Valuation

Though the shares have lost momentum after peaking in March, all along they stayed above the long-term average. The stock has remained resilient to the market downturn to a large extent and looks fairly valued. The current valuation can be seen as an opportunity to enter HPE since it is unlikely to get cheaper in the near future. The price-to-earnings ratio, compared to the industry average, is favorable from an investment perspective.

Hewlett Packard Enterprise Company Q3 2022 Earnings Call Transcript

Nevertheless, Hewlett-Packard is not an entirely safe bet. The primary risk is the company’s muted growth, with revenues and net profit almost stagnating in recent times. Also, the shortage of components due to tight supply conditions and fluctuations in foreign exchange rates could continue to be a drag on margins.

“From a supply chain perspective, the dynamics remained largely unchanged from the last few quarters, with certain components still in tight supply, which limited shipments. However, we have made progress in proactive measures we have taken to enhance the resilience of our supply chain, including still in demand to products that do not require supply-constrained components, offering new multi-sourcing options, and implementing program design changes to our world-class engineering capabilities,” said HPE’s CEO Antonio Neri at his post-earnings meeting with analysts this week.

Demand Power

Even so, computer hardware and cloud computing are rapidly-expanding industries and the uptrend is expected to continue in the foreseeable future, giving enough room for multiple players to grow their businesses. Also, information technology continues to be a top priority for enterprise spending despite the general market slump, thanks to the widespread adoption of digital technology.

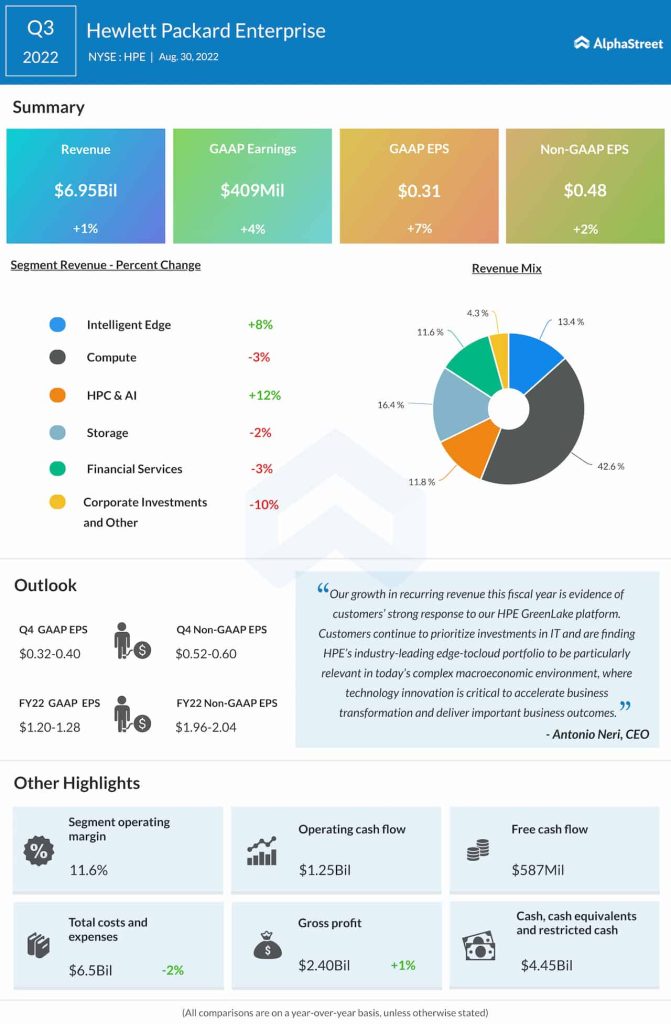

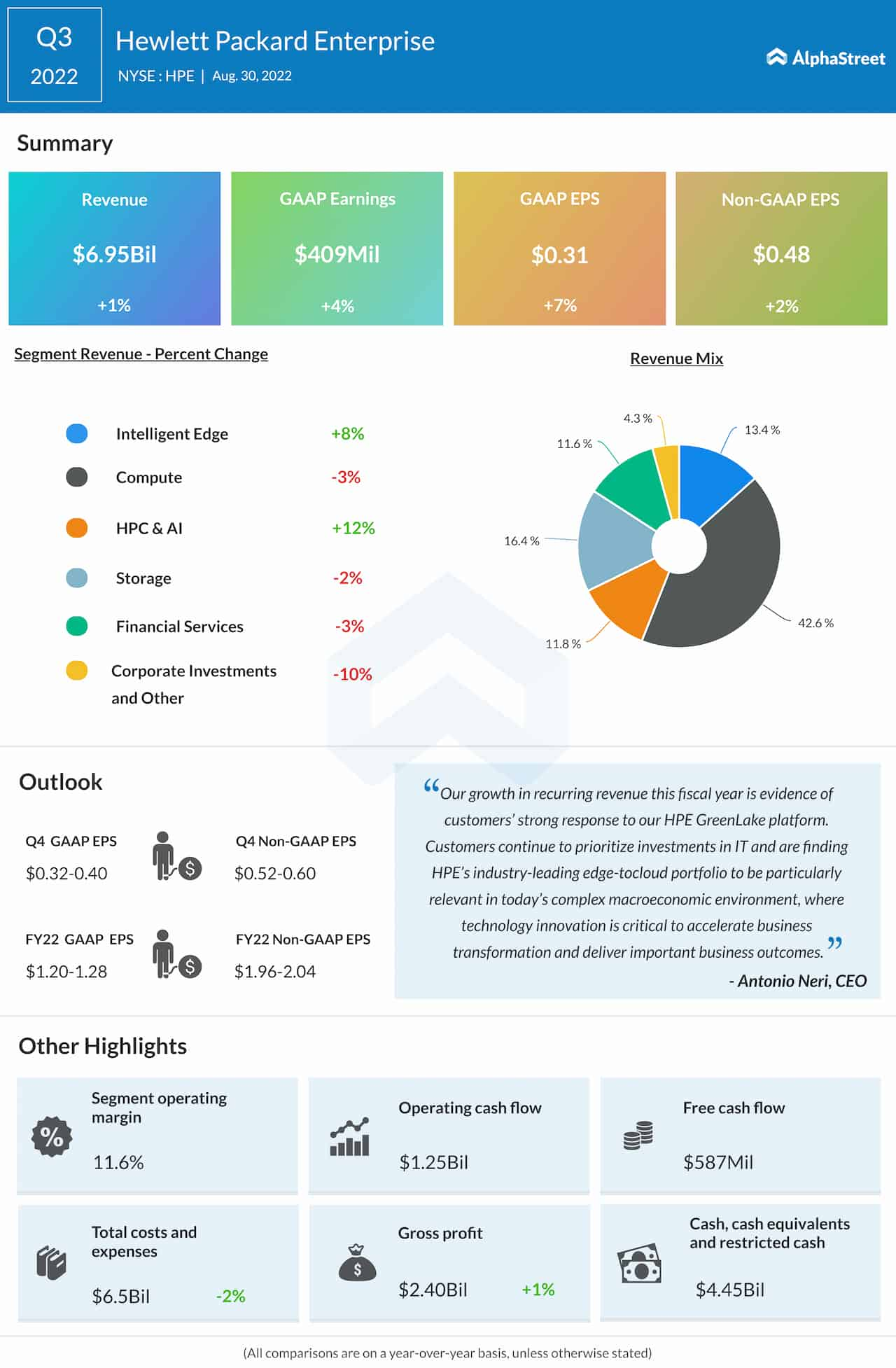

Over the years, Hewlett Packard’s financial results mostly beat Wall Street’s projections. At $0.48 per share, third-quarter adjusted profit was slightly higher compared to the year-ago period and came in line with estimates, which followed an earnings miss in the previous quarter.

Revenue, Outlook

Revenues edged up 1% to $6.95 billion, with higher sales at the Intelligent Edge and HPC&AI segments more than offsetting weakness in the core Compute division. Recurrent revenue grew at a faster pace, as it has done in the recent past, reflecting strong customer engagement and the positive response to HPE GreenLake, the company’s unified Edge-to-Cloud as a service platform. In an effort to further improve customers’ hybrid cloud experience, a series of new cloud services and enhancements were released for HPE GreenLake this year.

HPQ Earnings: A snapshot of HP’s Q3 2022 financial results

While the management issued positive fourth-quarter and full-year guidance that also exceeded experts’ estimates, a slight reduction to the top end of the annual earnings outlook seems to have weighed on sentiment. The management expects fourth-quarter adjusted earnings per share to be in the $0.52-0.60 range; the midpoint of it is above the prior-year level. The narrowed full-year earnings guidance is $2.04-2.10 per share.

Extending the recent weakness, Hewlett Packard’s stock traded lower on Wednesday afternoon. The stock has lost about 14% in the past six months.