Revenue decline

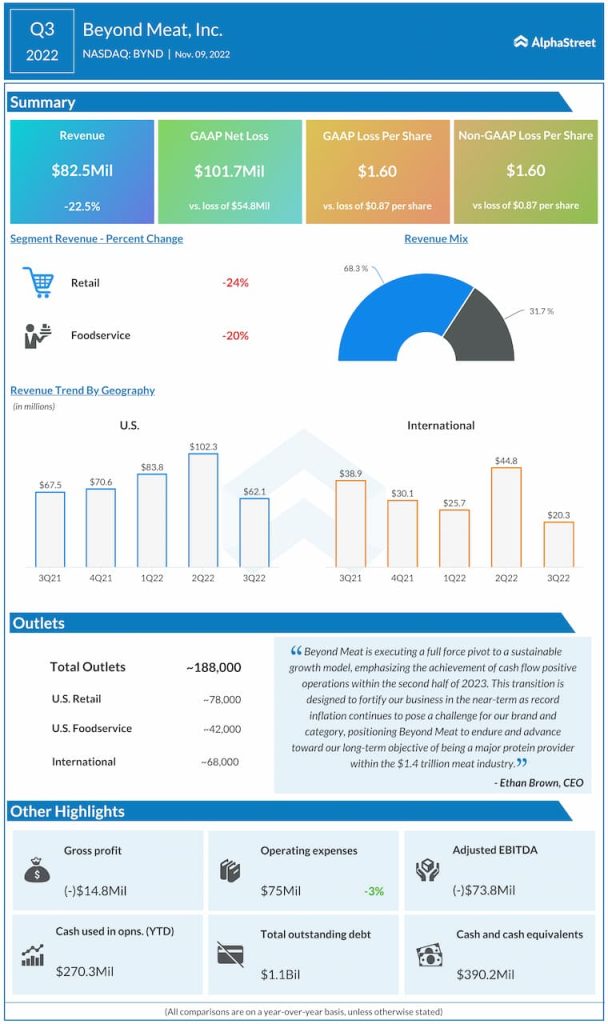

Slow demand for plant-based meat products and changes made by customers and distributors to inventory levels also hurt the top line. Net revenue per pound decreased 11.2%, mainly due to price reductions in the US and EU and higher trade discounts.

Revenues declined 11.8% and 52.3% in the US and international retail channels respectively, due to double-digit decreases in volume. International foodservice channel revenues dropped 42.2% in the quarter. Revenues in the US foodservice channel alone increased 5.6%, driven by a 32% increase in pounds sold.

The company also reduced its revenue outlook for the full year. It now expects FY2022 revenue to range between $400-425 million, which reflects a decline of 14% to 9% from FY2021. This compares to the prior outlook of $470-520 million.

Widening losses

In Q3, Beyond Meat delivered a net loss of $101.7 million, or $1.60 per share, which was wider than the $54.8 million, or $0.87 per share, reported in the year-ago period. EPS also missed consensus estimates. The company’s margins in the quarter were hit by higher costs and decreased net revenue per pound due to heavy discounting. The challenging macro environment also took a toll on margins.

Slowing demand and rising competition

One of the key challenges in front of Beyond Meat is softness within the overall plant-based meat category. In the current inflationary environment, consumers are moving away from higher-cost plant-based meat products and opting for cheaper products like chicken. In Q3, household penetration for the plant-based meat category fell by around 20 basis points versus Q2, marking the second quarterly drop in a row.

The company is also seeing rising competition in the sector as more players enter the field. This has led to an erosion in its market share. However, with more companies chasing the same set of consumers, Beyond Meat believes a shakeout could take place leading to brands either retreating or consolidating.

In retail, Beyond Meat is looking to restore growth to its core product offerings – burgers, beef, and dinner sausages, through product innovation, strategic pricing and distribution expansion. These products account for roughly three-quarters of its total gross revenues and carry the highest margins across its portfolio. However, it remains to be seen if this strategy yields results.

Click here to read more on consumer stocks