Read management/analysts’ comments on Target’s Q4 results

Experts recommend buying the stock, citing an estimated double-digit gain in the next twelve months. Moreover, the Minneapolis-based big-box retailer has a long history of paying decent dividends with regular hikes, eliciting much interest among income investors.

Long-term Growth

Going by the management’s bullish outlook, the company will maintain the current sales momentum beyond the pandemic, in line with experts’ analysis. Operating margin is expected to grow an impressive 8% for the rest of the year, which is significant considering the current inflation scenario. The margin expansion will be driven by continued sales growth, though rising prices remain a drag on customers’ purchasing power. And, the trend is expected to prevail next year, with full-year revenues projected to grow in mid-single digits and earnings per share in high-single digits.

From Target’s Q4 2021 earnings conference call:

“We expect ongoing CAPEX will be in the $4 billion to $5 billion range annually, and we’ll be focused first on our continued investments in our stores-as-hubs model, including new locations, full store-remodels, full filament retrofits, and projects to support key national brand partnerships. In addition, we’ll continue to invest in our upstream supply chain, sortation centers, and DC automation to further reduce store workload. Even after these sizable CAPEX investments, we expect to have ample capacity for shareholder returns as well given the robust operating cash flow our business continues to generate, amounting to more than $8.5 billion in 2021.”

The company was pretty quick in adapting to emerging market conditions in recent times and changed the strategy accordingly, with a focus on enhancing its eCommerce and omnichannel capabilities – several stores were transformed into fulfillment centers to support services like curbside pickup and same-day delivery.

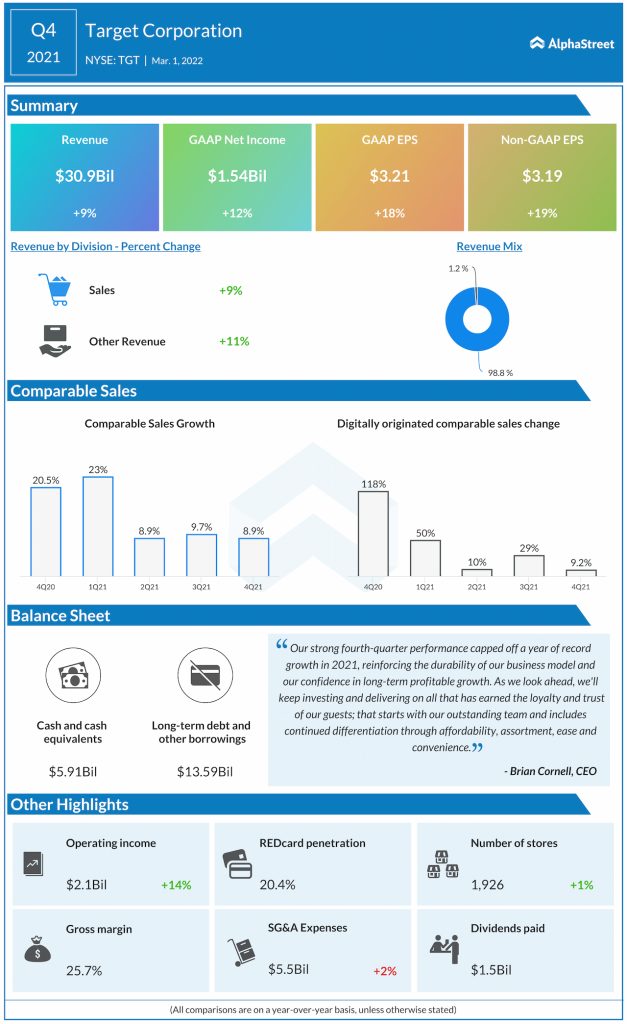

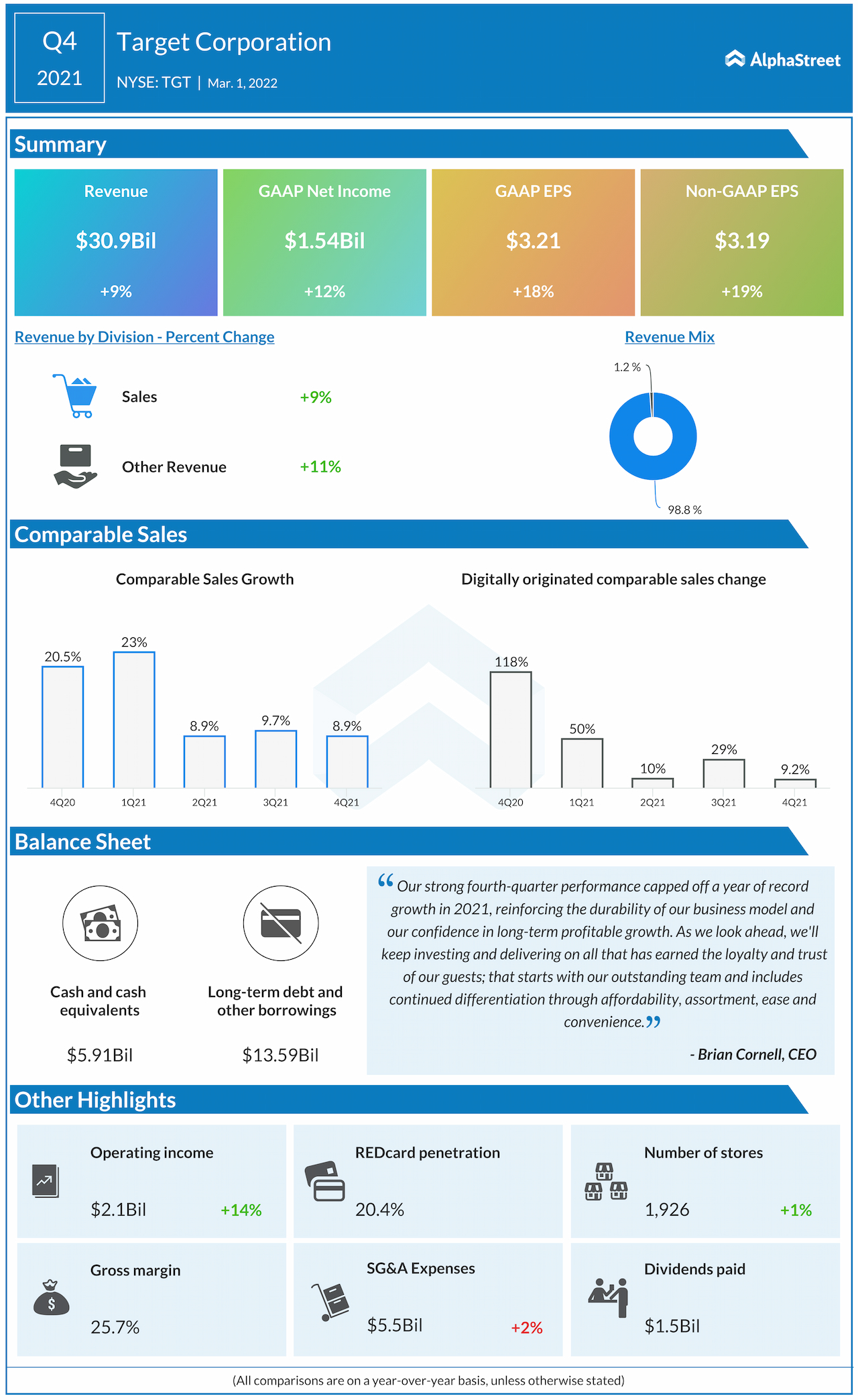

Q4 Numbers

Target has reported stronger-than-expected quarterly profit consistently in the last couple of years, with earnings hitting a record high of $3.19 per share in the most recent quarter. The bottom-line benefitted from a 9% increase in revenues to $31 billion in the fourth quarter. Comparable sales growth slowed, as it did in the preceding quarter, but it is due to tough comparisons with the previous year when sales spiked due to COVID-related factors.

Costco bets on strong customer loyalty to beat COVID blues

Though traffic continues to grow both at Target’s physical stores and online platform, even after the virus threat eased, it is not certain whether the momentum would be sustained after the economy returns to pre-pandemic levels. Shares of Target lost around 10% in the past six months though they hit a peak during that period. The stock traded lower on Wednesday afternoon, after opening the session flat.