Shares of Beyond Meat, Inc. (NASDAQ: BYND) were up over 2% on Monday. The stock has dropped 24% year-to-date and 36% over the past 12 months. There is a pessimistic sentiment in general surrounding the stock as the company’s prospects appear bleak. Its most recent quarterly results were disappointing and it expects current headwinds to persist. Here are three problems that continue to plague the plant-based food company:

Declining sales and continued losses

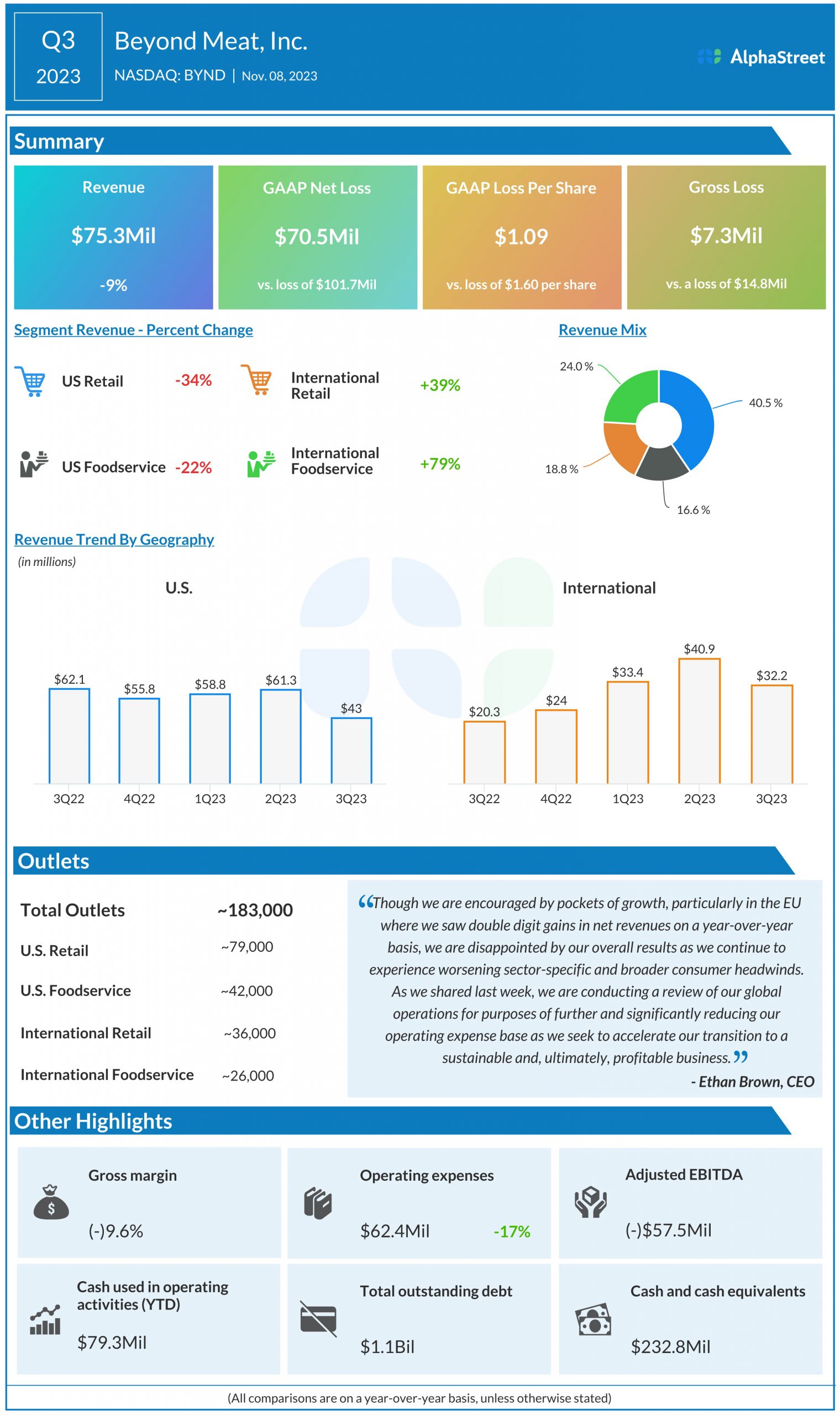

Beyond Meat has been seeing falling sales and continued losses for the past couple of quarters. In the third quarter of 2023, net revenues decreased nearly 9% year-over-year to $75.3 million. This decrease was driven by a double-digit decline in net revenue per pound caused by higher trade discounts and changes in product sales mix.

The company delivered a net loss of $70.5 million, or $1.09 per share, for the third quarter. Beyond Meat’s revenues and profits may not see a sudden pickup against the current backdrop of slow demand and high prices for its products.

Lower sales in the US

Beyond Meat continues to see a drop in revenues from the US market. In Q3 2023, total US segment revenues decreased nearly 31% year-over-year, led by declines of around 34% and 22% in the retail and foodservice channels respectively. These declines were mainly due to weak category demand.

On the bright side, the international segment performed well in the third quarter, with total revenues up around 59%. The retail channel saw revenue growth of around 39% while the foodservice channel saw a growth of around 79%. The company is investing in markets where it is seeing growth and this includes select markets in Europe.

Slow demand

A key factor affecting Beyond Meat’s performance is low demand for plant-based products. On its third quarter conference call, it outlined two main challenges it is facing – high prices and category perception. The first challenge is Beyond Meat’s products cost more than animal protein and in an inflationary environment, consumers tend to choose the latter as they seek more value.

The second challenge the company said it faces is misinformation regarding the quality and health benefits of its products. On its call, Beyond Meat said there has been a drop in the percentage of consumers that believe plant-based meats are healthy. The company is working to raise awareness on the health benefits of its products which it believes is key to restoring growth.