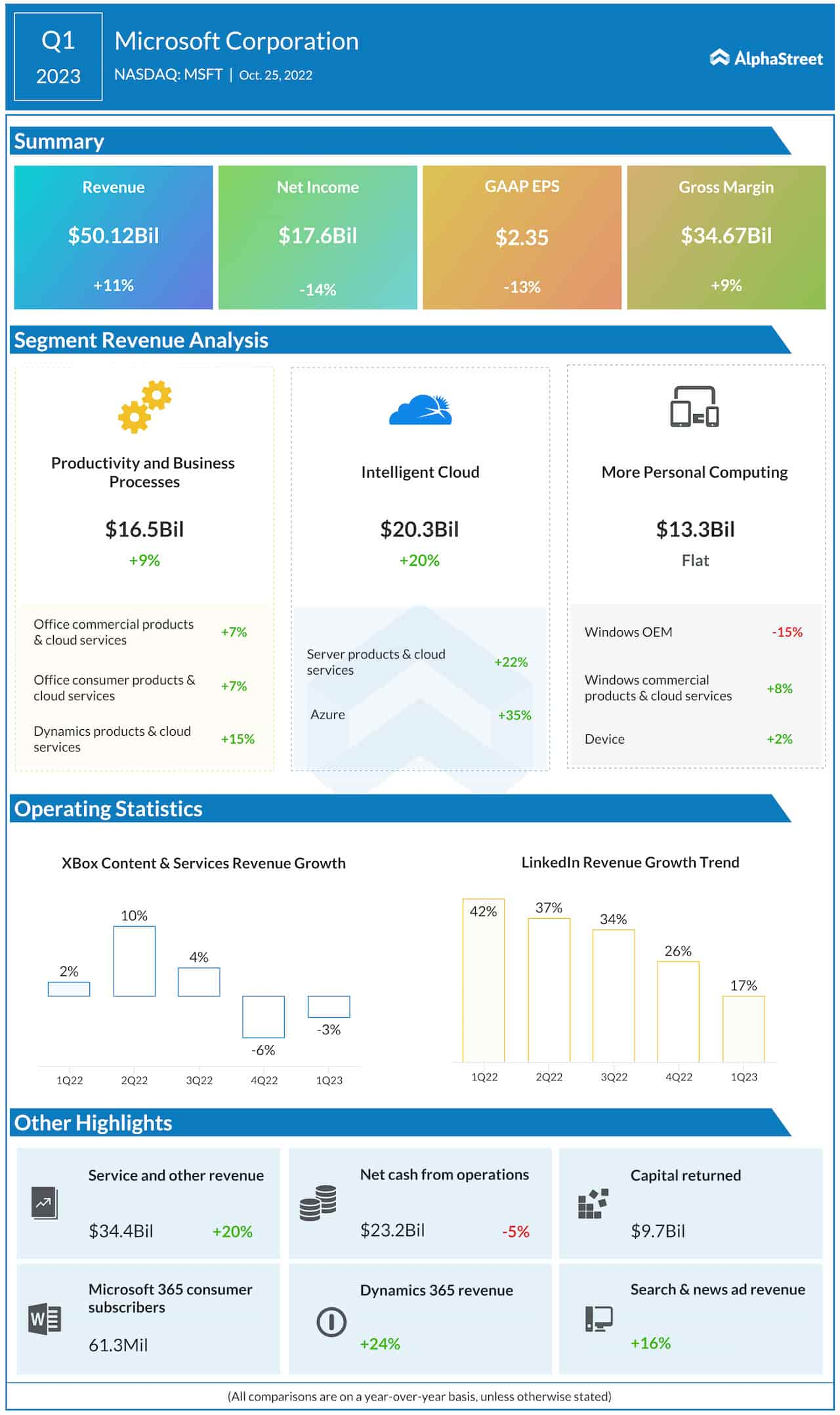

When it comes to future growth, the company is well-positioned to tap into emerging opportunities in areas like cloud computing, digital advertising, and cybersecurity. For instance, the Intelligent Cloud business accounted for around 40% of total revenues in the most recent quarter — Azure is touted as the second-largest cloud provider in the world now. Microsoft also dominates in enterprise productivity services, thanks to the widespread adoption of products like Microsoft 365.

Microsoft Corporation Q1 2023 Earnings Call Transcript

“At the total company level, we continue to expect double-digit revenue and operating income growth on a constant currency basis. Revenue will be driven by around 20% constant currency growth in our commercial business, driven by strong demand for our Microsoft Cloud offerings. With the high margins in our Windows OEM business and the cyclical nature of the PC market, we take a long-term approach to investing in our core strategic growth areas and maintain these investment levels regardless of PC market conditions,” said Microsoft’s CFO Amy Hood at the first-quarter earnings call.

Results Beat

The company has a good track record of delivering stronger quarterly financial results than estimated, with revenues growing steadily and crossing the $50-billion mark for the first time in the last fiscal year. In the three months that ended September 2022, the top line moved up 11% year-over-year to $50.1 billion. All the operating segments and sub-divisions, except Windows OEM, registered growth. However, earnings declined by double digits to $2.35 per share, which is mainly attributable to a higher tax provision.

Microsoft’s stock had a rather unimpressive start to the year, suffering losses in the initial days. At $222, it traded slightly lower on Friday afternoon.