Shares of the Coca-Cola Company (NYSE: KO) were down over 1% on Tuesday following the announcement of its fourth quarter 2022 earnings results. The beverage giant delivered revenue that surpassed expectations and earnings that matched estimates and also provided an encouraging outlook for the upcoming year.

Quarterly numbers

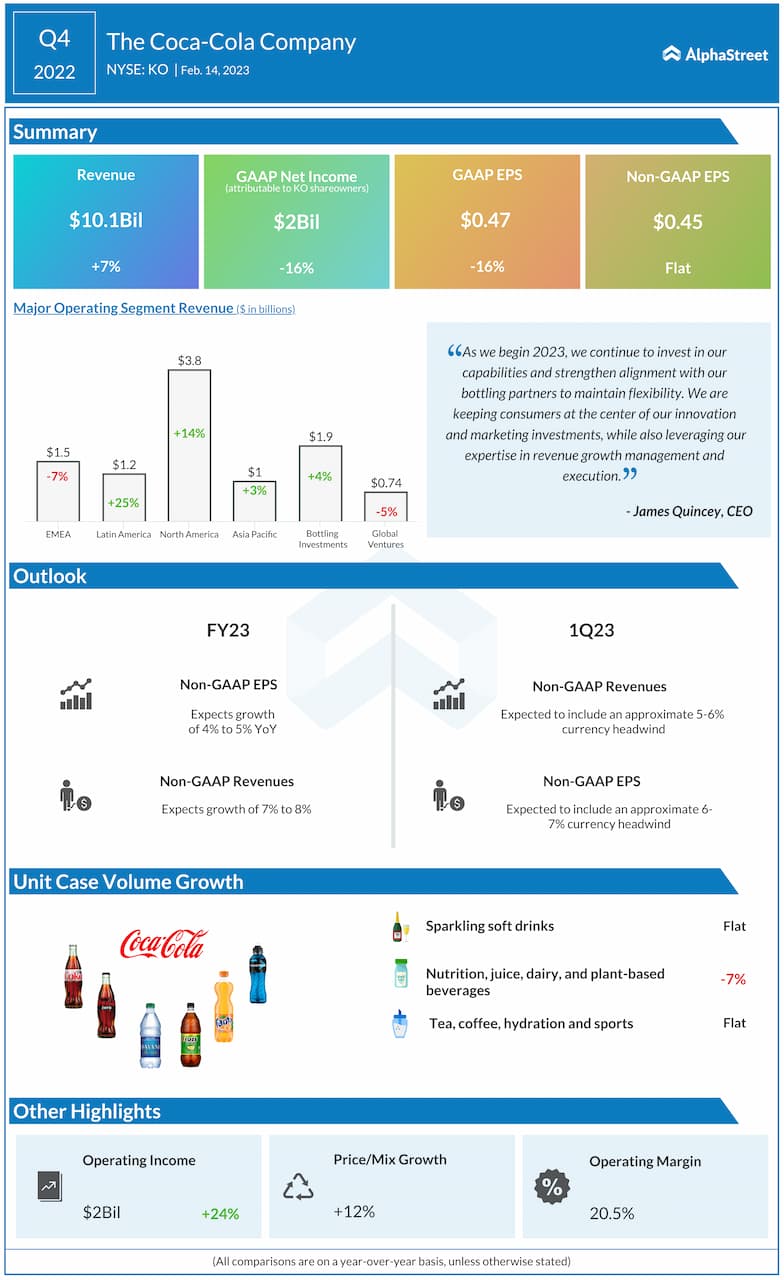

Coca-Cola’s revenues in the fourth quarter of 2022 grew 7% year-over-year to $10.1 billion, beating estimates of $10.02 billion. Organic revenue grew 15%. The top line performance was driven by pricing actions as well as favorable channel and package mix. Adjusted EPS of $0.45 was flat with the year-ago quarter and in line with the consensus target.

Business performance

During the fourth quarter, Coca-Cola recorded organic revenue growth across all its segments with the highest of 32% coming from Latin America. North America and Asia Pacific delivered double-digit increases while the Europe, Middle East & Africa (EMEA) region witnessed single-digit growth of 9%.

Unit case volume declined 1% in Q4, as strong growth in India, Brazil, Mexico and Great Britain was more than offset by the business suspension in Russia. While developed markets grew in the low single digits, developing and emerging markets declined in the low single digits for the quarter.

Unit case volumes remained flat for the sparkling soft drinks and the water, sports, coffee and tea categories during the fourth quarter while the juice, value-added dairy and plant-based beverages category saw a decline of 7%. While volumes benefited from strong growth in Latin America, Asia Pacific and other developed markets, it was hurt by the stoppage of operations in Russia and pandemic-related headwinds in China.

During the fourth quarter, unit case volumes declined 5% in EMEA, as strong growth in Western Europe was offset by the business suspension in Russia. Volume grew 2% in Latin America with the growth led by Brazil and Mexico. Unit case volume remained flat in North America as growth in sparkling soft drinks, juice drinks and dairy beverages were offset by declines in other beverage categories. Volume declined 1% in Asia Pacific as growth in India and Vietnam was offset by a decline in China.

Outlook

For the full year of 2023, Coca-Cola expects organic revenue growth of 7-8% and comparable EPS growth of 4-5% versus the prior year. The company expects commodity price inflation to be mid-single digit percentage headwind on comparable cost of goods sold.