Constellation Brands, Inc. (NYSE: STZ) has entered the second half of the year on a high note, reporting impressive results for the August quarter and issuing strong guidance. While continuing the successful journey, the beer behemoth is on a reorganization drive with focus on rightsizing its wine & spirits business.

Shares of the New York-based company, which sells iconic brands like Corona Extra and Modelo Especial, mostly traded sideways in the past six months, unlike the broad market that experienced a downturn. Interestingly, STZ climbed to a record high in August but pared those gains in the following weeks. The good news is that Constellation Brands has more room to grow despite the recent gains.

Buy STZ?

The strong prospects, underscored by the bullish target price that signals a 20% growth from the current levels, make the stock a compelling buy. STZ is a relatively safe bet. The strong cash flow should enable the company to keep giving solid returns to shareholders. However, some prospective buyers would find the stock a bit expensive.

From Constellation Brands’ Q2 2023 earnings conference call:

“Beyond product innovation, we continue to extend our growth in direct-to-consumer and three-tier e-commerce channels, as well as international markets. Wine and spirits DTC net sales grew 15% in the second quarter as our investments in these channels continue to yield strong performance. We also continue to outperform in three-tier e-commerce delivering dollar sales growth 16 points ahead of the competition in the second quarter.”

Constellation Brands Q2 2023 Earnings Call Transcript

More Fizz

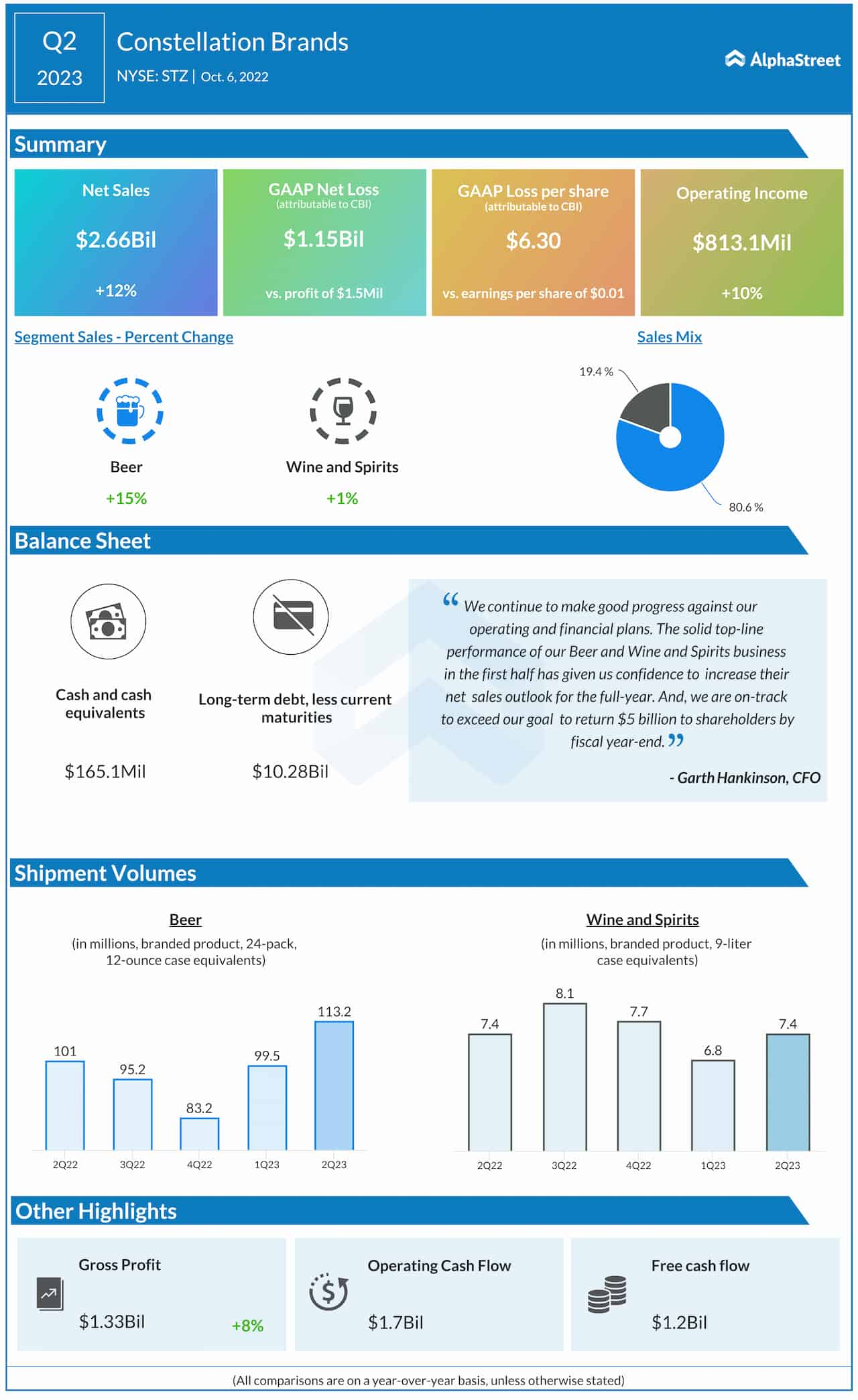

The company has expanded market share consistently, mainly in the beer segment, and lived up to the market’s expectations almost every time it reported earnings in the recent past. It was no different in the second quarter when adjusted profit climbed 33% year-over-year to $3.17 per share. The earnings growth was driven by a 12% increase in revenues to $2.66 billion. The top line also beat the estimates, as it did every quarter in the past two years.

Encouraged by the strong performance, the management raised its full-year sales outlook. While recent additions to the wine portfolio, like Woodbridge and Meiomi Red Blend, are doing well, the overall performance of the wine & spirits segment remains lackluster. Efforts are underway to make the business extra premium by divesting a portion of the mainstream wine portfolio, which will allow the company to focus its portfolio and efforts on delivering better growth and margins.

PEP Stock: Is PepsiCo a safe investment in the bear market?

Currently, it is offloading some of the wine labels to rival brewery The Wine Group, including the Cooper & Thief, 7 Moons, and The Dreaming Tree brands. Earlier, it had sold some of the leading brands to E&J Gallo.

Canopy Growth Investment

Meanwhile, the impairment of investments in cannabis firm Canopy Growth Corporation (NASDAQ: CGC) would be a concern in the near future, though the market for recreational marijuana remains strong. A non-cash impairment charge of $1.1 billion on the Canopy investment was recorded in the most recent quarter. The other risks are rising operating costs and the strain on consumers’ spending power amid elevated inflation.

STZ closed Friday’s regular session sharply lower but made modest gains in the after-hours. In the past twelve months, the stock gained about 6%.