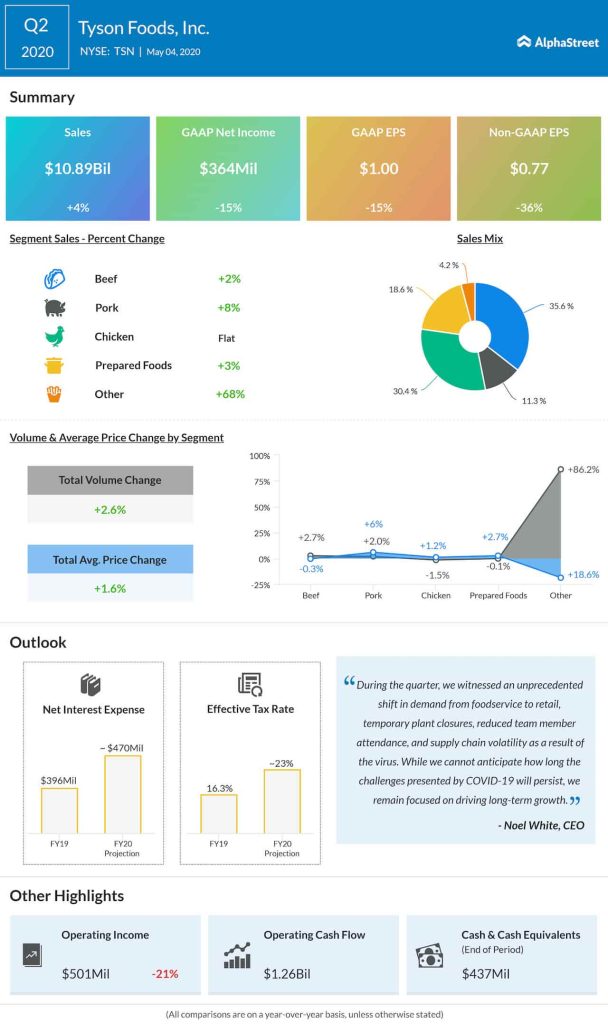

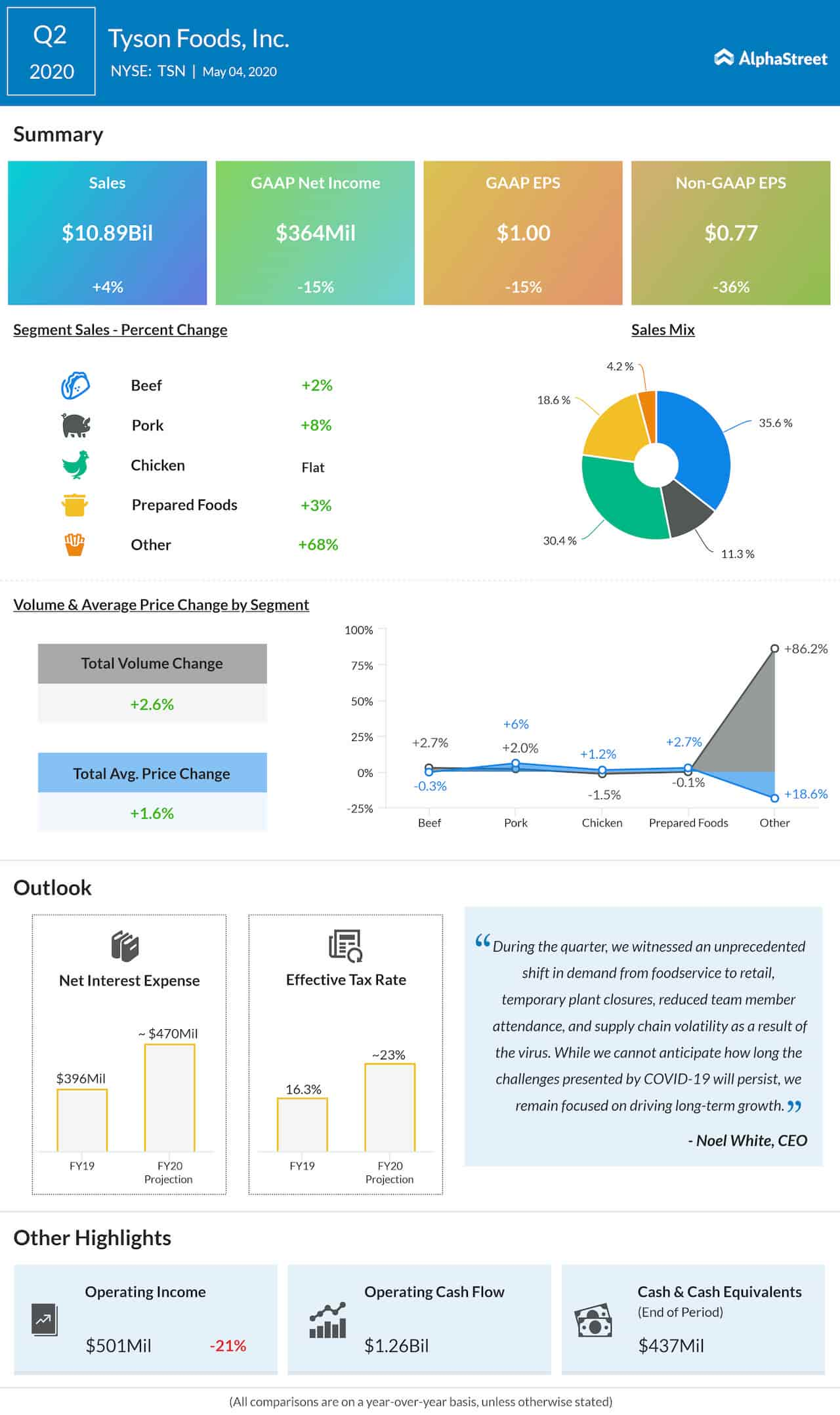

The company saw a sharp drop in its foodservice channel and faced pressure on its supply chain. It also saw weakness in its chicken segment due to an increase in feed costs and weak pricing. This segment has a higher exposure to the foodservice channel, which hurt volumes and margins. The chicken division is expected to incur losses in the second half of the year.

Despite these challenges, the future is not totally bleak

for Tyson. There are quite a number of bright spots ahead. In the second

quarter, the company saw double-digit increases in its market share in Japan

and Mexico as exports gained strength. Looking ahead, Tyson sees opportunities

to cater to international demand as supply levels impacted by African swine

fever remain low.

COVID-19 has impacted parts of the industry’s supply chain

such as pork but Tyson has been able to provide its customers with various alternatives

thanks to its array of protein options.

While foodservice demand has reduced, the demand in the

retail channel has gained significantly. Due to the pandemic, people have

stopped dining out and choose to buy easy-to-cook ingredients and meal kits

which has led to high demand from supermarkets and grocery stores that are

rushing to stock these items. Tyson’s shift to new product mixes and its

conversion of production lines have helped it meet this demand in a stable

manner.

The company’s retail business remains strong with

significant gains in its core retail lines. Retail sales now comprise about

two-thirds of total company sales versus the historical level of 45%.

During the third quarter, Tyson saw a 20% growth in retail

sales in its Prepared Foods segment which the company believes provides the

highest potential for growth and margin expansion across its portfolio.

Tyson has successfully managed to shift its beef business

from the foodservice channel to retail and believes the growth in demand seen

currently could continue after the pandemic subsides. The company also saw double-digit

increases in beef exports and believes this provides another growth opportunity

going forward.

In addition, Tyson saw significant sales growth in its

ecommerce channel, which is expected to continue. Going forward, Tyson expects

to see a rise in ecommerce for grocery and foodservice and believes the

investments it has made in this space will position it well for growth in the

future.

In the pork segment, Tyson has expanded its global supply capabilities and the company is seeing increased demand due to low supply levels caused by the African swine fever. Tyson expects to benefit from this strong supply and demand trend going forward.

The company expects volumes to drop in the second half of 2020 as the increases in retail were not enough to offset the losses in foodservice. However, for the year, Tyson expects to see strong supply and profitability in its beef division. The pork segment is expected to benefit from lower livestock costs and higher export opportunities. The Prepared Foods segment is also expected to see healthy trends in 2020 as people rely on ready-to-eat food products and snacks even after the crisis subsides.