Shares of Take-Two Interactive Software, Inc. (NASDAQ:TTWO) soared over 13% on Thursday, a day after the company reported its fourth quarter 2023 earnings results. The stock has gained 35% year-to-date and 21% over the past 12 months. The gaming company delivered sales and bookings growth and provided an encouraging outlook for the long term. Here are a few notable points from the earnings report:

Sales and bookings growth

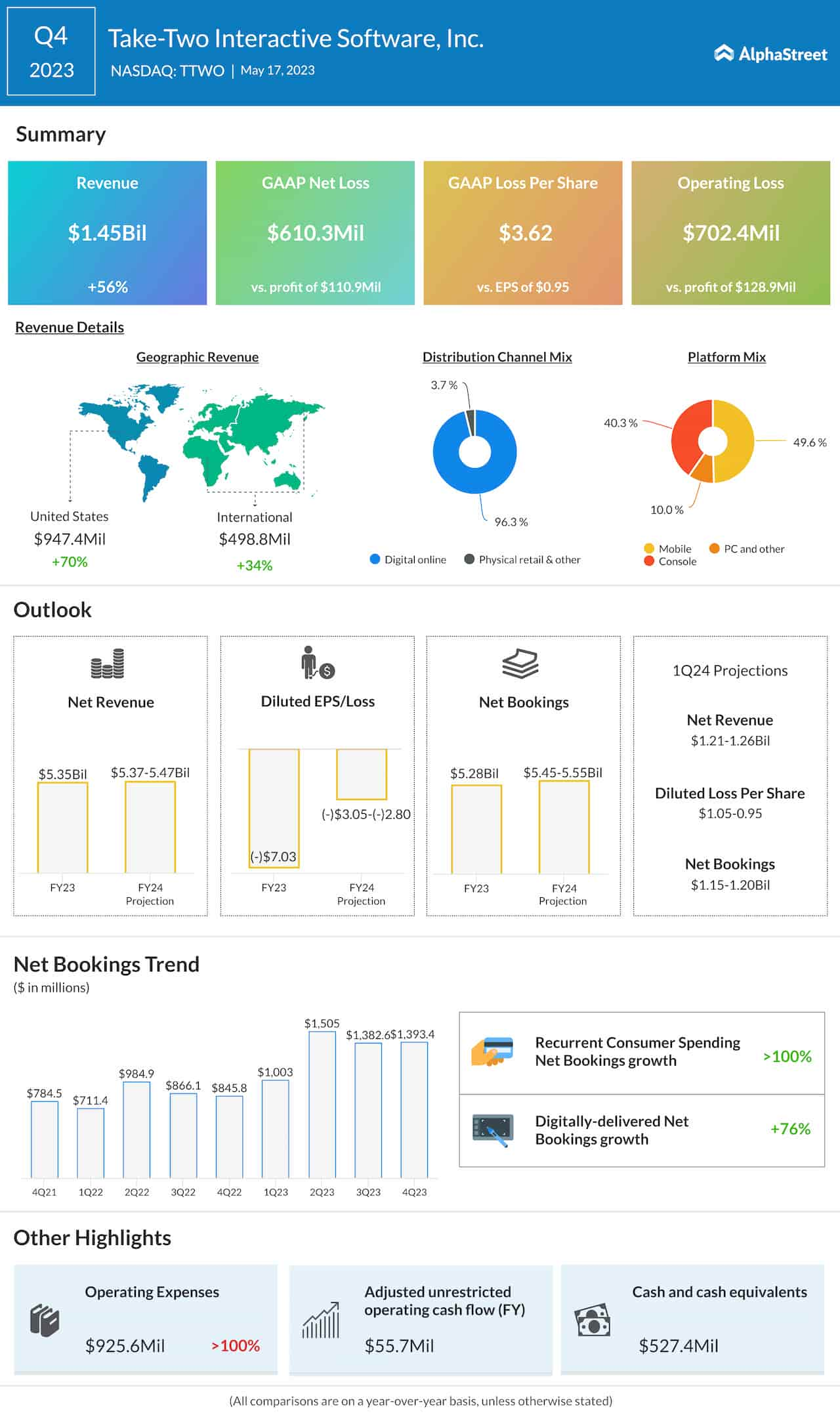

Take-Two’s revenue increased 56% year-over-year to $1.45 billion in Q4 2023. Recurrent consumer spending grew 94% and accounted for 79% of total revenue. Digitally-delivered revenue rose 67% and made up 96% of total revenue.

In Q4, net bookings grew 65% YoY to $1.39 billion. Net bookings from recurrent consumer spending rose 115% and accounted for 78% of total bookings. Digitally-delivered net bookings increased 76% and comprised 97% of total bookings.

Franchise strength

Take-Two witnessed strong performances from its popular titles such as Grand Theft Auto V and Red Dead Redemption 2 during the quarter. Even as customers remained cautious with their spending amid the inflationary environment, they gave more preference to popular franchises and titles which benefited the company.

The biggest contributors to sales and bookings growth in Q4 were Grand Theft Auto V, Grand Theft Auto Online, Red Dead Redemption 2, Red Dead Online, NBA 2K23, and Zynga’s mobile portfolio. Grand Theft Auto V and Red Dead Redemption 2 outperformed expectations and to date have sold over 180 million and 53 million units worldwide, respectively. NBA 2K23 also continues to grow, selling 11 million units to date.

Zynga

This acquisition has proven to be significantly beneficial to Take-Two and has helped expand its mobile platform. In Q4, Zynga’s offerings such as Empires and Puzzles, Game of Thrones Slots Casino, Zynga Poker and Top Eleven delivered strong performances. The hyper-casual mobile business is also doing well, contributing significantly to sales and bookings growth in the quarter. Rollic also increased its profitability during the period.

Long-term growth plans

Take-Two has encouraging growth plans for fiscal years 2025 and 2026. In FY2025, the company plans to launch several new titles that will help it achieve over $8 billion in net bookings and over $1 billion in adjusted unrestricted operating cash flow. It aims to generate even stronger results in FY2026. Its release slate for these two years includes 14 immersive core releases, two mid-core games, four new iterations of older titles, four independent titles from Private Division, and 12 mobile games.

Outlook

For the first quarter of 2024, Take-Two expects net revenue to range from $1.21-1.26 billion and net bookings to range between $1.15-1.2 billion. Recurrent consumer spending is estimated to increase by 35%.

For FY2024, net revenues are expected to be $5.37-5.47 billion and net bookings are expected to be $5.45-5.55 billion. 67% of net bookings are expected to come from the US and 33% from International. Recurrent consumer spending is expected to be up 5% versus FY2023.

On the flip side

Some parts of the report were not so bright. In Q4 2023, Take-Two reported a net loss of $610.3 million, or $3.62 per share, compared to a net income of $110.9 million, or $0.95 per share, in the same period last year.

The company has also forecasted losses for both Q1 2024 and FY2024. In Q1, net loss is expected to range between $161-178 million, or $0.95-1.05 per share. For the full year, net loss is estimated to be $477-518 million, or $2.80-3.05 per share.